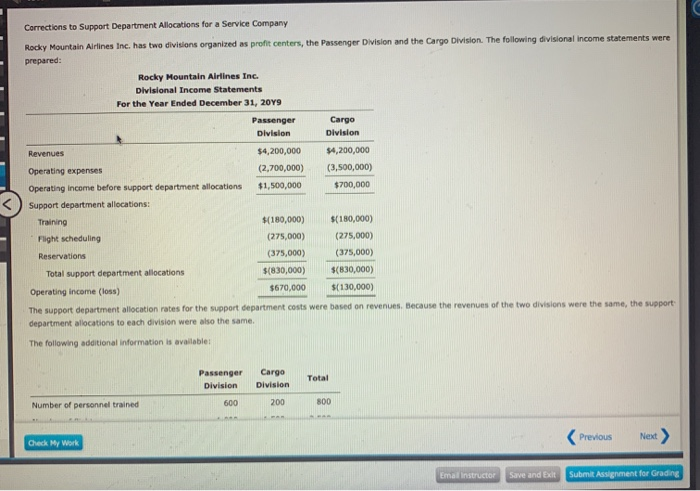

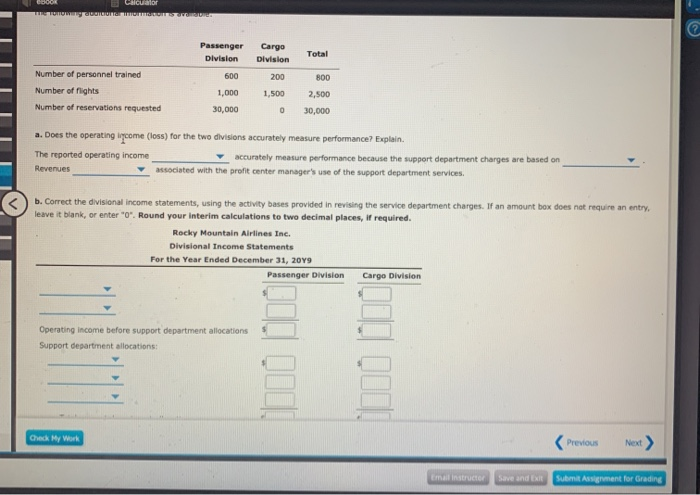

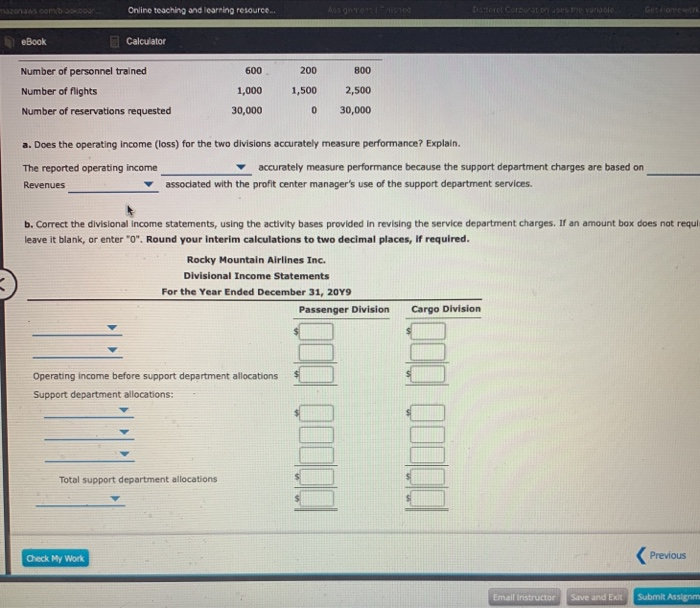

Corrections to Support Department Allocations for a Service Company Rocky Mountain Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared: Rocky Mountain Airlines Inc. Divisional Income Statements For the Year Ended December 31, 2019 Passenger Cargo Division Division Revenues $4,200,000 $4,200,000 Operating expenses (2,700,000) (3,500,000) Operating income before support department allocations $1,500,000 $700,000 Support department allocations: Training $(180,000) $(180,000) Flight scheduling (275,000) (275,000) Reservations (375,000) (375,000) Total support department allocations $(830,000) $(830,000) Operating income (loss) $670,000 $(130,000) The support department allocation rates for the support department costs were based on revenues. Because the revenues of the two divisions were the same, the support: department allocations to each division were also the same The following additional information is available: Passenger Division Cargo Division Total 600 Number of personnel trained 200 800 Previous Next > Check My Work Email Instructor Save and Exit Submit Assignment for Grading COOO Calcuator Cargo Passenger Division Total Division Number of personnel trained 200 600 1,000 30,000 Number of rights Number of reservations requested 1,500 800 2,500 30,000 0 a. Does the operating income (loss) for the two divisions accurately measure performance? Explain. The reported operating income accurately measure performance because the support department charges are based on Revenues associated with the profit center manager's use of the support department services. b. Correct the divisional income statements, using the activity bases provided in revising the service department charges. If an amount box does not require an entry. leave it blank, or enter "o". Round your interim calculations to two decimal places, if required. Rocky Mountain Airlines Inc. Divisional Income Statements For the Year Ended December 31, 2019 Passenger Division Cargo Division Operating income before support department allocations Support department allocations: Check My Work Email Instructor Save and Submit Assignment for Grading os.com DOO Online teaching and learning resource... ASSOTO eBook Calculator 600 200 800 Number of personnel trained Number of flights Number of reservations requested 1,500 1,000 30,000 2,500 30,000 0 a. Does the operating income (loss) for the two divisions accurately measure performance? Explain. The reported operating income accurately measure performance because the support department charges are based on Revenues associated with the profit center manager's use of the support department services. b. Correct the divisional income statements, using the activity bases provided in revising the service department charges. If an amount box does not requi leave it blank, or enter "0". Round your interim calculations to two decimal places, if required. Rocky Mountain Airlines Inc. Divisional Income Statements For the Year Ended December 31, 2019 Passenger Division Cargo Division Operating income before support department allocations Support department allocations: Total support department allocations Check My Work Previous Email Instructor Save and E Submit Assignm