Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COST OF CAPITAL AND CAPITAL BUDGETING 1. Tangshan Mining Company is considering investing in a new mining project. The firm's cost of capital is

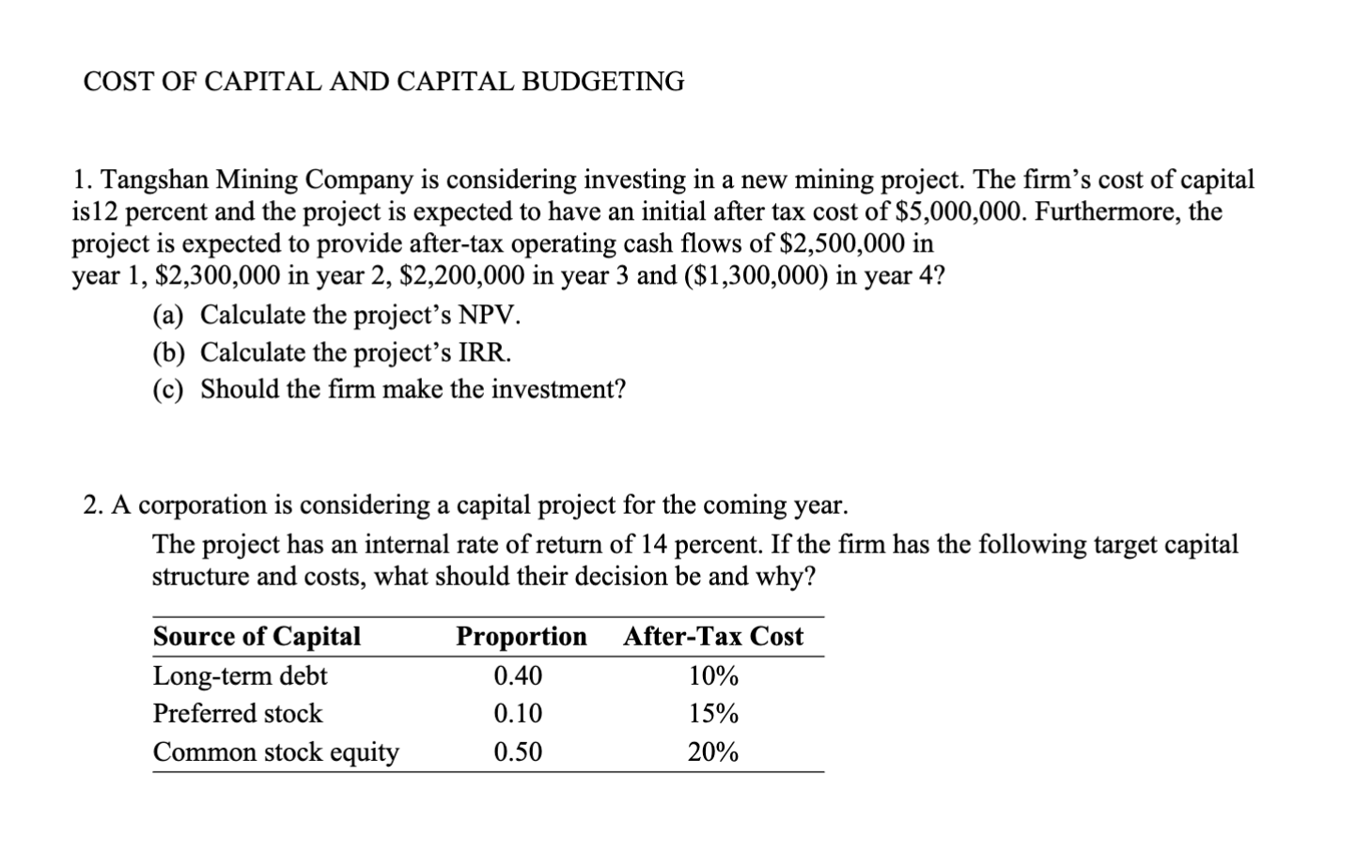

COST OF CAPITAL AND CAPITAL BUDGETING 1. Tangshan Mining Company is considering investing in a new mining project. The firm's cost of capital is 12 percent and the project is expected to have an initial after tax cost of $5,000,000. Furthermore, the project is expected to provide after-tax operating cash flows of $2,500,000 in year 1, $2,300,000 in year 2, $2,200,000 in year 3 and ($1,300,000) in year 4? (a) Calculate the project's NPV. (b) Calculate the project's IRR. (c) Should the firm make the investment? 2. A corporation is considering a capital project for the coming year. The project has an internal rate of return of 14 percent. If the firm has the following target capital structure and costs, what should their decision be and why? Source of Capital Proportion After-Tax Cost Long-term debt 0.40 10% Preferred stock 0.10 15% Common stock equity 0.50 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started