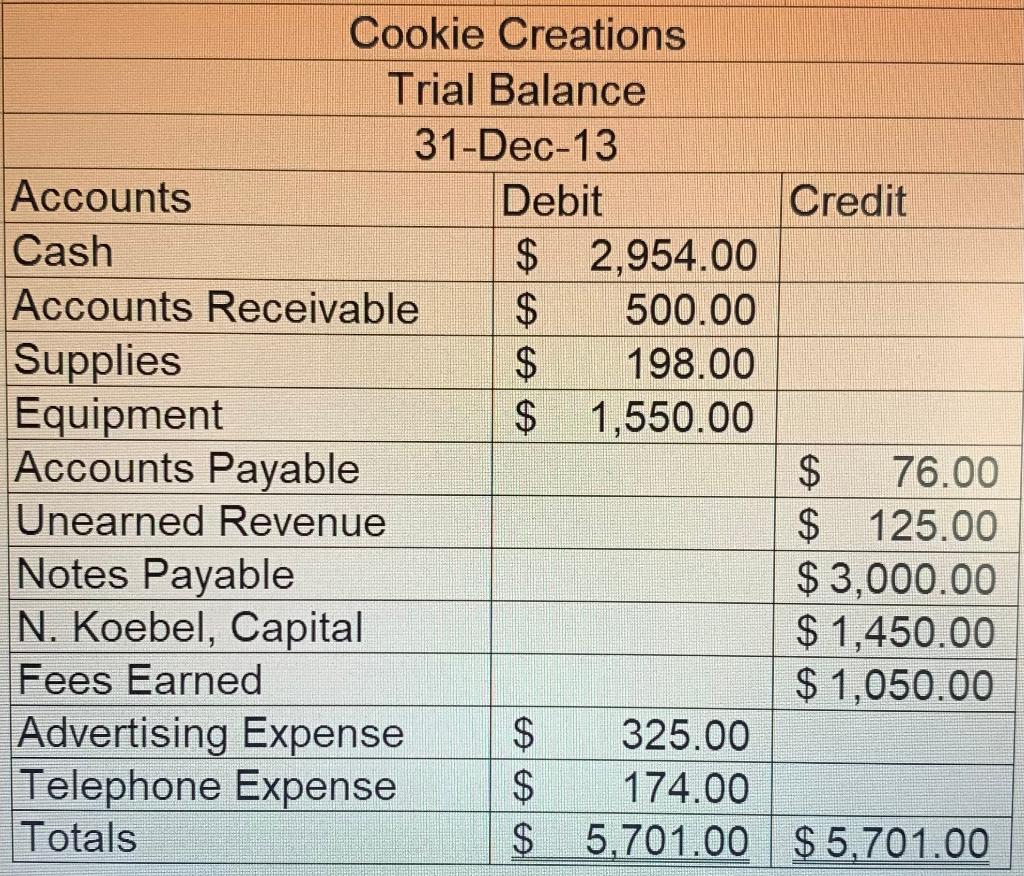

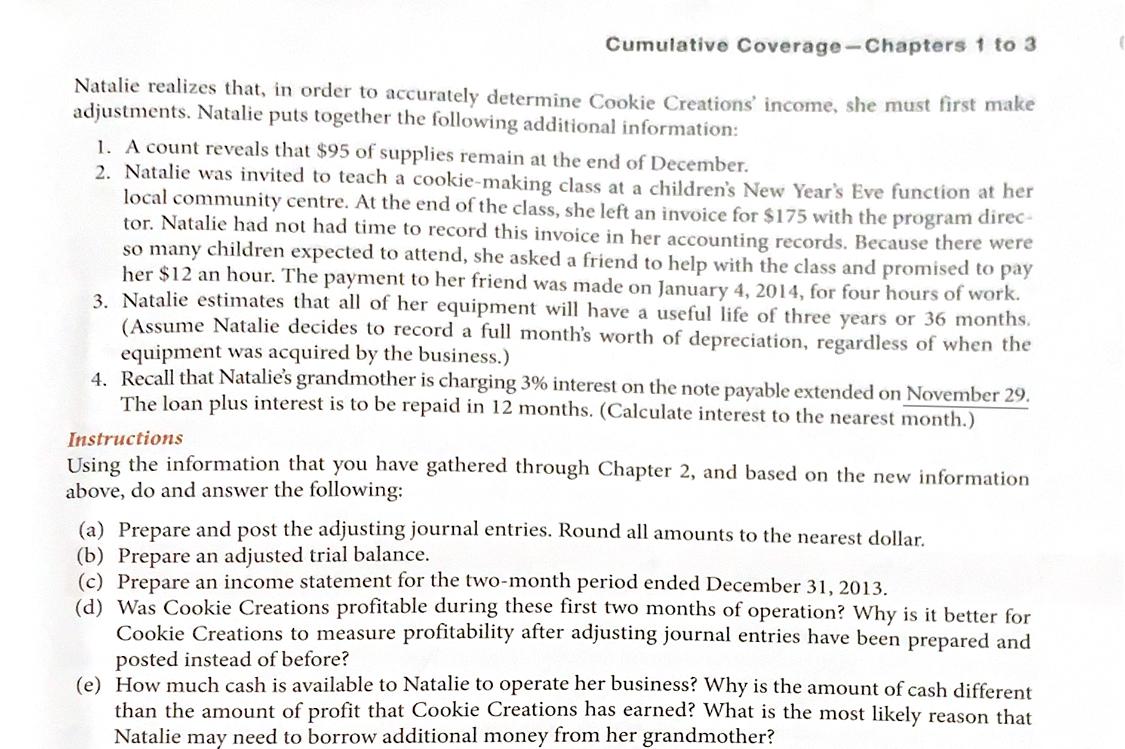

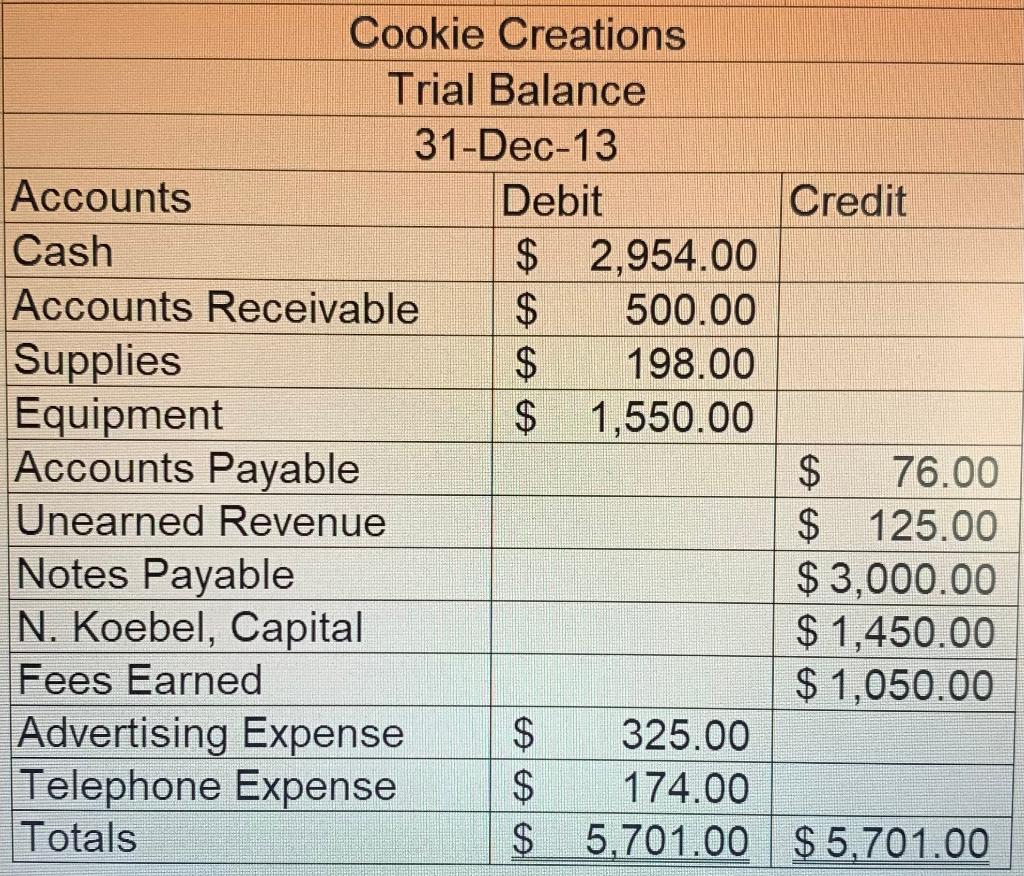

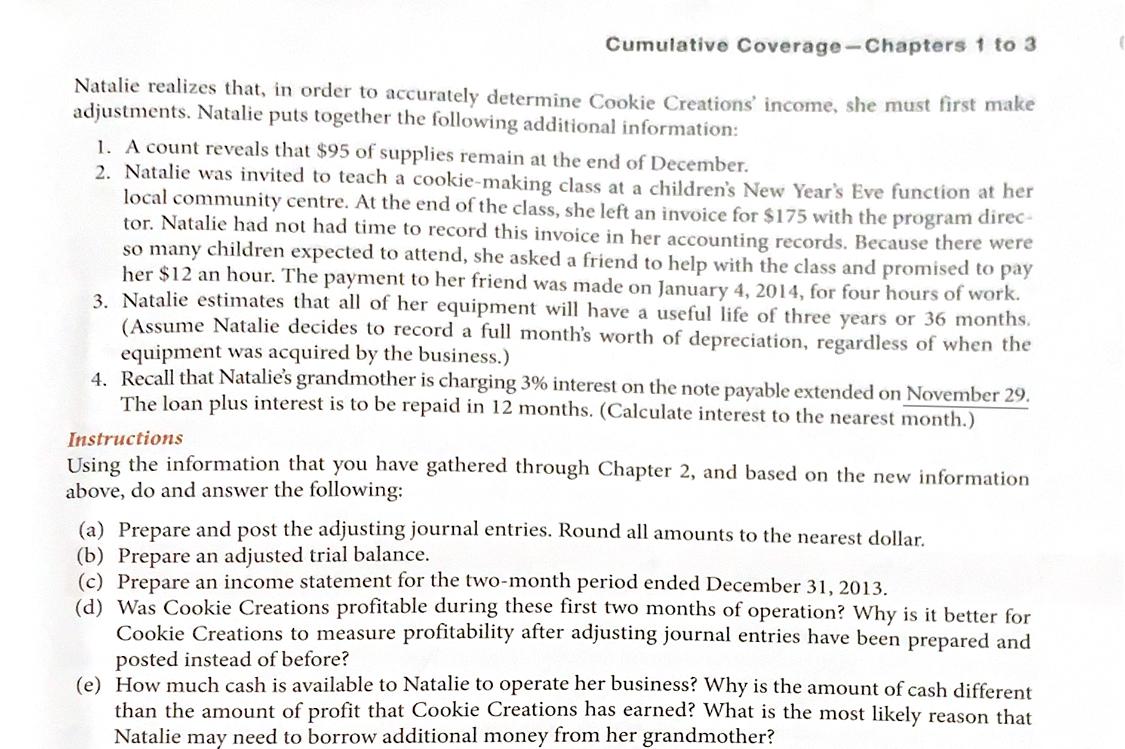

Cookie Creations Trial Balance 31-Dec-13 Accounts Debit Credit Cash $ 2,954.00 Accounts Receivable $ 500.00 Supplies $ 198.00 Equipment $ 1,550.00 Accounts Payable $ 76.00 Unearned Revenue $ 125.00 Notes Payable $ 3,000.00 N. Koebel, Capital $ 1,450.00 Fees Earned $ 1.050.00 Advertising Expense $ 325.00 Telephone Expense $ 174.00 Totals $ 5,701.00 $ 5,701.00 AAA Cumulative Coverage - Chapters 1 to 3 Natalie realizes that, in order to accurately determine Cookie Creations' income, she must first make adjustments. Natalie puts together the following additional information: 1. A count reveals that $95 of supplies remain at the end of December. 