Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could I please know how the $5 comes for interest expense and interest payable??? The Bramble Corporation had the following opening trial balance at the

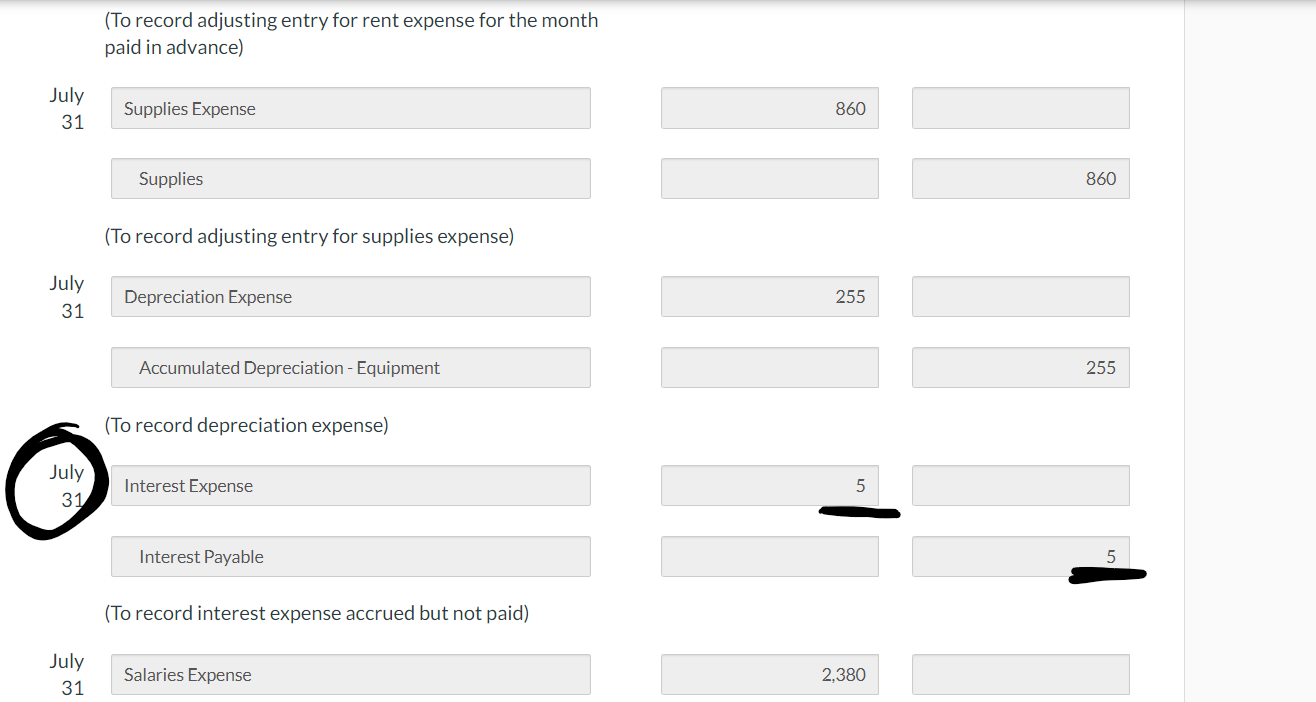

Could I please know how the $5 comes for interest expense and interest payable???

