Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could someone help me with this practice question? Thank you File Tools Vien exam 2 - Word e Venture Capital Limited has formed a private

Could someone help me with this practice question?

Thank you

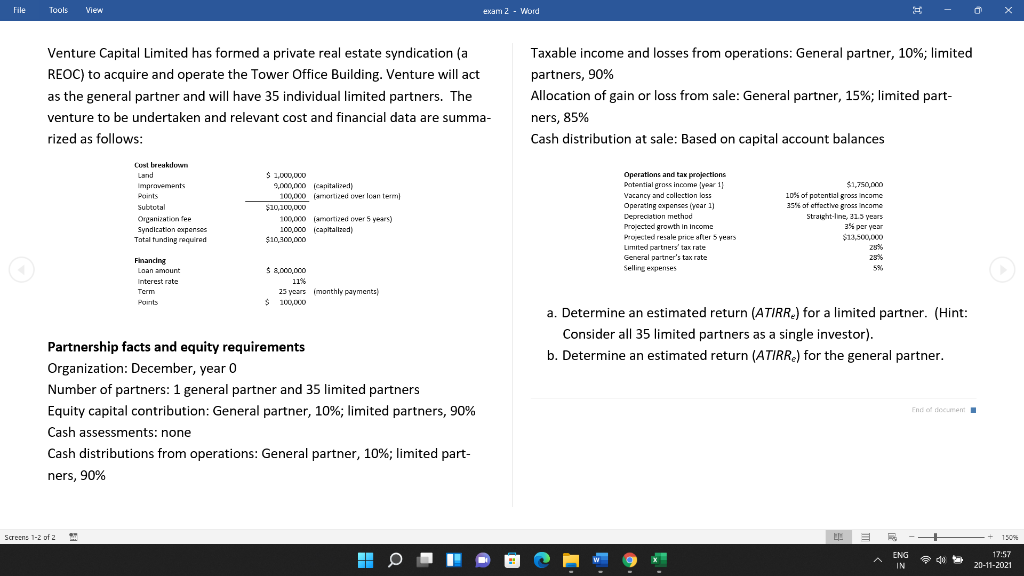

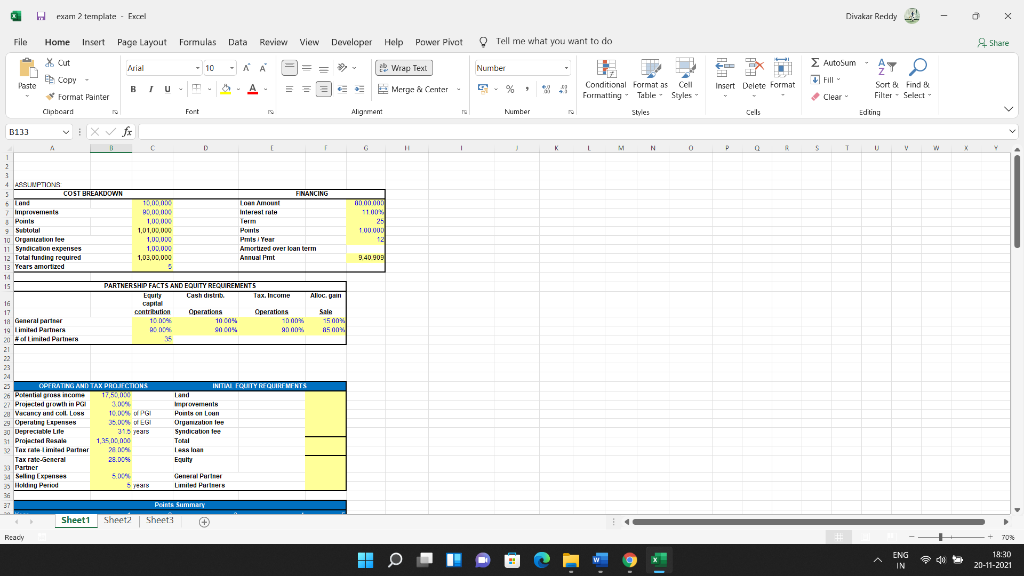

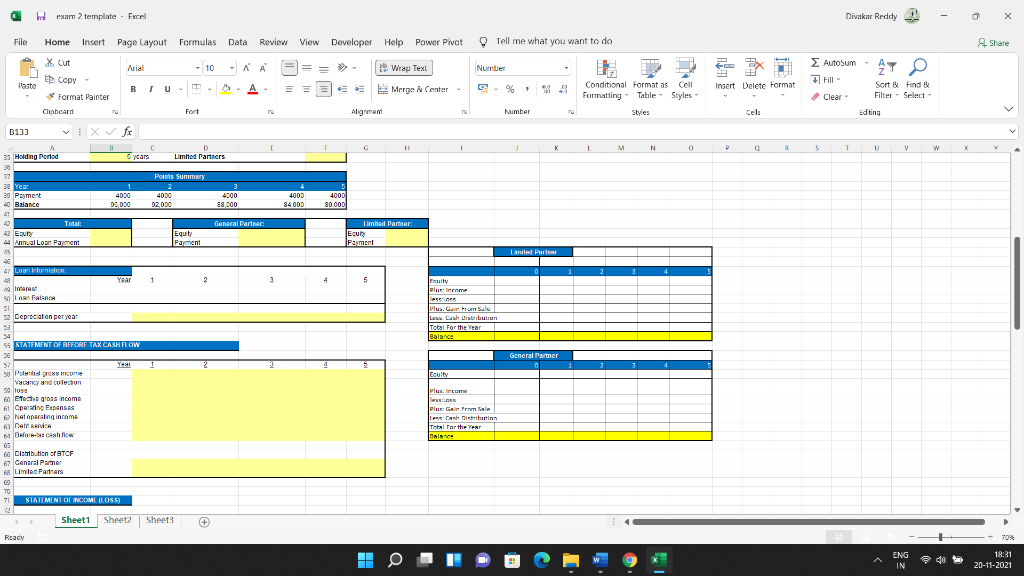

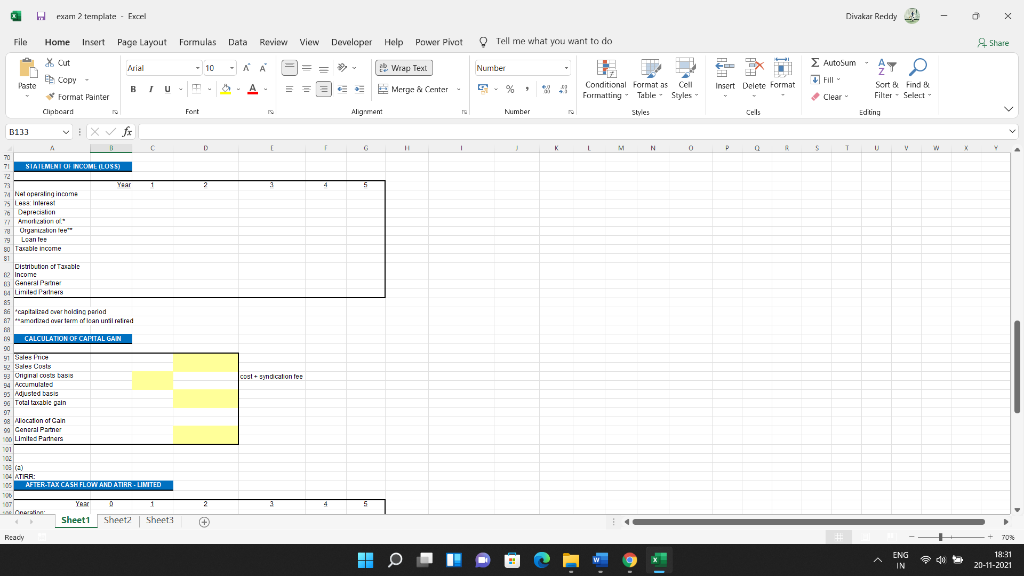

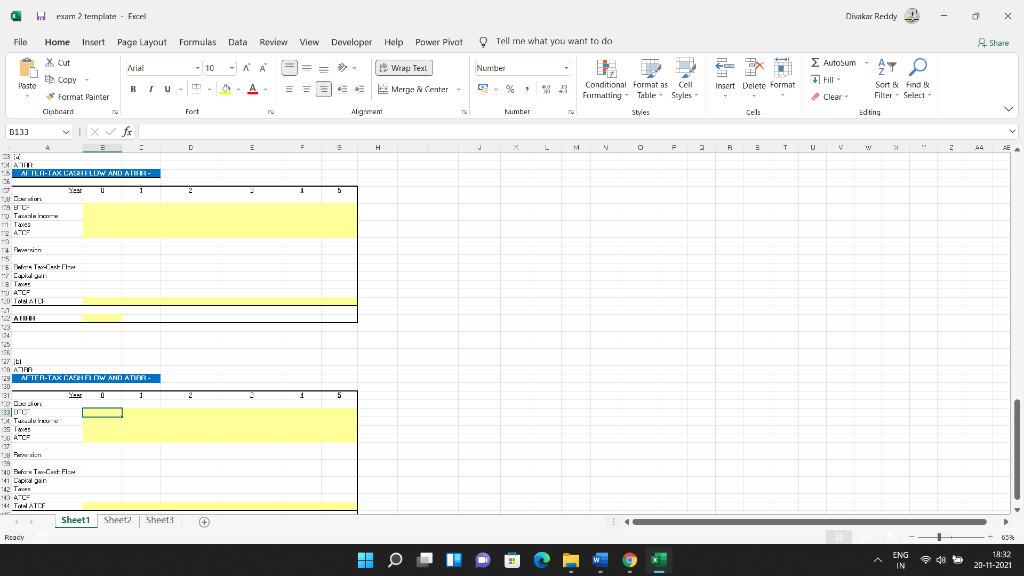

File Tools Vien exam 2 - Word e Venture Capital Limited has formed a private real estate syndication (a REOC) to acquire and operate the Tower Office Building. Venture will act as the general partner and will have 35 individual limited partners. The venture to be undertaken and relevant cost and financial data are summa- rized as follows: Taxable income and losses from operations: General partner, 10%; limited partners, 90% Allocation of gain or loss from sale: General partner, 15%; limited part- ners, 85% Cash distribution at sale: Based on capital account balances xl breakilun Land Improvements Subtotal Organization fee Syndication expenses Total funding required $3,000,000 9,000,000 (capitalized 100,000 (amortized over loan term $10,100,000 100,000 (amortized over 5 years) 100,000 capitalized) $10,100,000 Operations and tax projections Potential gross income year 1} Vacancy and collection loss Operating expenses (year 1) Depreciation method Projectec growth in Income Projected resale price after 5 years Limited partners' tax rate General partner's tax rate Selling expenses $1,750,000 10% of potential gross income 35't of effective gross income Straight line, 21.5 years 3% per year $13,500,000 28% 25% 596 Financing Loan amount Interest rate Term Points $ 8,000,000 11% 25 years (monthly payments $ 100,000 a. Determine an estimated return (ATIRR) for a limited partner. (Hint: Consider all 35 limited partners as a single investor). b. Determine an estimated return (ATIRR) for the general partner. Partnership facts and equity requirements Organization: December, year 0 Number of partners: 1 general partner and 35 limited partners Equity capital contribution: General partner, 10%; limited partners, 90% Cash assessments: none Cash distributions from operations: General partner, 