2. Natalie was invited to teach a cookie-making class at a children's New Year's Eve function at her local community centre. At the end of the class, she left an invoice for $175 with the program direc- tor. Natalie had not had time to record this invoice in her accounting records. Because there were so many children expected to attend, she asked a friend to help with the class and promised to pay her $12 an hour. The payment to her friend was made on January 4, 2014, for four hours of work. 3. Natalie estimates that all of her equipment will have a useful life of three years or 36 months. (Assume Natalie decides to record a full month's worth of depreciation, regardless of when the equipment was acquired by the business.) 4. Recall that Natalie's grandmother is charging 3% interest on the note payable extended on November 29. The loan plus interest is to be repaid in 12 months. (Calculate interest to the nearest month.) Instructions Using the information that you have gathered through Chapter 2, and based on the new information above, do and answer the following: (a) Prepare and post the adjusting journal entries. Round all amounts to the nearest dollar. (b) Prepare an adjusted trial balance. (c) Prepare an income statement for the two-month period ended December 31, 2013. (d) Was Cookie Creations profitable during these first two months of operation? Why is it better for Cookie Creations to measure profitability after adjusting journal entries have been prepared and posted instead of before? (e) How much cash is available to Natalie to operate her business? Why is the amount of cash different than the amount of profit that Cookie Creations has earned? What is the most likely reason that Natalie may need to borrow additional money from her grandmother