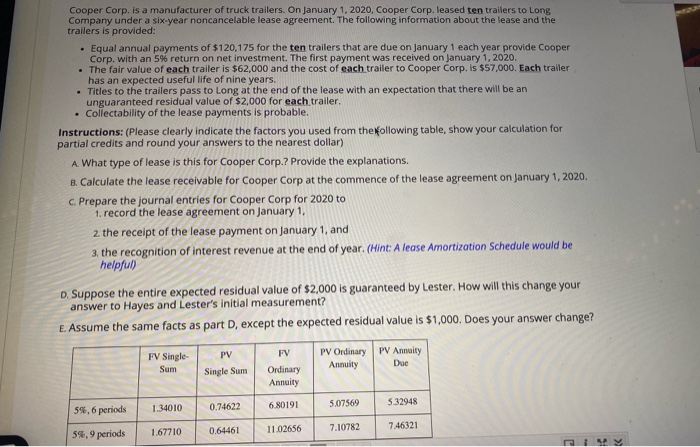

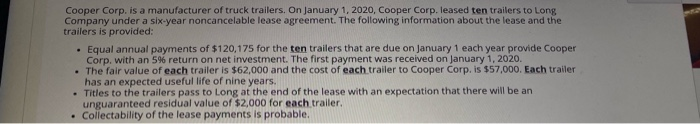

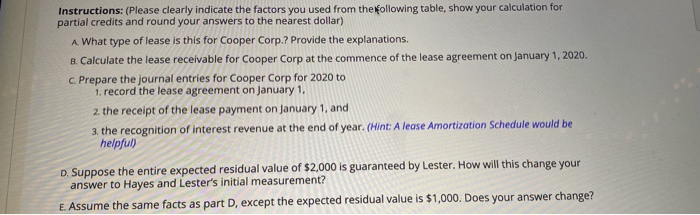

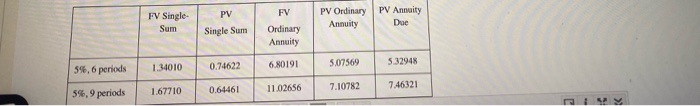

Cooper Corp. is a manufacturer of truck trailers. On January 1, 2020, Cooper Corp.leased ten trailers to Long Company under a six-year noncancelable lease agreement. The following information about the lease and the trailers is provided: Equal annual payments of $120,175 for the ten trailers that are due on January 1 each year provide Cooper Corp. with an 5% return on net investment. The first payment was received on January 1, 2020. The fair value of each trailer is $62,000 and the cost of each trailer to Cooper Corp. is $57,000. Each trailer has an expected useful life of nine years. . Titles to the trailers pass to Long at the end of the lease with an expectation that there will be an unguaranteed residual value of $2,000 for each trailer Collectability of the lease payments is probable. Instructions: (Please clearly indicate the factors you used from the following table, show your calculation for partial credits and round your answers to the nearest dollar) A. What type of lease is this for Cooper Corp.? Provide the explanations. B. Calculate the lease receivable for Cooper Corp at the commence of the lease agreement on January 1, 2020 c. Prepare the journal entries for Cooper Corp for 2020 to 1. record the lease agreement on January 1, 2 the receipt of the lease payment on January 1, and 3. the recognition of interest revenue at the end of year. (Hint: A lease Amortization Schedule would be helpful) D. Suppose the entire expected residual value of $2,000 is guaranteed by Lester. How will this change your answer to Hayes and Lester's initial measurement? E. Assume the same facts as part D, except the expected residual value is $1,000. Does your answer change? FV Single Sum PV Single Sum FV Ordinary Annuity PV Ordinary PV Annuity Annuity Due 1.34010 0.74622 6.80191 5.07569 5%, 6 periods 5.32948 11.02656 7.10782 7.46321 1.67710 0.64461 5%,9 periods Cooper Corp. is a manufacturer of truck trailers. On January 1, 2020, Cooper Corp.leased ten trailers to Long Company under a six-year noncancelable lease agreement. The following information about the lease and the trailers is provided: Equal annual payments of $120,175 for the ten trailers that are due on January 1 each year provide Cooper Corp. with an 5% return on net investment. The first payment was received on January 1, 2020. . The fair value of each trailer is $62,000 and the cost of each trailer to Cooper Corp. is $57,000. Each trailer has an expected useful life of nine years. Titles to the trailers pass to Long at the end of the lease with an expectation that there will be an unguaranteed residual value of $2,000 for each trailer, Collectability of the lease payments is probable. . Instructions: (Please clearly indicate the factors you used from the Wollowing table, show your calculation for partial credits and round your answers to the nearest dollar) A. What type of lease is this for Cooper Corp.? Provide the explanations. B. Calculate the lease receivable for Cooper Corp at the commence of the lease agreement on January 1, 2020. c. Prepare the journal entries for Cooper Corp for 2020 to 1. record the lease agreement on January 1, 2 the receipt of the lease payment on January 1, and 3. the recognition of interest revenue at the end of year. (Hint: A lease Amortization Schedule would be helpful D. Suppose the entire expected residual value of $2,000 is guaranteed by Lester. How will this change your answer to Hayes and Lester's initial measurement? E. Assume the same facts as part D, except the expected residual value is $1,000. Does your answer change? FV FV Single- Sum PV Single Sum PV Ordinary PV Annuity Annuity Doe Ordinary Annuity 1.34010 0.74622 6.80191 