Answered step by step

Verified Expert Solution

Question

1 Approved Answer

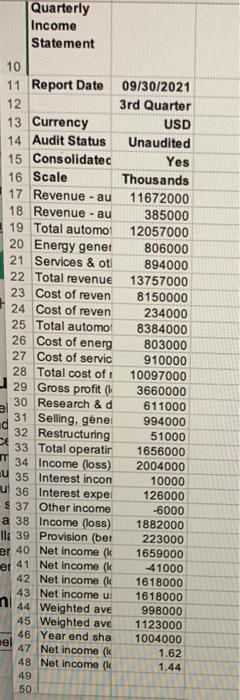

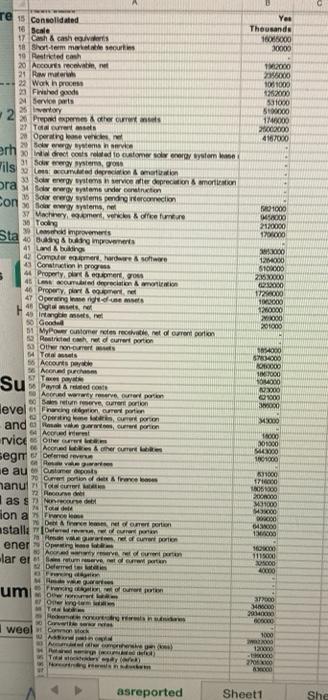

could i please get help to determine based off three options which senario would be the best for the business based off of the quarterly

could i please get help to determine based off three options which senario would be the best for the business based off of the quarterly statement of tesla inc.