10%; limited part- End of document ners, 90% Screen 1-2 of 2 LE 1309 H ENG IN 17:57 20-11-2021 exam 2 template - Excel Divakar Reddy X File View Developer Help Power Pivot Tell me what you want to do Share == Wrap Text Number Home Insert Page Layout Formulas Data Review X Out Arial - 10 - A Copy - $ A Format Painter Cliaboard Font Autosum Fill AYO e Paste Merge Center 88 Insert Delete Format Conditional Format as Cell Formatting - Table Styles Styles Sort Find Filter Select Clear Alignment Number Editing B133 X fi fx A G M N 0 0 S T w HET OG OTOK 1100 * 25 100 QUE 12 B C D [ 1 2 3 4 ASSUMPTIONS 5 COST BREAKDOWN FINANCING 6 And 10.0.0 Loan Amount 7 proses 89,03,000 mii i 8 Pents 1,03,000 9 9 Subtotal 1,01,03,000 Ponts 10 Organization 1,03,000 Pris Year 11 Syndication experises 1,00,000 Amortized over loan term 12 Total funding required 1,03,00,000 Annual Pint 13 Years amortized 3 14 15 PARTNERSHIP FACTS AND EQUITY REQUIREMENTS Equity Cash distrib: Tax Income Alloc, gan 16 Capris 17 contribution Operations Operations 1a General partner 10.004 | 1000% 1000% 1500% 19 limited Partners ROCA 9000% 9000% A500 20 #od Limited Partners 21 9.40 903 23 OPFRATING AND TAX PROJECTIONS INITIAL FQUITY REQUIREMENTS 26 Potential income 17.50.000 Tamil 27 Projected growth in PC 3.004 Improvements 20 Vacancy und LOM 10.00 PGI Punto Lour 29 Operating Lapenses 30.00% Of EG Oryubole 30 Depreciate Lite 31. years = Syndication fee 51 Projected Rise 1,35,00.00 Total Tax rate limited Partner 2004 Iesanan Tax rate General 28.0096 Equity 33 Partner 34 Selling Expres 6.004 General Purler 3 Houny Period 6 very Limited Puies 38 37 Points Summary Sheet1 Sheet2 Sheets + Reacy 70% H A ENG IN 18:30 20-11-2021 Hexam 2 template - Excel Divakar Reddy X Tell me what you want to do Share Number Autosum Fill AT 88 Insert Delete Format File Home Insert Page Layout Formulas Data Review View Developer Help Power Pivot X X Out Arial - 10 - A = Wrap Text Et Copy - Paste BIU A Format Painter Merge Center Cliaboard Font IS Alignment B133 fx B C D [ G ! ss Holding Period Limited Partners Conditional Format as Cell Formatting - Table Styles Styles Sort Find Filter - Select - Clear Number Cels Editing M N 0 0 S S T U V w X Scars Points Summary 1 4020 95,000 4000 92.000 4200 68,000 