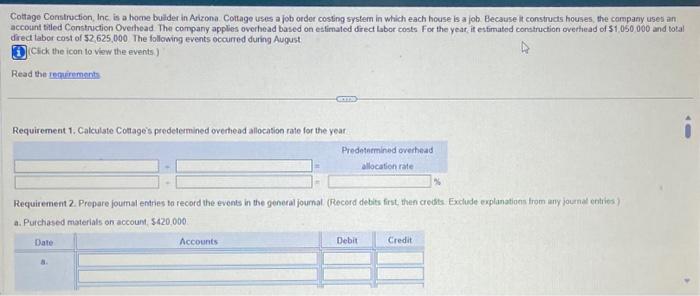

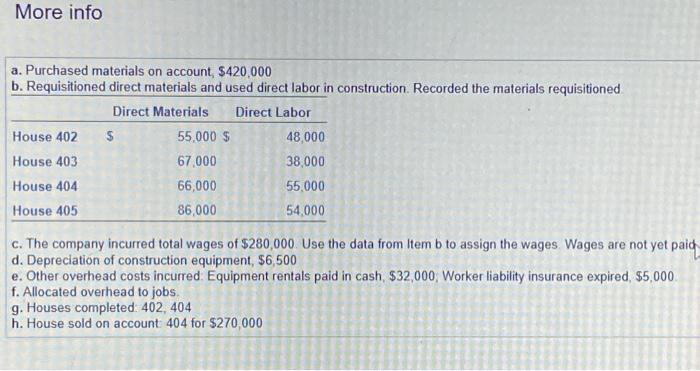

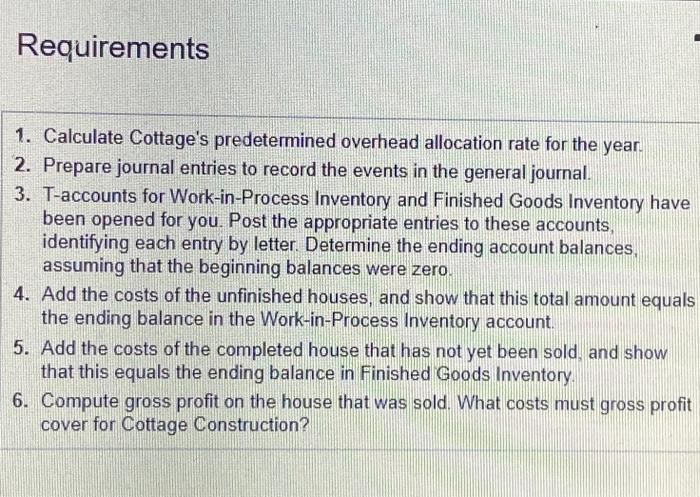

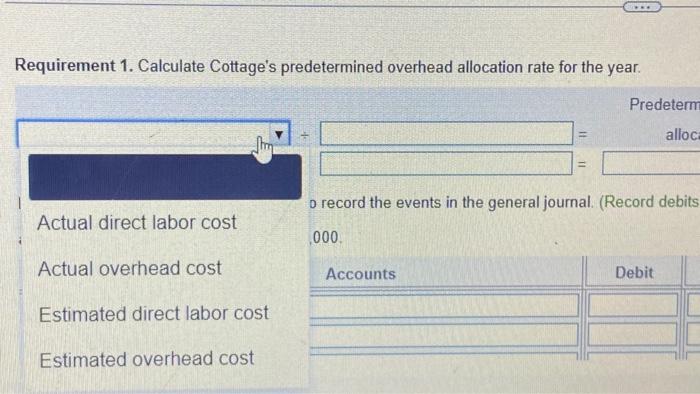

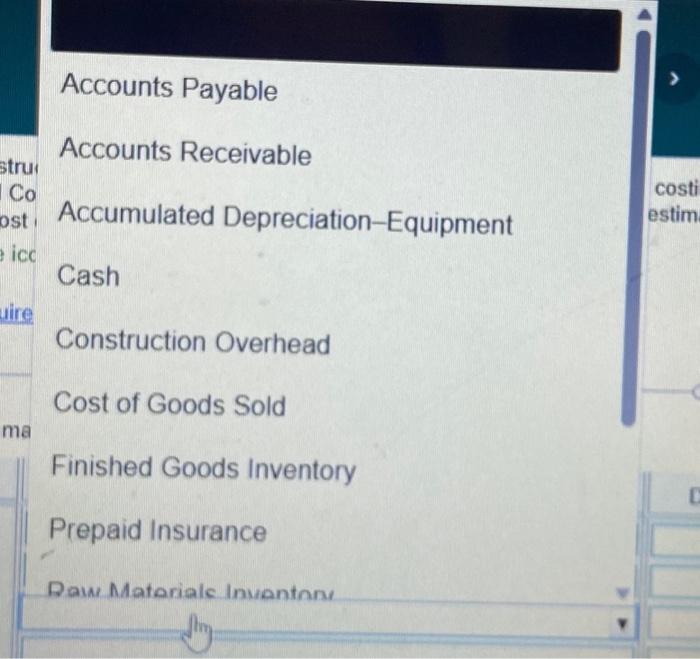

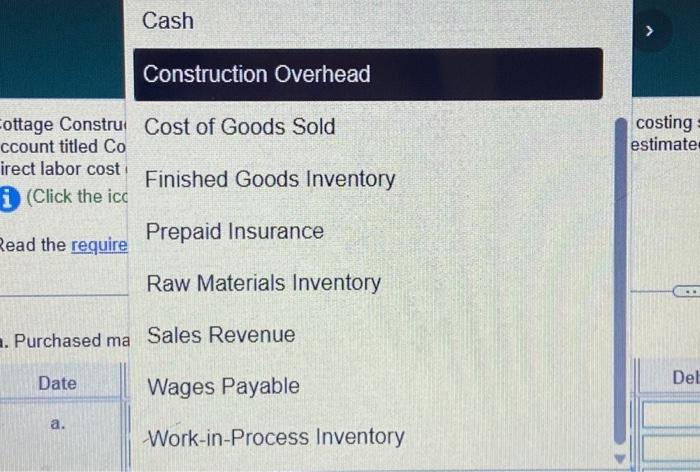

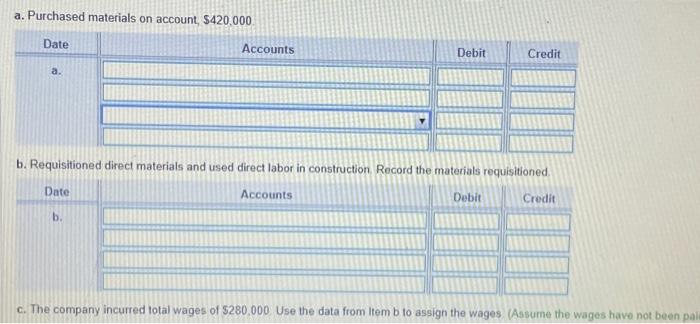

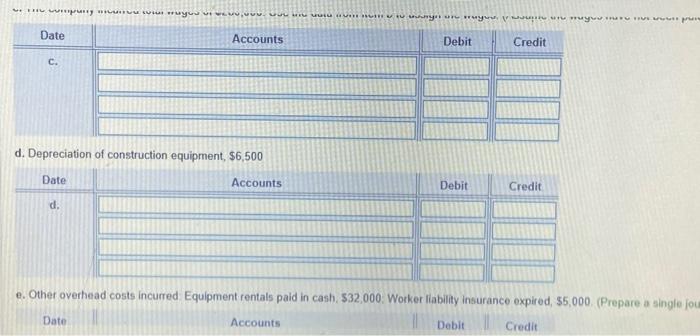

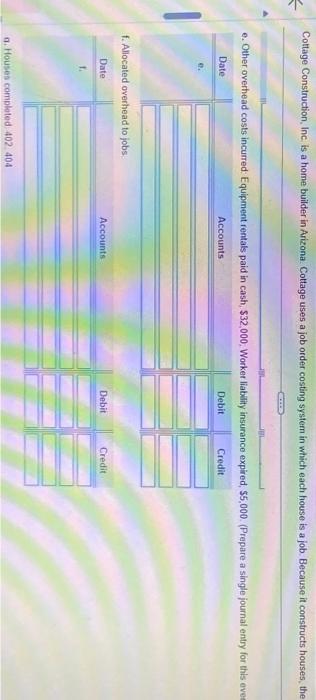

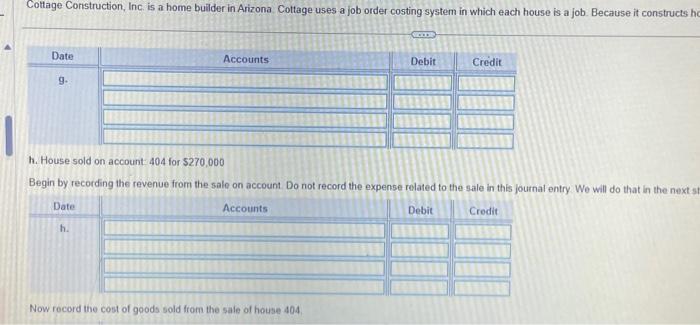

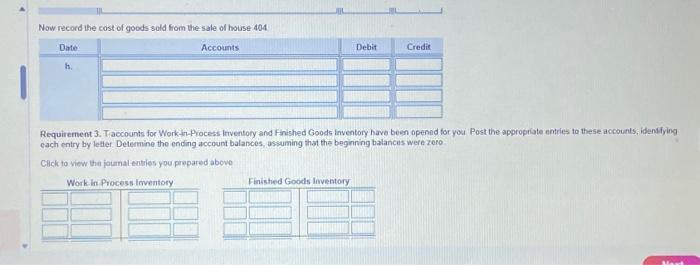

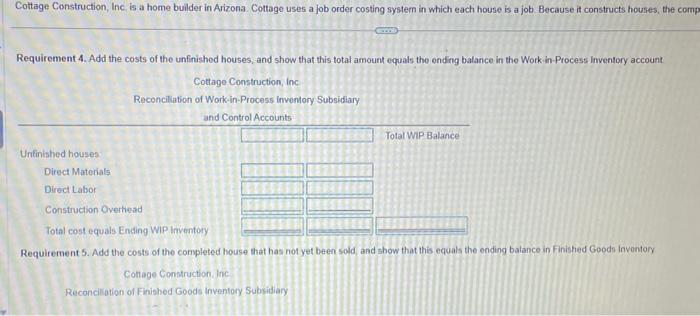

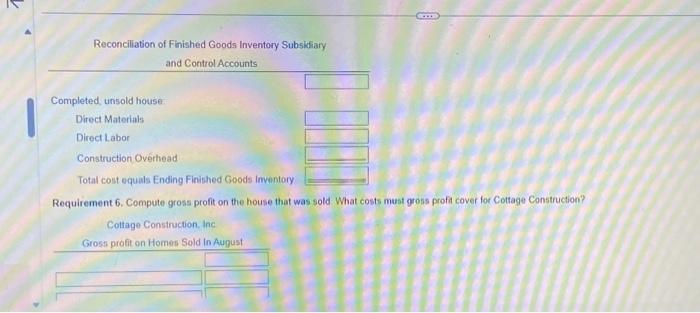

Cottage Corstruction, Inc. is a home bulder in Arizona. Cottage uses a job order costing system in which each house is a job. Because it constructs houses, the campany uses an account taled Construction Ovethead. The compary applies overhead based on estimaled drect labor costs For the yeat it estimated conatruction ovethead of $1, 050 000 and total drect laber cost of 52,625,000 The following events occurred during August Cick the icon to view the events.) Read the iemerements Requirement 1. Calculste Cotage's predetemined overtiead allocasion rate for the year Requirement 2. Prepare joumal entries to record the events in the general joumal (Record debits frst then crests. Exdude explanations trom any joumat enhies) a. Purchased materials on account, $420,000 More info a. Purchased materials on account, $420,000 b. Requisitioned direct materials and used direct labor in construction. Recorded the materials requisitioned c. The company incurred