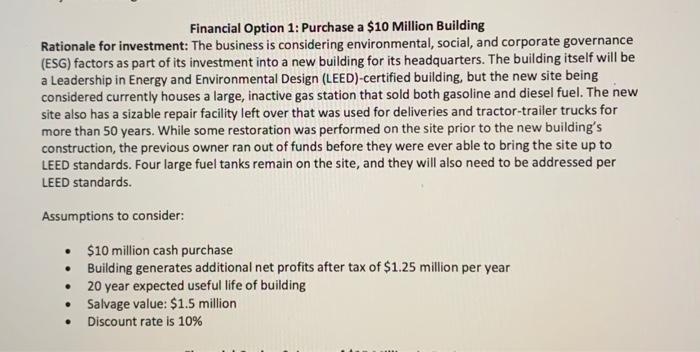

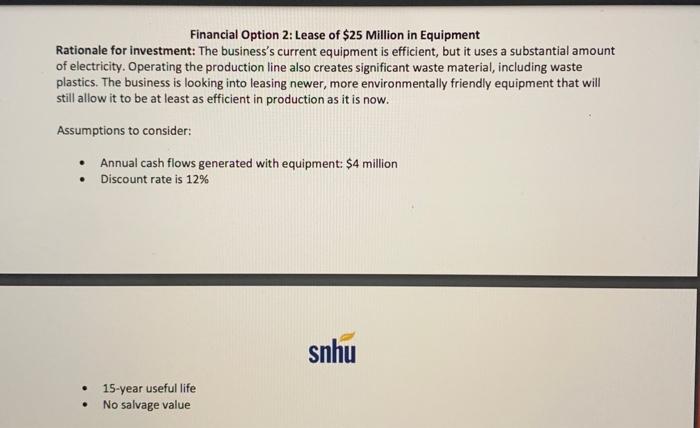

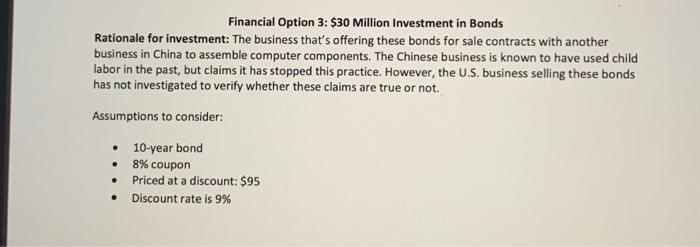

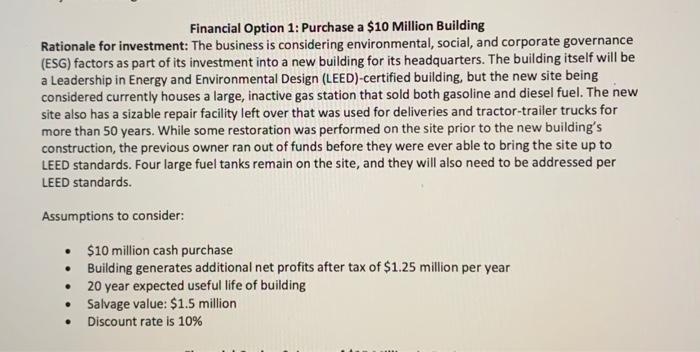

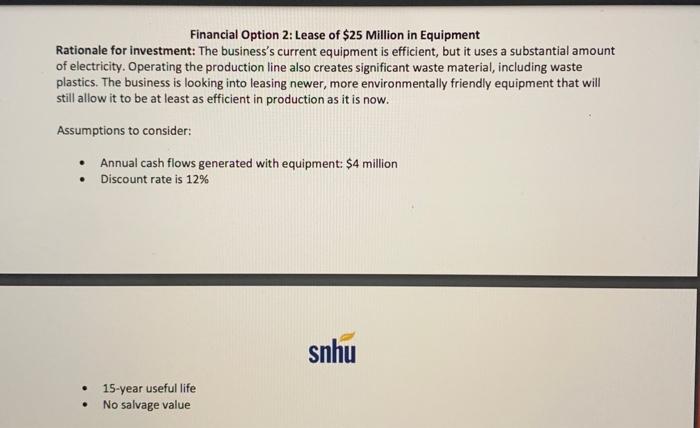

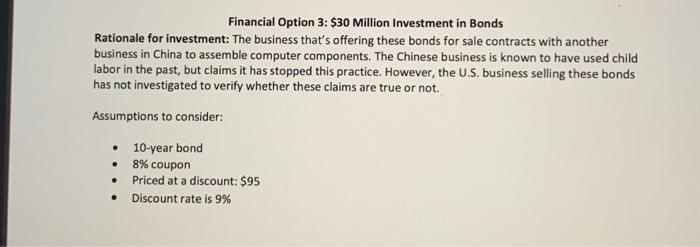

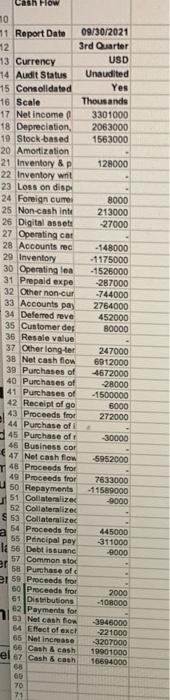

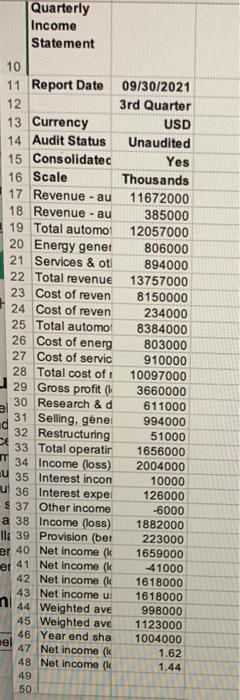

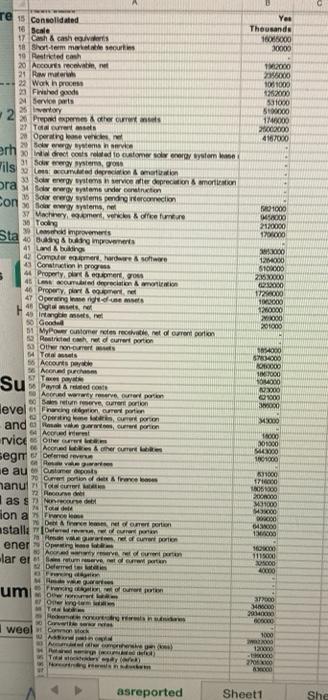

Financial Option 1: Purchase a $10 Million Building Rationale for investment: The business is considering environmental, social, and corporate governance (ESG) factors as part of its investment into a new building for its headquarters. The building itself will be a Leadership in Energy and Environmental Design (LEED)-certified building, but the new site being considered currently houses a large, inactive gas station that sold both gasoline and diesel fuel. The new site also has a sizable repair facility left over that was used for deliveries and tractor-trailer trucks for more than 50 years. While some restoration was performed on the site prior to the new building's construction, the previous owner ran out of funds before they were ever able to bring the site up to LEED standards. Four large fuel tanks remain on the site, and they will also need to be addressed per LEED standards. Assumptions to consider: . $10 million cash purchase Building generates additional net profits after tax of $1.25 million per year 20 year expected useful life of building Salvage value: $1.5 million Discount rate is 10% . . Financial Option 2: Lease of $25 Million in Equipment Rationale for investment: The business's current equipment is efficient, but it uses a substantial amount of electricity. Operating the production line also creates significant waste material, including waste plastics. The business is looking into leasing newer, more environmentally friendly equipment that will still allow it to be at least as efficient in production as it is now. Assumptions to consider: Annual cash flows generated with equipment: $4 million Discount rate is 12% snhu 15-year useful life No salvage value . Financial Option 3: $30 Million Investment in Bonds Rationale for investment: The business that's offering these bonds for sale contracts with another business in China to assemble computer components. The Chinese business is known to have used child labor in the past, but claims it has stopped this practice. However, the U.S. business selling these bonds has not investigated to verify whether these claims are true or not. Assumptions to consider: 10-year bond 8% coupon Priced at a discount: $95 Discount rate is 9% Cash Flow 10 1 Report Date 09/30/2021 12 3rd Quarter 13 Currency USD 14 Audit Status Unaudited Yes 15 Consolidated 16 Scale Thousands 17 Net income 3301000 18 Depreciation 2063000 19 Stock-based 1563000 20 Amortization 21 Inventory & P 128000 22 Inventory writ 23 Loss on dispe 24 Foreign curre 8000 25 Non-cash inte 213000 26 Digital assets 27000 27 Operating car 28 Accounts rec -148000 29 Inventory -1175000 30 Operating les -1525000 31 Prepaid expe -287000 32 Other non-cur -744000 33 Accounts pay 2764000 