Answered step by step

Verified Expert Solution

Question

1 Approved Answer

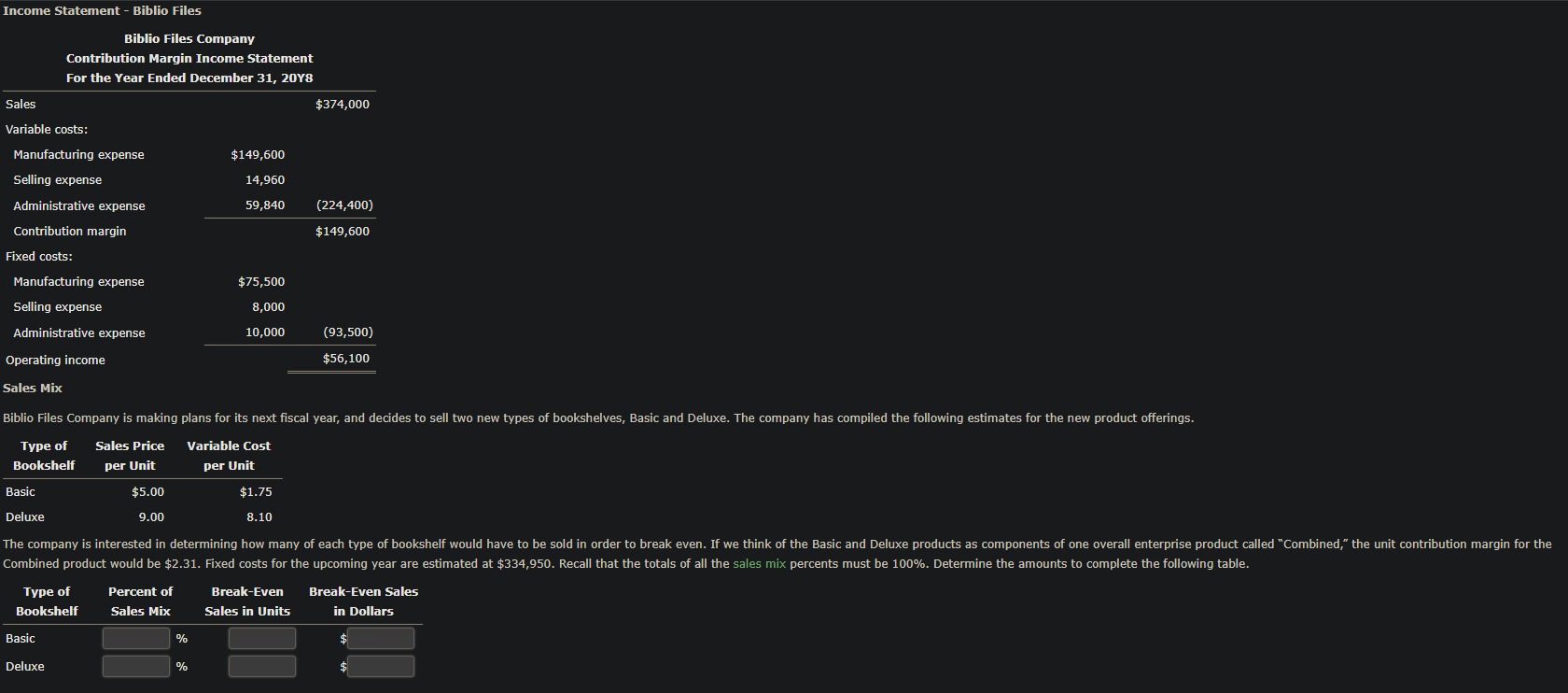

Contribution Margin Income Statement - Biblio Files Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 Sales $374,000 Variable costs:

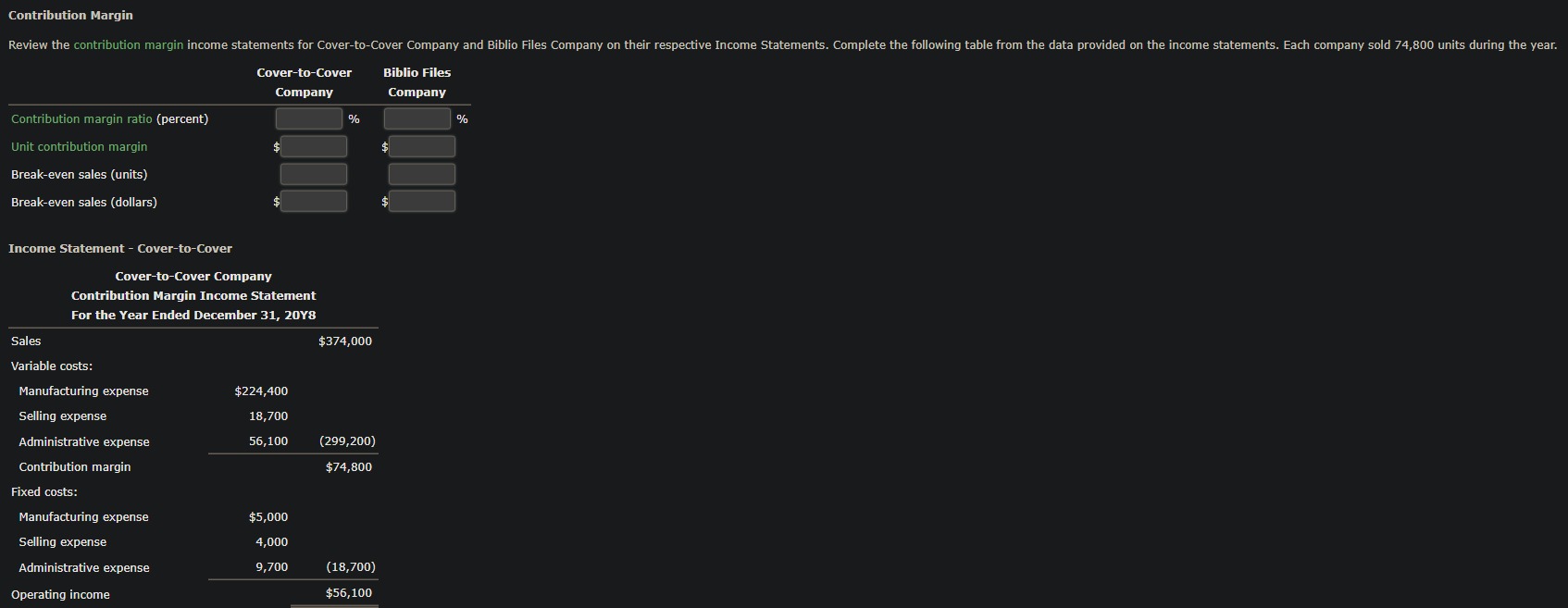

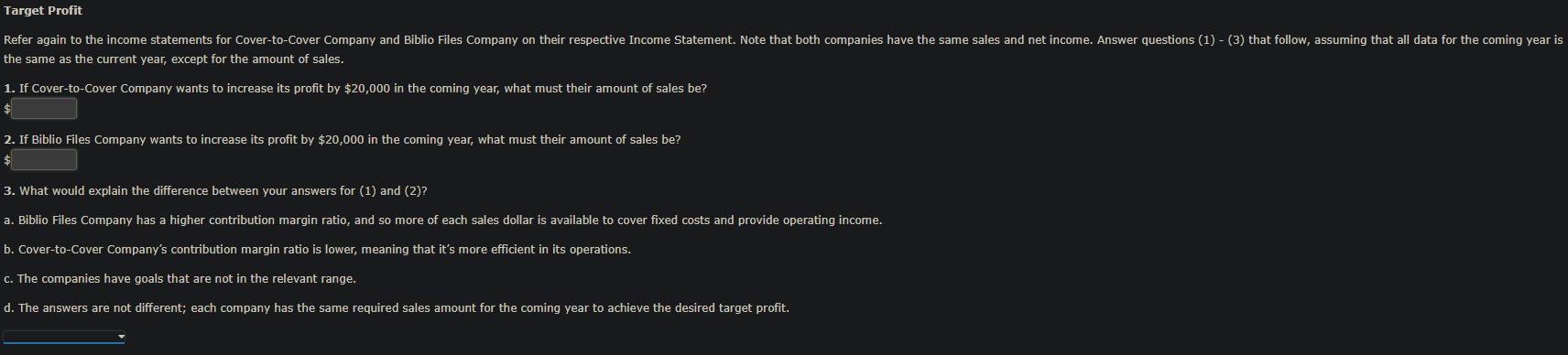

Contribution Margin Income Statement - Biblio Files Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 Sales $374,000 Variable costs: \begin{tabular}{lrr} Manufacturing expense & $149,600 & \\ Selling expense & 14,960 & \\ Administrative expense & 59,840 & (224,400) \\ \cline { 2 - 3 } Contribution margin & & $149,600 \\ Fixed costs: & $75,500 & \\ Manufacturing expense & 8,000 & \\ Selling expense & 10,000 & (93,500) \\ \hline Administrative expense & & $56,100 \\ \hline Operating income & & \\ \hline \end{tabular} Sales Mix \begin{tabular}{lrr} \multicolumn{1}{c}{TypeofBookshelf} & SalesPriceperUnit & VariableCostperUnit \\ \hline Basic & $5.00 & $1.75 \\ Deluxe & 9.00 & 8.10 \end{tabular} he same as the current year, except for the amount of sales. 1. If Cover-to-Cover Company wants to increase its profit by $20,000 in the coming year, what must their amount of sales be? 2. If Biblio Files Company wants to increase its profit by $20,000 in the coming year, what must their amount of sales be? 3. What would explain the difference between your answers for (1) and (2)? B. Biblio Files Company has a higher contribution margin ratio, and so more of each sales dollar is available to cover fixed costs and provide operating income. . Cover-to-Cover Company's contribution margin ratio is lower, meaning that it's more efficient in its operations. The companies have goals that are not in the relevant range. 1. The answers are not different; each company has the same required sales amount for the coming year to achieve the desired target profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started