Continuation:

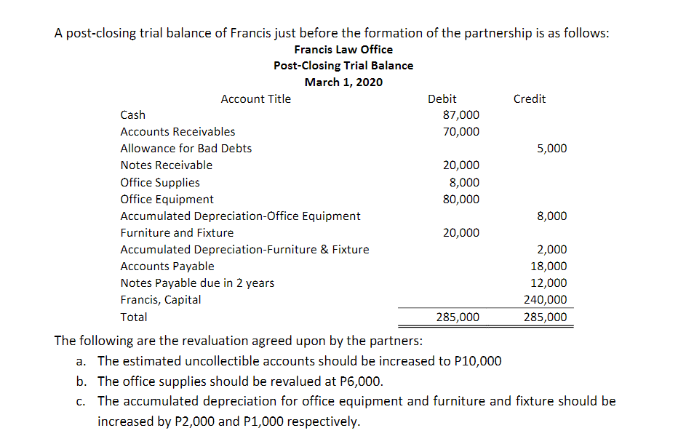

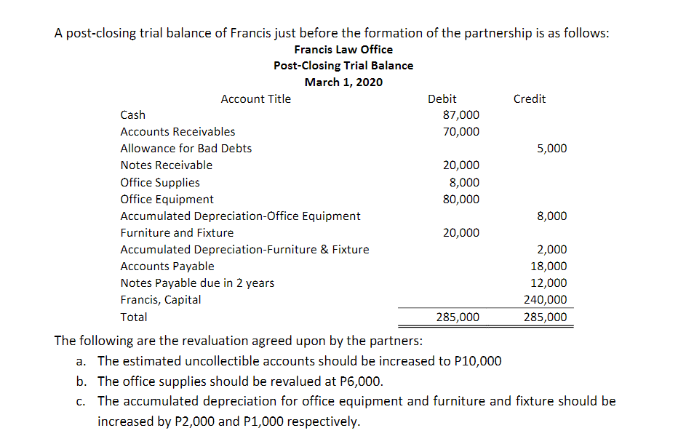

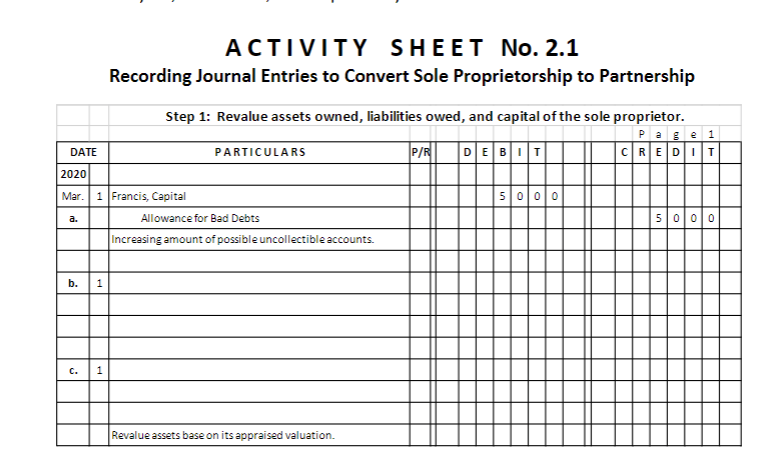

The following are the revaluation agreed upon by the partners:

a.The estimated uncollectible accounts should be increased toP10,000

b.The office supplies should be revalued at P6,000

.c.The accumulated depreciation for office equipment and furniture and fixture should be increased by P2,000and P1,000respectively.

