Question

Constructing the Consolidated Balance Sheet at Acquisition Easton Company acquires 100 percent of the outstanding voting shares of Harris Company on January 1,2016. To obtain

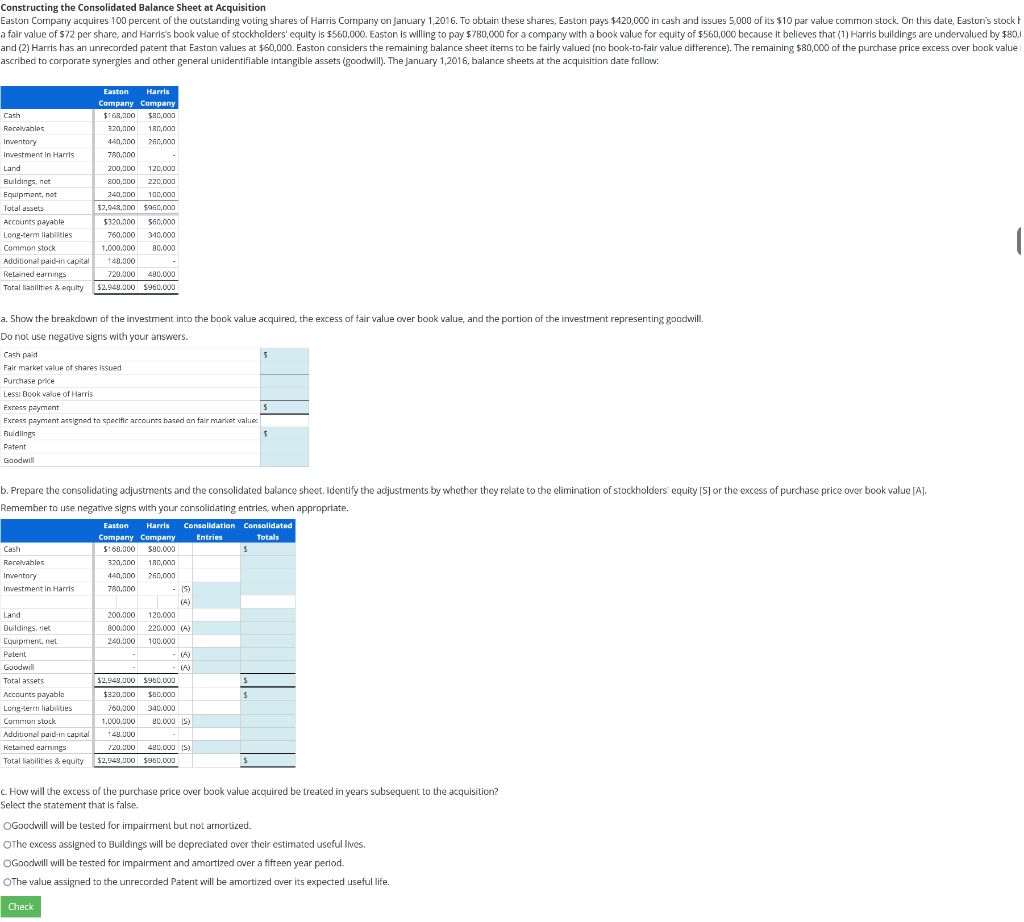

Constructing the Consolidated Balance Sheet at Acquisition Easton Company acquires 100 percent of the outstanding voting shares of Harris Company on January 1,2016. To obtain these shares, Easton pays $420,000 in cash and issues 5,000 of its $10 par value common stock. On this date, Easton's stock has a fair value of $72 per share, and Harris's book value of stockholders' equity is $560,000. Easton is willing to pay $780,000 for a company with a book value for equity of $560,000 because it believes that (1) Harris buildings are undervalued by $80,000, and (2) Harris has an unrecorded patent that Easton values at $60,000. Easton considers the remaining balance sheet items to be fairly valued (no book-to-fair value difference). The remaining $80,000 of the purchase price excess over book value is ascribed to corporate synergies and other general unidentifiable intangible assets (goodwill). The January 1,2016, balance sheets at the acquisition date follow:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started