4000 84000 400D 8000D 37 38 Yes 39 Payment 40 Balance 27 42 Total: 43 Eu 44 Anal Loan Pament General Partner Equity Payment Limited Partner EUR Payment Limited Puit 40 27 Luan information Year 1 1 2 3 5 19 Interest SO Balance 51 52 Depreciation per year 53 Ecuity Plue Inne ere Plua. Gain From Sale L Lash Distribution Total For the war Balance General Partner Equity 55 STATEMENT OF RFFORE TAX CASH FLOW 36 57 Y-811 50 Police Vacancy and lechon 99 USH 60 The gross ncome 61 Operating Fapens Na operating income Del AVEA 6. Draw plus: LOE Plue: Gain From Sale IP Cash Distributinn Total For the Year Naise 66 Distribution of BTCF 67 Central Partner Limited Partners ca 70 71 STATEMENT OF INCOME LOSS) 12 Sheet1 Sheet2 Sheet3 + Reacy 70% H A ENG IN 18:31 20-11-2021 exam 2 template - Excel Divakar Reddy X File View Developer Help Power Pivot Tell me what you want to do Share == Wrap Text Number Home Insert Page Layout Formulas Data Review X Out Arial - 10 - A Et Copy - BUT Format Painter Cliaboard Font Autosum Fill 47 O Paste Merge Center 88 Insert Delete Format Conditional Formatos Cell Formatting - Table Styles Styles Sort Find Filter - Select - Clear Alignment Number Cels Editing B133 X ft D [ G M N 0 Q T U w x 2 2 S C 70 STATEMENT OF INCOME (LOSS) 72 73 Year 7 NA Operating inname 75 HR interest 76 Deprecation Amon Orarication 79 Loan les 50 Tacable income 81 Distribution of Tarable O Income General 64 Limler SS Scaptated over holding period 87 mortod over term loan urinered of 19 CALCULATION OF CAPITAL GAN 90 913 52 les Costs 53 93 Ongnal costs tas 54 Accumulated 95 Adjusted basis 90 Total taxable pain 97 08 Nlocation of Can 99 Central Partner 100 Limited Partners *01 09 os 04 ATRR: 06 AFTER-TAX CASH FLOW AND ATIRR - LIMITED *00 YAR Col + syndication fee 2 Sheet1 Sheet2 Sheets + Reacy 70% H o A ENG IN 40 18:31 20-11-2021 exam 2 template - Excel Divakar Reddy X File View Developer Help Power Pivot Tell me what you want to do Share Autosum - Ay == Wrap Text Number Home Insert Page Layout Formulas Data Review X X Out Arial - 10 - A Et Copy - A *Format Painter Cliaboard Font Paste Merge Center A 88 Conditional Format as Cell Formatting Table Styles Insert Delete Format Sort Find Filter - Select Clear Alignment Number Style: Cels Editing B133 fr A D H J L M o F 3 R 3 T U w X Z 49 RE MAR ALILI-TAX CAUTILUW AND ATHER Year U 1 2 1 1 5 5 1. 