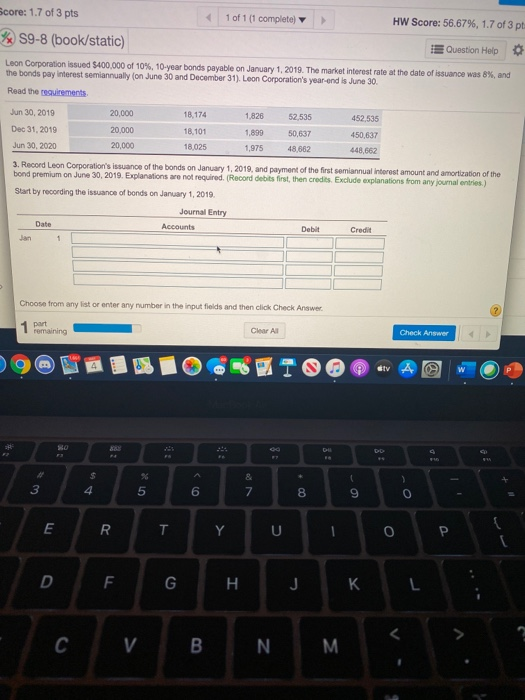

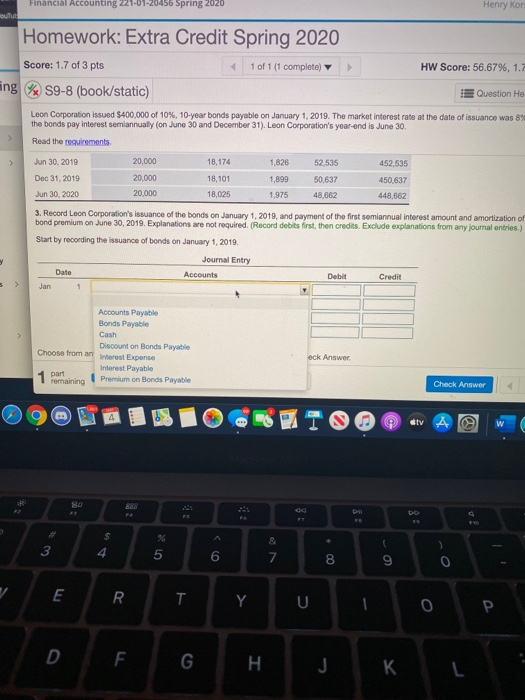

core: 1.7 of 3 pts 1 of 1 (1 completo) HW Score: 56.67%, 1.7 of 3 pt 59-8 (book/static) E Question Help Leon Corporation issued $400,000 of 10%, 10-year bonds payable on January 1, 2019. The market interest rate at the date of issuance was 8%, and the bonds pay interest semiannually (on June 30 and December 31). Leon Corporation's year-end is June 30 Read the requirements 1.826 52,535 Jun 30, 2019 Dec 31, 2019 Jun 30, 2020 20.000 20.000 20,000 18.174 18.101 18.025 452,536 450.637 1,899 1,975 50.537 48,662 3. Record Leon Corporation's issuance of the bonds on January 1, 2019, and payment of the first semiannual interest amount and amortization of the bond premium on June 30, 2019. Explanations are not required. Record debitsrst, then credits Exclude explanations from any journal entries) Start by recording the issuance of bonds on January 1, 2019. Journal Entry Date Accounts Choose from any list or enter any number in the input fields and then click Check Answer 4 Clear All Check Answer OF GH KL B N. Financial Accounting Z21-01-20450 spring zuzu Henry kor Homework: Extra Credit Spring 2020 Score: 1.7 of 3 pts 1 of 1 (1 complete) HW Score: 56.67%, 1. ing % 59-8 (book/static) E Question He Leon Corporation issued $400,000 of 10%, 10-year bonds payable on January 1, 2019. The market interest rate at the date of issuance was 89 the bonds pay interest semiannualy (on June 30 and December 31). Leon Corporation's year-end is June 30. Read the requirements Jun 30, 2019 20,000 20.000 Dec 31, 2019 Jun 30, 2020 18,174 18,101 18.025 1,826 1,899 1,975 52,535 5 0,637 48,662 452,535 450,637 448.662 20.000 3. Record Leon Corporation's issuance of the bonds on January 1, 2019, and payment of the first semiannual interest amount and amortization of bond premium on June 30, 2019. Explanations are not required. Record debits frst the credits Exclude explanations from anyjournal entries.) Start by recording the issuance of bonds on January 1, 2019. Journal Entry Accounts Debit Date Accounts Payable Bonds Payable Cash Discount on Bonds Payable Choose from anw est Expense Interest Payable 1 remaining Premium on Bonds Payable eck Answer 1 part Check Answer ERTY op D F G H J K L