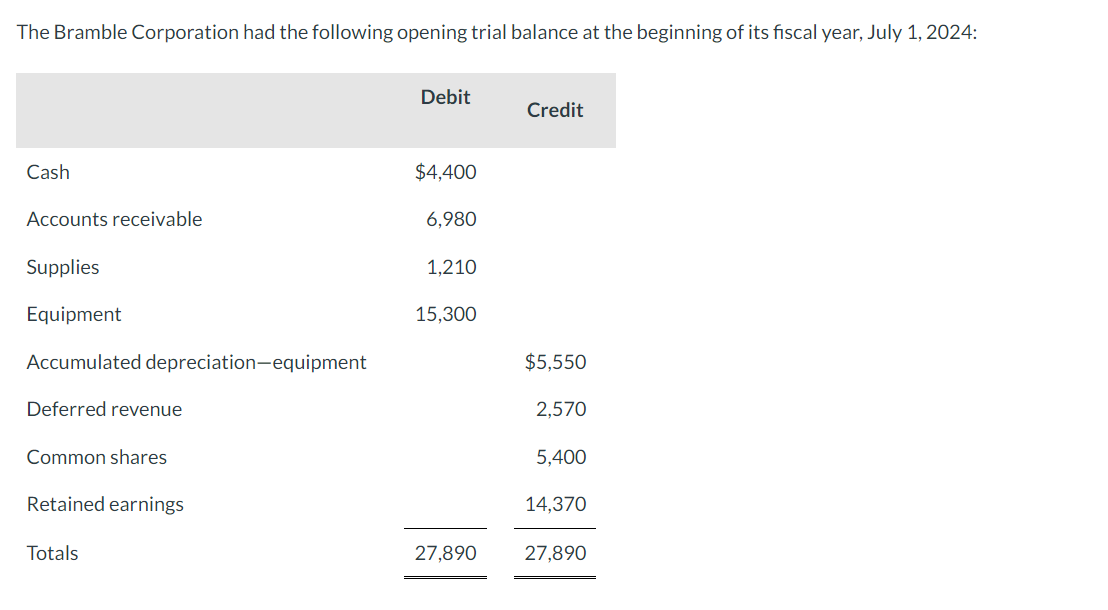

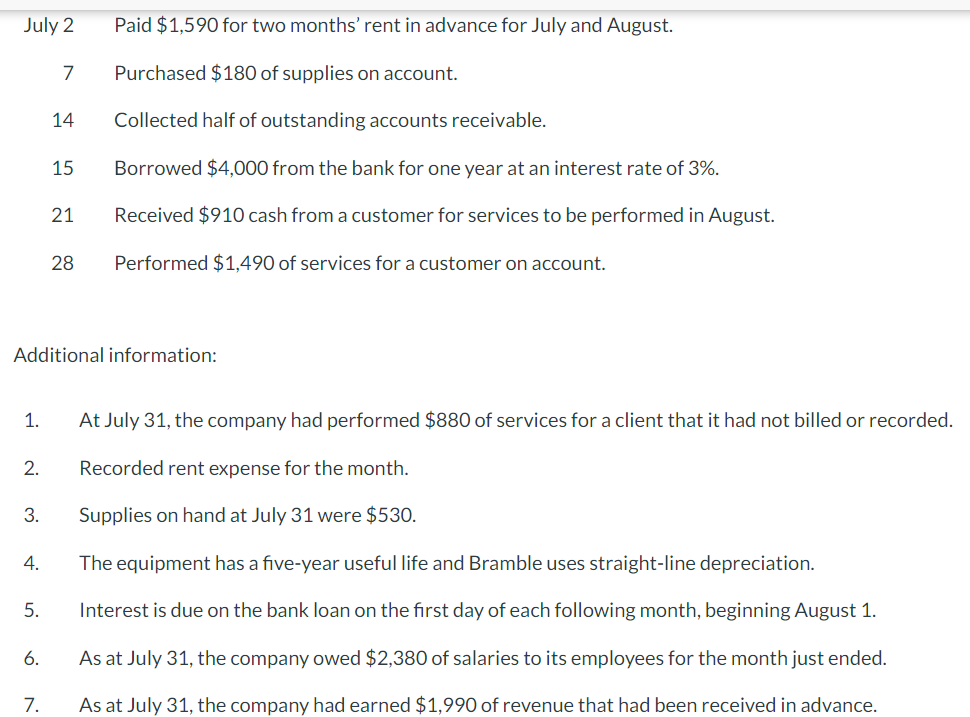

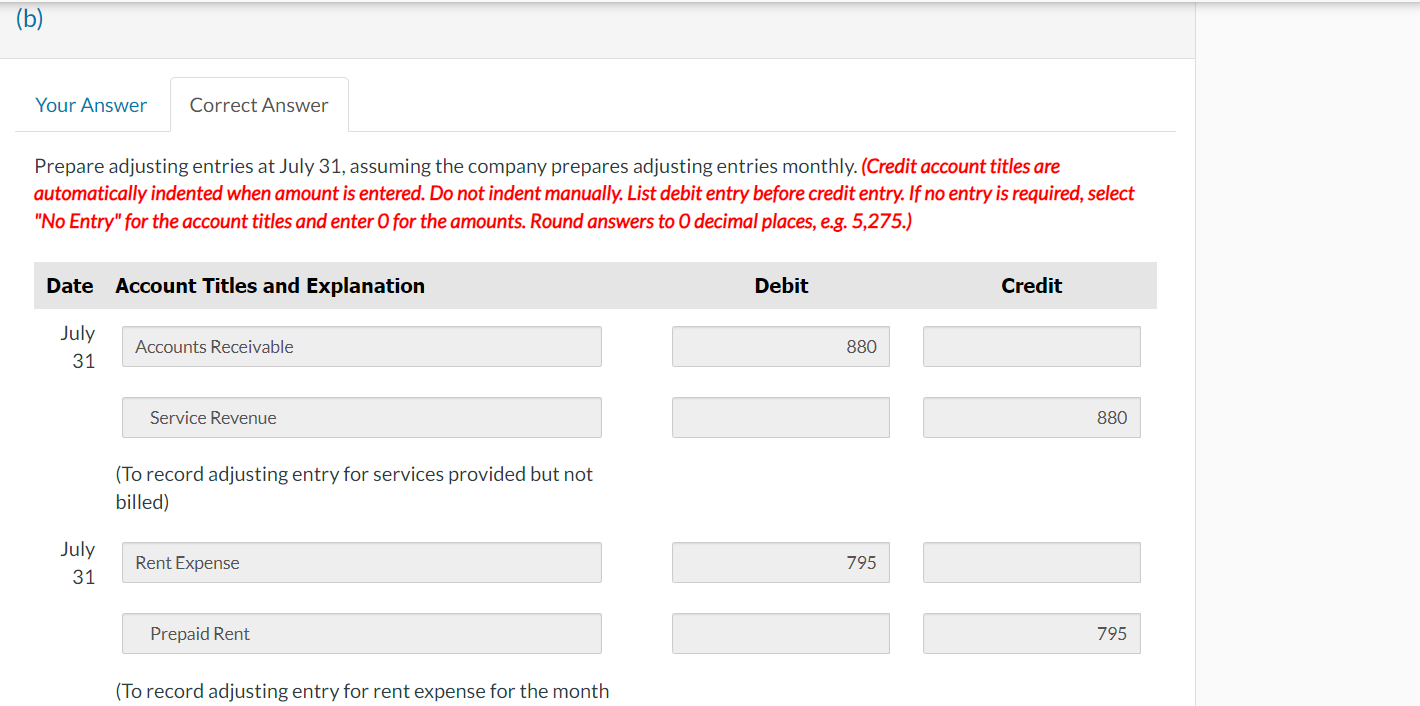

The Bramble Corporation had the following opening trial balance at the beginning of its fiscal year, July 1, 2024: July 2 Paid $1,590 for two months' rent in advance for July and August. 7 Purchased $180 of supplies on account. 14 Collected half of outstanding accounts receivable. 15 Borrowed $4,000 from the bank for one year at an interest rate of 3%. 21 Received \$910 cash from a customer for services to be performed in August. 28 Performed $1,490 of services for a customer on account. Additional information: 1. At July 31 , the company had performed $880 of services for a client that it had not billed or recorded. 2. Recorded rent expense for the month. 3. Supplies on hand at July 31 were $530. 4. The equipment has a five-year useful life and Bramble uses straight-line depreciation. 5. Interest is due on the bank loan on the first day of each following month, beginning August 1. 6. As at July 31 , the company owed $2,380 of salaries to its employees for the month just ended. 7. As at July 31, the company had earned $1,990 of revenue that had been received in advance. Prepare adjusting entries at July 31 , assuming the company prepares adjusting entries monthly. (Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275.) (To record adjusting entry for rent expense for the month paid in advance) July 31 Supplies Expense Supplies (To record adjusting entry for supplies expense) July 31 Depreciation Expense Accumulated Depreciation - Equipment (To record depreciation expense) July Interest Expense Interest Payable (To record interest expense accrued but not paid) July Salaries Expense 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started