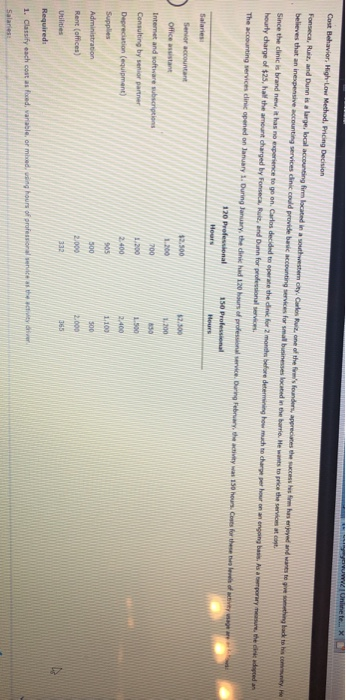

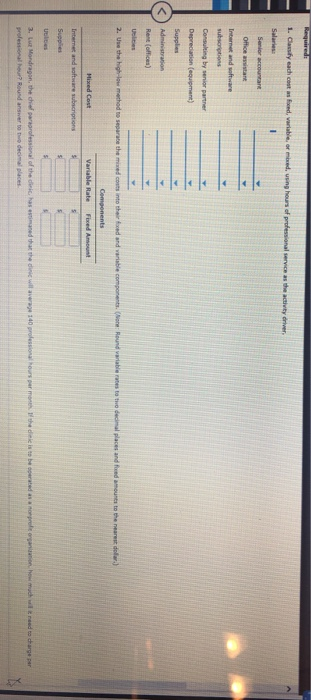

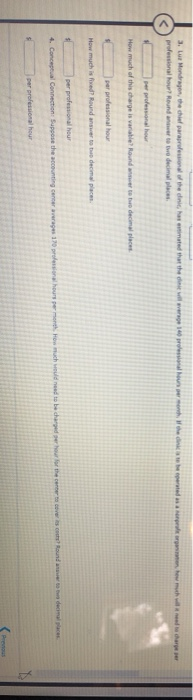

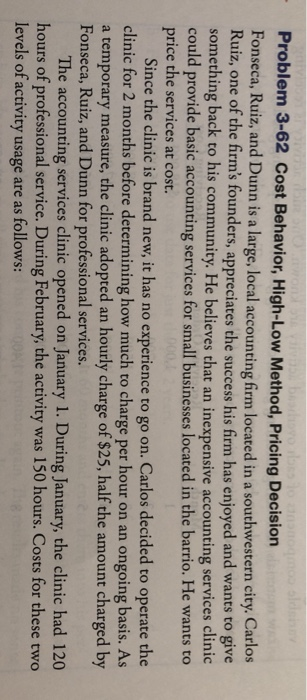

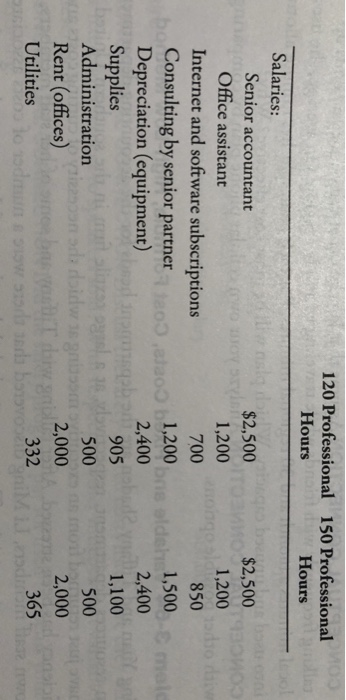

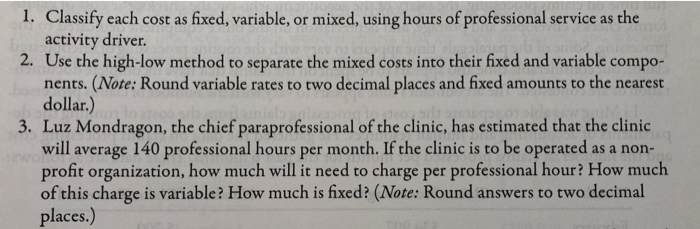

Cost Behavior, High-Low Method, Pricing Decision Fonseca, Ruit, and Dunn is a large local accounting firm located in a southwestern city. Carles Ruiz.one of the believes that an inexpensive accounting services in could provide basic c ong services for founders, appreciate t h e form haserre and wants to the barre Me wants to pice the service n how to charge perherowongeng ba w Since the clinic is brand new it has no experience to go on Carlos decided to opere the dink for moder hourly charge of $25. hall the amount charged by Fonseca R and Dann for profesional bad this conte a n The accounting service clinic opened on January 1. During January, the dine ad 1.20 hours of professional service. During February. the y was 150 hour. Ces for these 120 Professional 150 Professional Salaries Senior accountant Office assistant Internet and software subscriptions Consulting by senior partner Depreciation (equipment) Administration Rent (offices Utilities Required: 1. Classify each cost as foed varable, or med. Nours of professoralnica Salaries 1. C . eadh centaxed, variate Internet and software Consulting by senior parte Depreciation equipment Supplies Rent (offices) 2. Use the high-low method to separate the mind Mixed Cost 3. Luz Mondragon, the chief pargolessional of the direchos 3. Lue Mondragon, the chief parag professional how Round on the inherited that the we decimal places per professional hou How much of this charge is variable? Round a t the decimal places How much is fixed Round answer to decimal place per professional hour month. How much would need to be charged gehou 4. Conceptual Connection Suppose the accounting center av per realhoun SA Problem 3-62 Cost Behavior, High-Low Method, Pricing Decision Fonseca, Ruiz, and Dunn is a large, local accounting firm located in a southwestern city. Carlos Ruiz, one of the firm's founders, appreciates the success his firm has enjoyed and wants to give something back to his community. He believes that an inexpensive accounting services clinic could provide basic accounting services for small businesses located in the barrio. He wants to price the services at cost. Since the clinic is brand new, it has no experience to go on. Carlos decided to operate the clinic for 2 months before determining how much to charge per hour on an ongoing basis. As a temporary measure, the clinic adopted an hourly charge of $25, half the amount charged by Fonseca, Ruiz, and Dunn for professional services. The accounting services clinic opened on January 1. During January, the clinic had 120 hours of professional service. During February, the activity was 150 hours. Costs for these two levels of activity usage are as follows: 120 Professional 150 Professional Hours Hours Salaries: Senior accountant Office assistant Internet and software subscriptions Consulting by senior partner Depreciation (equipment) Supplies Administration Rent (offices) Utilities $2,500 1,200 700 1,200 2,400 o $2,500 1,200 850 1,500 2,400 1,100 500 2,000 905 500 2,000 o 332 od 365 1. Classify each cost as fixed, variable, or mixed, using hours of professional service as the activity driver. 2. Use the high-low method to separate the mixed costs into their fixed and variable compo- nents. (Note: Round variable rates to two decimal places and fixed amounts to the nearest dollar.) 3. Luz Mondragon, the chief paraprofessional of the clinic, has estimated that the clinic will average 140 professional hours per month. If the clinic is to be operated as a non- profit organization, how much will it need to charge per professional hour? How much of this charge is variable? How much is fixed? (Note: Round answers to two decimal places.)