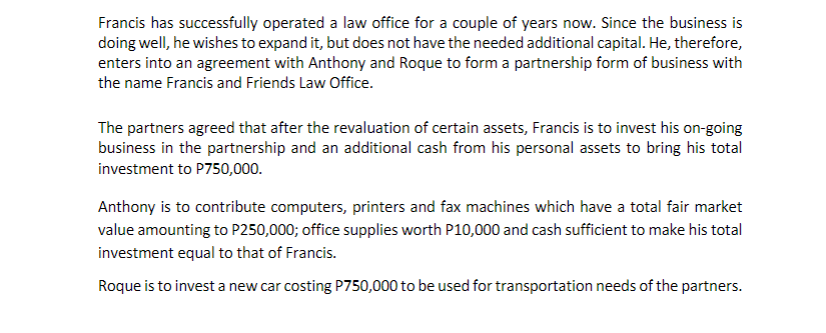

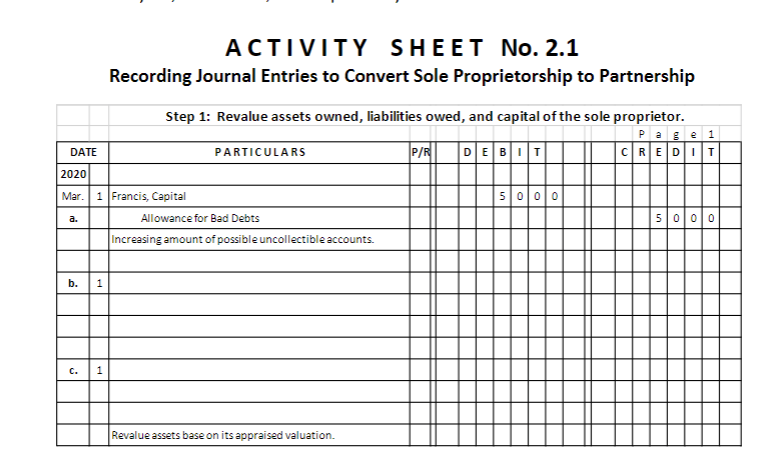

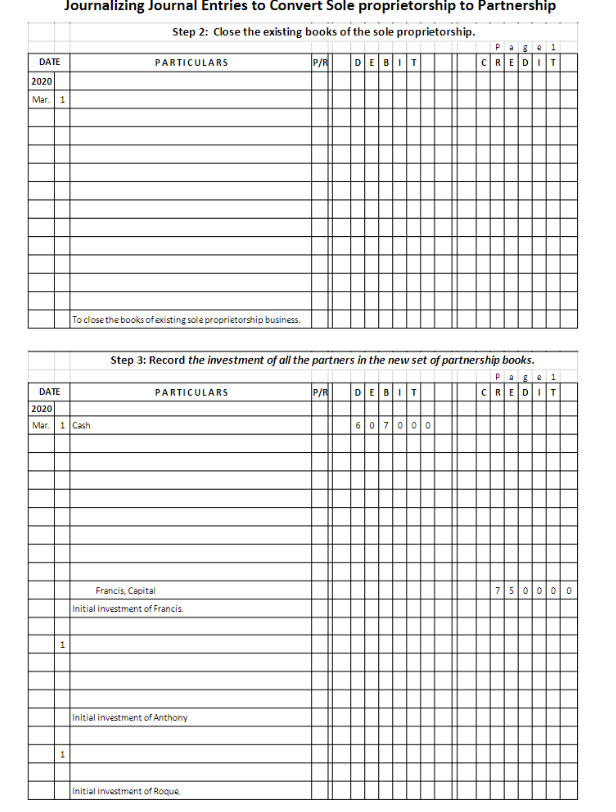

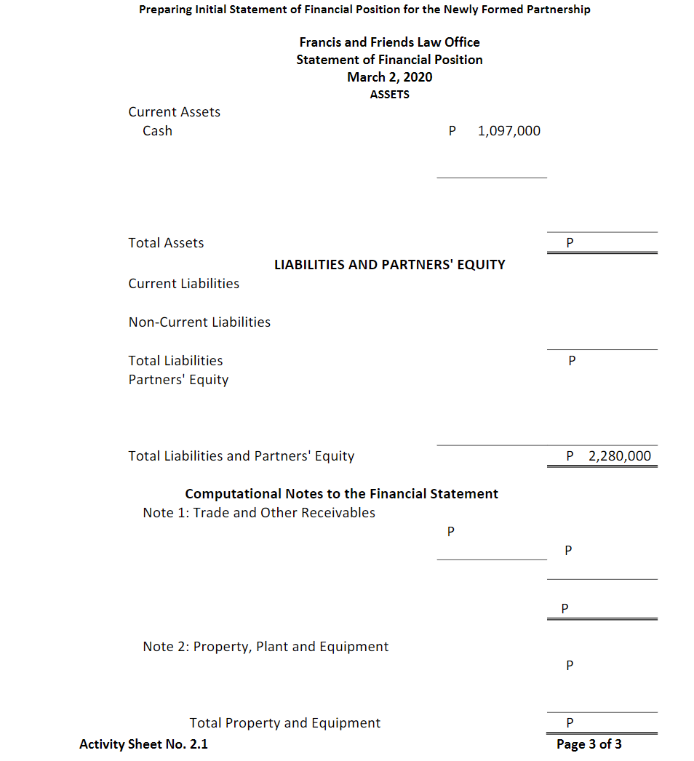

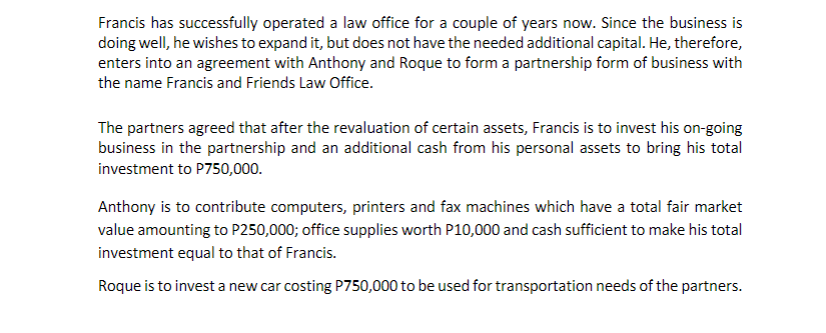

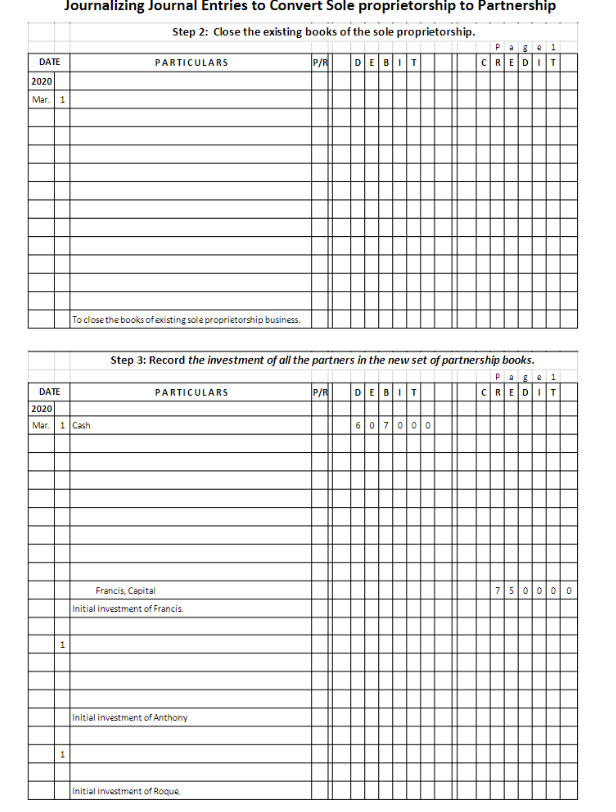

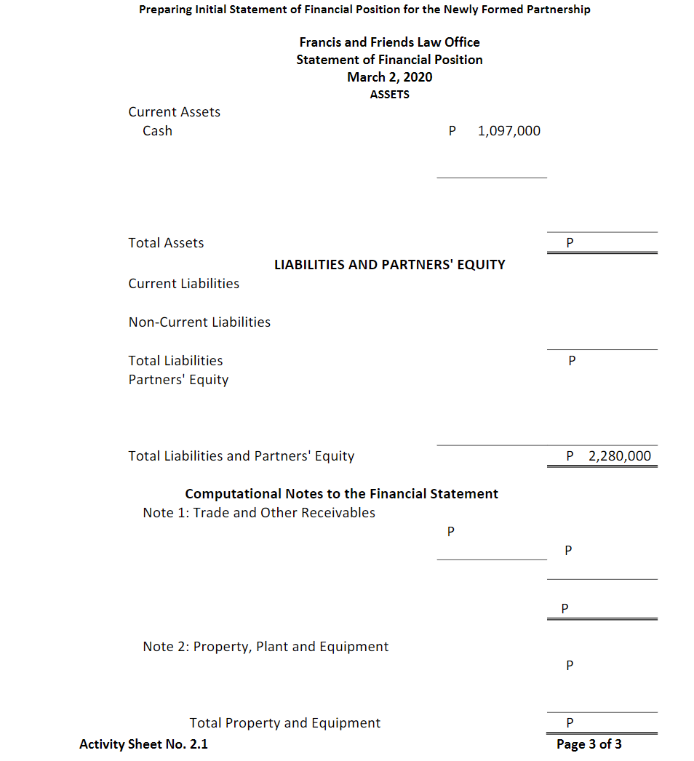

Francis has successfully operated a law office for a couple of years now. Since the business is doing well, he wishes to expand it, but does not have the needed additional capital. He, therefore, enters into an agreement with Anthony and Roque to form a partnership form of business with the name Francis and Friends Law Office. The partners agreed that after the revaluation of certain assets, Francis is to invest his on-going business in the partnership and an additional cash from his personal assets to bring his total investment to P750,000. Anthony is to contribute computers, printers and fax machines which have a total fair market value amounting to P250,000; office supplies worth P10,000 and cash sufficient to make his total investment equal to that of Francis. Roque is to invest a new car costing P750,000 to be used for transportation needs of the partners. A