34 Deferred reve 452000 35 Customer deg 80000 36 Resale value 37 Other long-ter 247000 38 Net cash flow 6912000 39 Purchases of 4572000 40 Purchases of 28000 41 Purchases of -1500000 42 Receipt of go 6000 43 Proceeds fror 272000 44 Purchase of 45 Purchase of 30000 46 Business cor 47 Net cash flow -5952000 48 Proceeds fror 49 Proceeds fror 7633000 50 Repayments -11589000 51 Collateralized 9000 52 Collateralized S53 Collateralize 54 Proceeds fror 445000 55 Principal pay 311000 I56 Debt issuanc -9000 57 Common stoc er 58 Purchase of 21 50 Proceeds fror 60 Proceeds fro 2000 51 Distributions -108000 62 Payments for 53 Net cashion 3946000 64 Effect of exch 221000 65 Not incase -3207000 66 Cash & cash 19901000 el 67 Cash & cash 16604000 68 60 70 71 Quarterly Income Statement 10 11 Report Date 09/30/2021 12 3rd Quarter 13 Currency USD 14 Audit Status Unaudited 15 Consolidatec Yes 16 Scale Thousands 17 Revenue - au 11672000 18 Revenue - au 385000 19 Total automo 12057000 20 Energy gener 806000 21 Services & oti 894000 22 Total revenue 13757000 23 Cost of reven 8150000 24 Cost of reven 234000 25 Total automo 8384000 26 Cost of energ 803000 27 Cost of servic 910000 28 Total cost oft 10097000 29 Gross profit (1) 3660000 30 Research & d 611000 31 Selling, genel 994000 32 Restructuring 51000 SE 33 Total operatir 1656000 MT 34 Income (loss) 2004000 U 35 Interest incon 10000 u 36 Interest expe 126000 $ 37 Other income -6000 a 38 Income (loss) 1882000 la 39 Provision (bet 223000 er 40 Net Income (k 1659000 er 41 Net income (k 41000 42 Net income (k 1618000 43 Net income u 1618000 n 44 Weighted ave 998000 45 Weighted ave 1123000 46 Year end sha 1004000 del 47 Net income (k 1.62 48 Net income ( 1.44 49 50 Yes Thousands 10016000 10000 12000 2x 1001000 4352000 531000 59000 1/48000 2000 4167000 1000 WOO 2120000 196000 Te is consolidated 10 Sele 17 Cash & cash 18. Short-term marele securi 19 Restricted cash 20 Acous recev 21 Raw mater 22 Work in process Fished goods 2 Services 25 wetery 2 Pred peres other curs 2 Total 2 Operating severe erh 20 Bewers have 30 Indrect could to customer weergy system me ils 31 Systems, 22 Los Budrio & motion 33 Sierro ysters View depreciation & meriton bra Borrar yatana de correction Con Sawyers, 35 So errey system pendingerconnection 37 Valves & offerumur Tooling 30 Lamod improvements Sta Bang & burg improve 41 und & bukings 42 Commerce & sowe Construction in progress 5 44 Property, plant & ementos 46 Le wurdepreciation & want to 46 Propery & co.ee 47 Operating med 4 oglase Igor , 1 My Power cutomer retes recev, net alorrent portion Restricted red ourer portion Othernet Tam 50 Accounts pece 16 Modurch Tres 67 ad con Acord worrwtyrrverar por retur ere, current portion evel Frageporten Operating in porton and a ham, un portion Acort rvice Circe Acor & other curren segir Dermed e au Cameron 70 Our portion & Travel hanule 22 as see Torelle son as De moment portion astallieren Het of current porn enero 5. Art of our lar elementen Deler 12 So Good 201000 OOO 6784000 OOOOO 17000 Su MO 2000 100 3.000 MODO 16000 1000 SO 1000 31000 000 EXO 31000 M3000 