5.07569 54,6 periods 5.32948 0.64461 11.02656 7.10782 1.67710 7.46321 5%,9 periods ma Cooper Corp. is a manufacturer of truck trailers. On January 1, 2020, Cooper Corp.leased ten trailers to Long Company under a six-year noncancelable lease agreement. The following information about the lease and the trailers is provided: Equal annual payments of $120,175 for the ten trailers that are due on January 1 each year provide Cooper Corp. with an 5% return on net investment. The first payment was received on January 1, 2020. The fair value of each trailer is $62,000 and the cost of each trailer to Cooper Corp. is $57,000. Each trailer has an expected useful life of nine years. . Titles to the trailers pass to Long at the end of the lease with an expectation that there will be an unguaranteed residual value of $2,000 for each trailer Collectability of the lease payments is probable. Instructions: (Please clearly indicate the factors you used from the following table, show your calculation for partial credits and round your answers to the nearest dollar) A. What type of lease is this for Cooper Corp.? Provide the explanations. B. Calculate the lease receivable for Cooper Corp at the commence of the lease agreement on January 1, 2020 c. Prepare the journal entries for Cooper Corp for 2020 to 1. record the lease agreement on January 1, 2 the receipt of the lease payment on January 1, and 3. the recognition of interest revenue at the end of year. (Hint: A lease Amortization Schedule would be helpful) D. Suppose the entire expected residual value of $2,000 is guaranteed by Lester. How will this change your answer to Hayes and Lester's initial measurement? E. Assume the same facts as part D, except the expected residual value is $1,000. Does your answer change? FV Single Sum PV Single Sum FV Ordinary Annuity PV Ordinary PV Annuity Annuity Due 1.34010 0.74622 6.80191 5.07569 5%, 6 periods 5.32948 11.02656 7.10782 7.46321 1.67710 0.64461 5%,9 periods Cooper Corp. is a manufacturer of truck trailers. On January 1, 2020, Cooper Corp.leased ten trailers to Long Company under a six-year noncancelable lease agreement. The following information about the lease and the trailers is provided: Equal annual payments of $120,175 for the ten trailers that are due on January 1 each year provide Cooper Corp. with an 5% return on net investment. The first payment was received on January 1, 2020. . The fair value of each trailer is $62,000 and the cost of each trailer to Cooper Corp. is $57,000. Each trailer has an expected useful life of nine years. Titles to the trailers pass to Long at the end of the lease with an expectation that there will be an unguaranteed residual value of $2,000 for each trailer, Collectability of the lease payments is probable. . Instructions: (Please clearly indicate the factors you used from the Wollowing table, show your calculation for partial credits and round your answers to the nearest dollar) A. What type of lease is this for Cooper Corp.? Provide the explanations. B. Calculate the lease receivable for Cooper Corp at the commence of the lease agreement on January 1, 2020. c. Prepare the journal entries for Cooper Corp for 2020 to 1. record the lease agreement on January 1, 2 the receipt of the lease payment on January 1, and 3. the recognition of interest revenue at the end of year. (Hint: A lease Amortization Schedule would be helpful D. Suppose the entire expected residual value of $2,000 is guaranteed by Lester. How will this change your answer to Hayes and Lester's initial measurement? E. Assume the same facts as part D, except the expected residual value is $1,000. Does your answer change? FV FV Single- Sum PV Single Sum PV Ordinary PV Annuity Annuity Doe Ordinary Annuity 1.34010 0.74622 6.80191 5.07569 54,6 periods 5.32948 0.64461 11.02656 7.10782 1.67710 7.46321 5%,9 periods ma