10 Tarn - Taxes 12 AT 13 14 Pin 15 15 wore TR Fim 17 Con IB TE 9490 120 ATG 122 AT 125 126 127 ti A AIR 129 ATI HI-TAX CASHFLOW AND ATIR. AFTER 130 131 Year 0 1 12 Deur 133 DO 12 TAM 135 Tavs 738 AC- 197 2 5 59 199 140 BTC FM 141 con 142 TCE 113 AC 144 TANATE Sheet1 Sheet2 Sheet3 Reacy H A ENG IN 18:32 20-11-2021 File Tools Vien exam 2 - Word e Venture Capital Limited has formed a private real estate syndication (a REOC) to acquire and operate the Tower Office Building. Venture will act as the general partner and will have 35 individual limited partners. The venture to be undertaken and relevant cost and financial data are summa- rized as follows: Taxable income and losses from operations: General partner, 10%; limited partners, 90% Allocation of gain or loss from sale: General partner, 15%; limited part- ners, 85% Cash distribution at sale: Based on capital account balances xl breakilun Land Improvements Subtotal Organization fee Syndication expenses Total funding required $3,000,000 9,000,000 (capitalized 100,000 (amortized over loan term $10,100,000 100,000 (amortized over 5 years) 100,000 capitalized) $10,100,000 Operations and tax projections Potential gross income year 1} Vacancy and collection loss Operating expenses (year 1) Depreciation method Projectec growth in Income Projected resale price after 5 years Limited partners' tax rate General partner's tax rate Selling expenses $1,750,000 10% of potential gross income 35't of effective gross income Straight line, 21.5 years 3% per year $13,500,000 28% 25% 596 Financing Loan amount Interest rate Term Points $ 8,000,000 11% 25 years (monthly payments $ 100,000 a. Determine an estimated return (ATIRR) for a limited partner. (Hint: Consider all 35 limited partners as a single investor). b. Determine an estimated return (ATIRR) for the general partner. Partnership facts and equity requirements Organization: December, year 0 Number of partners: 1 general partner and 35 limited partners Equity capital contribution: General partner, 10%; limited partners, 90% Cash assessments: none Cash distributions from operations: General partner, 10%; limited part- End of document ners, 90% Screen 