post-closing trial balance of Francis just before the formation of the partnership is as follows: Francis Law Office Post-Closing Trial Balance March 1, 2020 Account Title Debit Credit Cash 87,000 Accounts Receivables 70,000 Allowance for Bad Debts 5,000 Notes Receivable 20,000 Office Supplies 8,000 Office Equipment 80,000 Accumulated Depreciation Office Equipment 8,000 Furniture and Fixture 20,000 Accumulated Depreciation Furniture & Fixture 2,000 Accounts Payable 18,000 Notes Payable due in 2 years 12,000 Francis, Capital 240,000 Total 285,000 285,000 The following are the revaluation agreed upon by the partners: a. The estimated uncollectible accounts should be increased to P10,000 b. The office supplies should be revalued at P6,000. c. The accumulated depreciation for office equipment and furniture and fixture should be increased by P2,000 and P1,000 respectively. ACTIVITY SHEET No. 2.1 Recording Journal Entries to Convert Sole Proprietorship to Partnership Step 1: Revalue assets owned, liabilities owed, and capital of the sole proprietor. P/R DEBIT CREDIT DATE PARTICULARS 2020 Mar. 1 Francis, Capital Allowance for Bed Debts Increasing amount of possible uncollectible accounts. a. 5 000 b. 1 C. 1 Revalue assets base on its appraised valuation Journalizing Journal Entries to Convert Sole proprietorship to Partnership Step 2: Close the existing books of the sole proprietorship. DE BOT CREDOT Page 1 DATE PARTICULARS P/R 2020 Mar. 1 To close the books of existing sole proprietorship business. Step 3: Record the investment of all the partners in the new set of partnership books. Page 1 PARTICULARS P/RO DEBUT CREDIT DATE 2020 Mar. 1 Cash 750 000 Francis Capital Initial investment of Francis. 1 Initial investment of Anthony 1 Initial investment of Roque Preparing Initial Statement of Financial Position for the Newly formed Partnership Francis and Friends Law Office Statement of Financial Position March 2, 2020 ASSETS Current Assets Cash P 1,097,000 Total Assets LIABILITIES AND PARTNERS' EQUITY Current Liabilities Non-Current Liabilities P Total Liabilities Partners' Equity Total Liabilities and Partners' Equity P 2,280,000 Computational Notes to the Financial Statement Note 1: Trade and Other Receivables P P P Note 2: Property, Plant and Equipment P P Total Property and Equipment Activity Sheet No. 2.1 Page 3 of 3