DOGODB 000 1MDO NO 1119000 4000 um 317000 MO 20140000 MHR 5 golur MO EF Owo- To Medan we weel Contoh AN mo Tower re 1000 ma 12 IOCO 204000 asreported Sheet1 She Financial Option 1: Purchase a $10 Million Building Rationale for investment: The business is considering environmental, social, and corporate governance (ESG) factors as part of its investment into a new building for its headquarters. The building itself will be a Leadership in Energy and Environmental Design (LEED)-certified building, but the new site being considered currently houses a large, inactive gas station that sold both gasoline and diesel fuel. The new site also has a sizable repair facility left over that was used for deliveries and tractor-trailer trucks for more than 50 years. While some restoration was performed on the site prior to the new building's construction, the previous owner ran out of funds before they were ever able to bring the site up to LEED standards. Four large fuel tanks remain on the site, and they will also need to be addressed per LEED standards. Assumptions to consider: . $10 million cash purchase Building generates additional net profits after tax of $1.25 million per year 20 year expected useful life of building Salvage value: $1.5 million Discount rate is 10% . . Financial Option 2: Lease of $25 Million in Equipment Rationale for investment: The business's current equipment is efficient, but it uses a substantial amount of electricity. Operating the production line also creates significant waste material, including waste plastics. The business is looking into leasing newer, more environmentally friendly equipment that will still allow it to be at least as efficient in production as it is now. Assumptions to consider: Annual cash flows generated with equipment: $4 million Discount rate is 12% snhu 15-year useful life No salvage value . Financial Option 3: $30 Million Investment in Bonds Rationale for investment: The business that's offering these bonds for sale contracts with another business in China to assemble computer components. The Chinese business is known to have used child labor in the past, but claims it has stopped this practice. However, the U.S. business selling these bonds has not investigated to verify whether these claims are true or not. Assumptions to consider: 10-year bond 8% coupon Priced at a discount: $95 Discount rate is 9% Cash Flow 10 1 Report Date 09/30/2021 12 3rd Quarter 13 Currency USD 14 Audit Status Unaudited Yes 15 Consolidated 16 Scale Thousands 17 Net income 3301000 18 Depreciation 2063000 19 Stock-based 1563000 20 Amortization 21 Inventory & P 128000 22 Inventory writ 23 Loss on dispe 24 Foreign curre 8000 25 Non-cash inte 213000 26 Digital assets 27000 27 Operating car 28 Accounts rec -148000 29 Inventory -1175000 30 Operating les -1525000 31 Prepaid expe -287000 32 Other non-cur -744000 33 Accounts pay 2764000 34 Deferred reve 452000 35 Customer deg 80000 36 Resale value 37 Other long-ter 247000 38 Net cash flow 6912000 39 Purchases of 4572000 40 Purchases of 28000 41 Purchases of -1500000 42 Receipt of go 6000 43 Proceeds