1-2 of 2 LE 1309 H ENG IN 17:57 20-11-2021 exam 2 template - Excel Divakar Reddy X File View Developer Help Power Pivot Tell me what you want to do Share == Wrap Text Number Home Insert Page Layout Formulas Data Review X Out Arial - 10 - A Copy - $ A Format Painter Cliaboard Font Autosum Fill AYO e Paste Merge Center 88 Insert Delete Format Conditional Format as Cell Formatting - Table Styles Styles Sort Find Filter Select Clear Alignment Number Editing B133 X fi fx A G M N 0 0 S T w HET OG OTOK 1100 * 25 100 QUE 12 B C D [ 1 2 3 4 ASSUMPTIONS 5 COST BREAKDOWN FINANCING 6 And 10.0.0 Loan Amount 7 proses 89,03,000 mii i 8 Pents 1,03,000 9 9 Subtotal 1,01,03,000 Ponts 10 Organization 1,03,000 Pris Year 11 Syndication experises 1,00,000 Amortized over loan term 12 Total funding required 1,03,00,000 Annual Pint 13 Years amortized 3 14 15 PARTNERSHIP FACTS AND EQUITY REQUIREMENTS Equity Cash distrib: Tax Income Alloc, gan 16 Capris 17 contribution Operations Operations 1a General partner 10.004 | 1000% 1000% 1500% 19 limited Partners ROCA 9000% 9000% A500 20 #od Limited Partners 21 9.40 903 23 OPFRATING AND TAX PROJECTIONS INITIAL FQUITY REQUIREMENTS 26 Potential income 17.50.000 Tamil 27 Projected growth in PC 3.004 Improvements 20 Vacancy und LOM 10.00 PGI Punto Lour 29 Operating Lapenses 30.00% Of EG Oryubole 30 Depreciate Lite 31. years = Syndication fee 51 Projected Rise 1,35,00.00 Total Tax rate limited Partner 2004 Iesanan Tax rate General 28.0096 Equity 33 Partner 34 Selling Expres 6.004 General Purler 3 Houny Period 6 very Limited Puies 38 37 Points Summary Sheet1 Sheet2 Sheets + Reacy 70% H A ENG IN 18:30 20-11-2021 Hexam 2 template - Excel Divakar Reddy X Tell me what you want to do Share Number Autosum Fill AT 88 Insert Delete Format File Home Insert Page Layout Formulas Data Review View Developer Help Power Pivot X X Out Arial - 10 - A = Wrap Text Et Copy - Paste BIU A Format Painter Merge Center Cliaboard Font IS Alignment B133 fx B C D [ G ! ss Holding Period Limited Partners Conditional Format as Cell Formatting - Table Styles Styles Sort Find Filter - Select - Clear Number Cels Editing M N 0 0 S S T U V w X Scars Points Summary 1 4020 95,000 4000 92.000 4200 68,000 4000 84000 400D 8000D 37 38 Yes 39 Payment 40 Balance 