Answered step by step

Verified Expert Solution

Question

1 Approved Answer

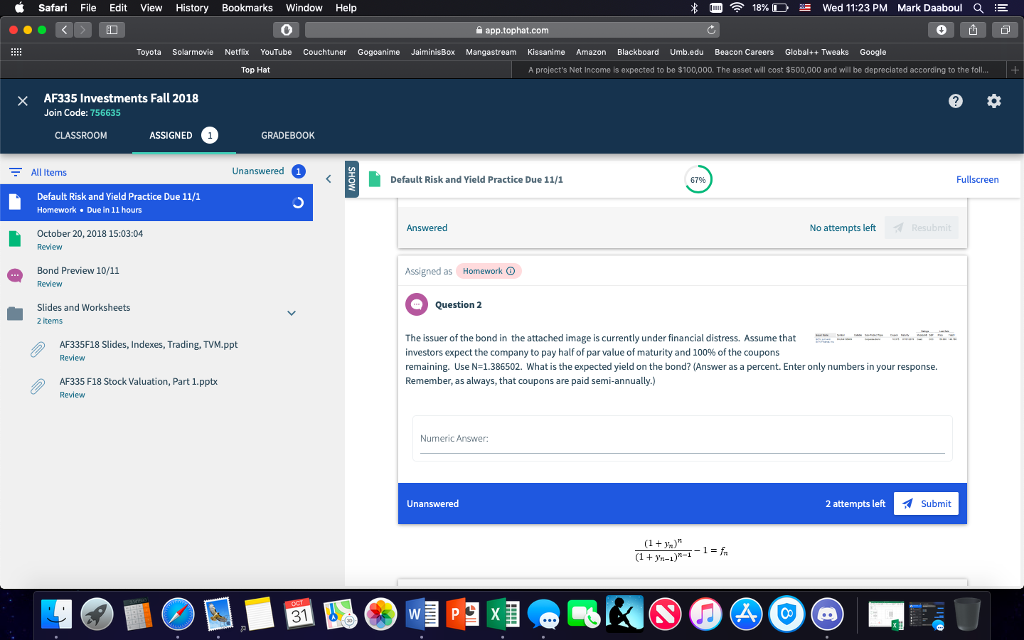

Corporate Bond; Coupon 10.375; Maturity 07/1/19; Price 50; Yield 148.780 Safari File Edit View History Bookmarks Window Help m 18% D Wed 11:23 PM Mark

Corporate Bond; Coupon 10.375; Maturity 07/1/19; Price 50; Yield 148.780

Safari File Edit View History Bookmarks Window Help m 18% D Wed 11:23 PM Mark Daaboul E 0 app.tophat.com 0 Toyota Solarmowie Netx YouTube Couchtuner Gogoanime JaiminisBox Mangastream Kissanime Amazon Blackbeard Umb.edu Beacon Careers Global++ Tweaks Google Top Hat A project's Net Income is expected to be $100,000 The asset will cost $500,000 and will be depreciated according to the foll XAF335 Investments Fall 2018 756635 Join Code: CLASSROOM ASSIGNED GRADEBOOK unansweredDefauit Risk and All Itens Default Risk and Yield Practice Due 11/1 67% Fullscreen Default Risk and Yield Practice Due 11/1 Homework Due in 11 hours Answered No attempts left October 20, 2018 15:03:04 Rewew Bond Preview 10/11 Assigned as Homework Rewew Question 2 sdes and workshets 2 items The issuer of the bond in the attached image is currently under financial distress. Assume that investors expect the company to pay half of par value of maturity and 100% of the coupons remaining. Use N=1.386502. What is the expected yield on the bond? (Answer as a percent. Enter only numbers in your response. Remember, as always, that coupons are paid slly.) AF335F18 Slides, Indexes, Trading, TVM.ppt Review AF335 F18 Stock Valuation, Part 1.pptx Review Numeric Answer: 2 attempts left Submit 1+--Im Safari File Edit View History Bookmarks Window Help m 18% D Wed 11:23 PM Mark Daaboul E 0 app.tophat.com 0 Toyota Solarmowie Netx YouTube Couchtuner Gogoanime JaiminisBox Mangastream Kissanime Amazon Blackbeard Umb.edu Beacon Careers Global++ Tweaks Google Top Hat A project's Net Income is expected to be $100,000 The asset will cost $500,000 and will be depreciated according to the foll XAF335 Investments Fall 2018 756635 Join Code: CLASSROOM ASSIGNED GRADEBOOK unansweredDefauit Risk and All Itens Default Risk and Yield Practice Due 11/1 67% Fullscreen Default Risk and Yield Practice Due 11/1 Homework Due in 11 hours Answered No attempts left October 20, 2018 15:03:04 Rewew Bond Preview 10/11 Assigned as Homework Rewew Question 2 sdes and workshets 2 items The issuer of the bond in the attached image is currently under financial distress. Assume that investors expect the company to pay half of par value of maturity and 100% of the coupons remaining. Use N=1.386502. What is the expected yield on the bond? (Answer as a percent. Enter only numbers in your response. Remember, as always, that coupons are paid slly.) AF335F18 Slides, Indexes, Trading, TVM.ppt Review AF335 F18 Stock Valuation, Part 1.pptx Review Numeric Answer: 2 attempts left Submit 1+--Im

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started