fror 272000 44 Purchase of 45 Purchase of 30000 46 Business cor 47 Net cash flow -5952000 48 Proceeds fror 49 Proceeds fror 7633000 50 Repayments -11589000 51 Collateralized 9000 52 Collateralized S53 Collateralize 54 Proceeds fror 445000 55 Principal pay 311000 I56 Debt issuanc -9000 57 Common stoc er 58 Purchase of 21 50 Proceeds fror 60 Proceeds fro 2000 51 Distributions -108000 62 Payments for 53 Net cashion 3946000 64 Effect of exch 221000 65 Not incase -3207000 66 Cash & cash 19901000 el 67 Cash & cash 16604000 68 60 70 71 Quarterly Income Statement 10 11 Report Date 09/30/2021 12 3rd Quarter 13 Currency USD 14 Audit Status Unaudited 15 Consolidatec Yes 16 Scale Thousands 17 Revenue - au 11672000 18 Revenue - au 385000 19 Total automo 12057000 20 Energy gener 806000 21 Services & oti 894000 22 Total revenue 13757000 23 Cost of reven 8150000 24 Cost of reven 234000 25 Total automo 8384000 26 Cost of energ 803000 27 Cost of servic 910000 28 Total cost oft 10097000 29 Gross profit (1) 3660000 30 Research & d 611000 31 Selling, genel 994000 32 Restructuring 51000 SE 33 Total operatir 1656000 MT 34 Income (loss) 2004000 U 35 Interest incon 10000 u 36 Interest expe 126000 $ 37 Other income -6000 a 38 Income (loss) 1882000 la 39 Provision (bet 223000 er 40 Net Income (k 1659000 er 41 Net income (k 41000 42 Net income (k 1618000 43 Net income u 1618000 n 44 Weighted ave 998000 45 Weighted ave 1123000 46 Year end sha 1004000 del 47 Net income (k 1.62 48 Net income ( 1.44 49 50 Yes Thousands 10016000 10000 12000 2x 1001000 4352000 531000 59000 1/48000 2000 4167000 1000 WOO 2120000 196000 Te is consolidated 10 Sele 17 Cash & cash 18. Short-term marele securi 19 Restricted cash 20 Acous recev 21 Raw mater 22 Work in process Fished goods 2 Services 25 wetery 2 Pred peres other curs 2 Total 2 Operating severe erh 20 Bewers have 30 Indrect could to customer weergy system me ils 31 Systems, 22 Los Budrio & motion 33 Sierro ysters View depreciation & meriton bra Borrar yatana de correction Con Sawyers, 35 So errey system pendingerconnection 37 Valves & offerumur Tooling 30 Lamod improvements Sta Bang & burg improve 41 und & bukings 42 Commerce & sowe Construction in progress 5 44 Property, plant & ementos 46 Le wurdepreciation & want to 46 Propery & co.ee 47 Operating med 4 oglase Igor , 1 My Power cutomer retes recev, net alorrent portion Restricted red ourer portion Othernet Tam 50 Accounts pece 16 Modurch Tres 67 ad con Acord worrwtyrrverar por retur ere, current portion evel Frageporten Operating in porton and a ham, un portion Acort rvice Circe Acor & other curren segir Dermed e au Cameron 70 Our portion & Travel hanule 22 as see Torelle son as De moment portion astallieren Het of current porn enero 5. Art of our lar elementen Deler 12 So Good 201000 OOO 6784000 OOOOO 17000 Su MO 2000 100 3.000 MODO 16000 1000 SO 1000 31000 000 EXO 31000 M3000 DOGODB 000 1MDO NO 1119000 4000 um 317000 MO 20140000 MHR 5 golur MO EF Owo- To Medan we weel Contoh AN mo Tower re 1000 ma 12 IOCO 204000 asreported Sheet1 She

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started