total wages of $280,000. Use the data from Item b to assign the wages. Wages are not yet paid d. Depreciation of construction equipment, $6,500 e. Other overhead costs incurred Equipment rentals paid in cash, $32,000, Worker liability insurance expired, $5,000. f. Allocated overhead to jobs. g. Houses completed 402, 404 h. House sold on account 404 for $270,000 Requirements 1. Calculate Cottage's predetermined overhead allocation rate for the year. 2. Prepare journal entries to record the events in the general journal. 3. T-accounts for Work-in-Process Inventory and Finished Goods Inventory have been opened for you. Post the appropriate entries to these accounts, identifying each entry by letter. Determine the ending account balances, assuming that the beginning balances were zero. 4. Add the costs of the unfinished houses, and show that this total amount equals the ending balance in the Work-in-Process Inventory account. 5. Add the costs of the completed house that has not yet been sold, and show that this equals the ending balance in Finished Goods Inventory. 6. Compute gross profit on the house that was sold. What costs must gross profit cover for Cottage Construction? Requirement 1. Calculate Cottage's predetermined overhead allocation rate for the year. 0 record the events in the general journal. (Record debits Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Cash Construction Overhead Cost of Goods Sold Finished Goods Inventory Prepaid Insurance Daw Matoriale Invantnn ottage Constru ccount titled Co irect labor cost (Click the icc costing estimate Purchased ma a. Purchased materials on account, $420.000 d. Depreciation of construction equipment, $6,500 f. Allocated overhead to jobs. a. Houses comploted 402.404 Cottage Construction, Inc. is a home bulider in Arizona. Cottage uses a job order costing system in which each house is a job. Because it constructs h. House sold on account 404 for $270,000 Begin by recording the revenue from the sale on account Do not record the expense related to the sale in this journal entry We will do that in the next Now record the cost of goods sold from the sale of house 404 Now record the cost of goods sold from the sale of house 404 Requirement 3. Taocounts for Work tr-Process lnventory and Finished Goods inventory have been opened for you Post the appropriate entries to these accounts, iflantfying each entry by letter. Determine the ending account balances, assuming that the beginning balances were zero Click to yirye the ioumal entries you prepared abowe Requirement 5 . Add the costs of the completed house that has not yet been sold and show that this equals the ending balance in Finished Goeds invontory Conage Construction, Inc Reconcillation of Finished Goods inventory Subzitiary Reconciliation of Finished Goods Inventory Subsidiary Requirement 6. Compute gross profit on the house that was sold What costs must gross profi cover for Cottage Construction? ona. Cottage uses a job order costing system