Answered step by step

Verified Expert Solution

Question

1 Approved Answer

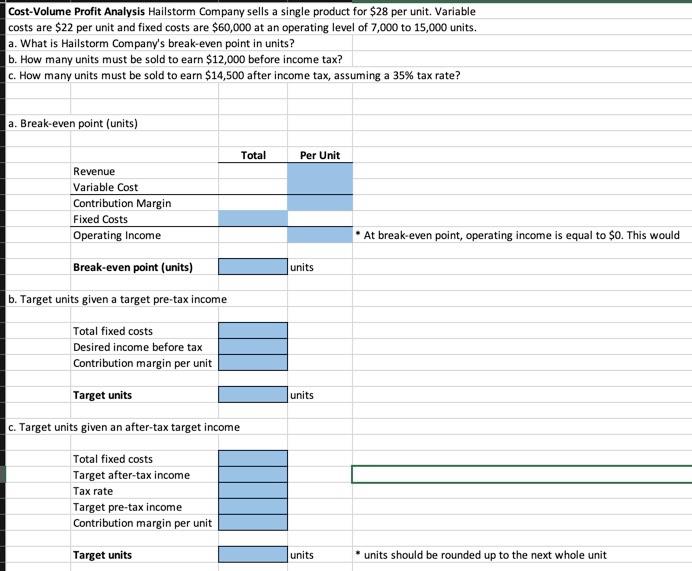

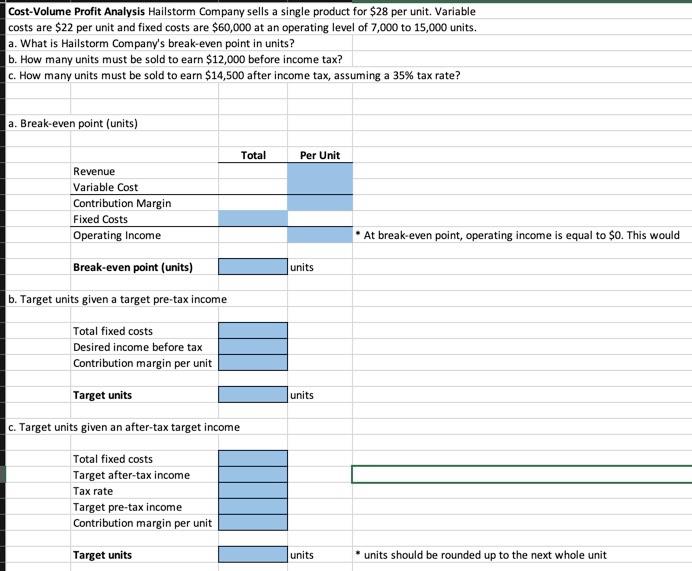

Cost-Volume Profit Analysis Hailstorm Company sells a single product for $28 per unit. Variable costs are $22 per unit and fixed costs are $60,000 at

Cost-Volume Profit Analysis Hailstorm Company sells a single product for $28 per unit. Variable costs are $22 per unit and fixed costs are $60,000 at an operating level of 7,000 to 15,000 units. a. What is Hailstorm Company's break-even point in units? b. How many units must be sold to earn $12,000 before income tax? C. How many units must be sold to earn $14,500 after income tax, assuming a 35% tax rate? a. Break-even point (units) Total Per Unit Revenue Variable Cost Contribution Margin Fixed Costs Operating Income At break-even point, operating income is equal to $0. This would Break-even point (units) units b. Target units given a target pre-tax income Total fixed costs Desired income before tax Contribution margin per unit Target units units C. Target units given an after-tax target income Total fixed costs Target after-tax income Tax rate Target pre-tax income Contribution margin per unit Target units units * units should be rounded up to the next whole unit

Cost-Volume Profit Analysis Hailstorm Company sells a single product for $28 per unit. Variable costs are $22 per unit and fixed costs are $60,000 at an operating level of 7,000 to 15,000 units. a. What is Hailstorm Company's break-even point in units? b. How many units must be sold to earn $12,000 before income tax? C. How many units must be sold to earn $14,500 after income tax, assuming a 35% tax rate? a. Break-even point (units) Total Per Unit Revenue Variable Cost Contribution Margin Fixed Costs Operating Income At break-even point, operating income is equal to $0. This would Break-even point (units) units b. Target units given a target pre-tax income Total fixed costs Desired income before tax Contribution margin per unit Target units units C. Target units given an after-tax target income Total fixed costs Target after-tax income Tax rate Target pre-tax income Contribution margin per unit Target units units * units should be rounded up to the next whole unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started