27 42 Total: 43 Eu 44 Anal Loan Pament General Partner Equity Payment Limited Partner EUR Payment Limited Puit 40 27 Luan information Year 1 1 2 3 5 19 Interest SO Balance 51 52 Depreciation per year 53 Ecuity Plue Inne ere Plua. Gain From Sale L Lash Distribution Total For the war Balance General Partner Equity 55 STATEMENT OF RFFORE TAX CASH FLOW 36 57 Y-811 50 Police Vacancy and lechon 99 USH 60 The gross ncome 61 Operating Fapens Na operating income Del AVEA 6. Draw plus: LOE Plue: Gain From Sale IP Cash Distributinn Total For the Year Naise 66 Distribution of BTCF 67 Central Partner Limited Partners ca 70 71 STATEMENT OF INCOME LOSS) 12 Sheet1 Sheet2 Sheet3 + Reacy 70% H A ENG IN 18:31 20-11-2021 exam 2 template - Excel Divakar Reddy X File View Developer Help Power Pivot Tell me what you want to do Share == Wrap Text Number Home Insert Page Layout Formulas Data Review X Out Arial - 10 - A Et Copy - BUT Format Painter Cliaboard Font Autosum Fill 47 O Paste Merge Center 88 Insert Delete Format Conditional Formatos Cell Formatting - Table Styles Styles Sort Find Filter - Select - Clear Alignment Number Cels Editing B133 X ft D [ G M N 0 Q T U w x 2 2 S C 70 STATEMENT OF INCOME (LOSS) 72 73 Year 7 NA Operating inname 75 HR interest 76 Deprecation Amon Orarication 79 Loan les 50 Tacable income 81 Distribution of Tarable O Income General 64 Limler SS Scaptated over holding period 87 mortod over term loan urinered of 19 CALCULATION OF CAPITAL GAN 90 913 52 les Costs 53 93 Ongnal costs tas 54 Accumulated 95 Adjusted basis 90 Total taxable pain 97 08 Nlocation of Can 99 Central Partner 100 Limited Partners *01 09 os 04 ATRR: 06 AFTER-TAX CASH FLOW AND ATIRR - LIMITED *00 YAR Col + syndication fee 2 Sheet1 Sheet2 Sheets + Reacy 70% H o A ENG IN 40 18:31 20-11-2021 exam 2 template - Excel Divakar Reddy X File View Developer Help Power Pivot Tell me what you want to do Share Autosum - Ay == Wrap Text Number Home Insert Page Layout Formulas Data Review X X Out Arial - 10 - A Et Copy - A *Format Painter Cliaboard Font Paste Merge Center A 88 Conditional Format as Cell Formatting Table Styles Insert Delete Format Sort Find Filter - Select Clear Alignment Number Style: Cels Editing B133 fr A D H J L M o F 3 R 3 T U w X Z 49 RE MAR ALILI-TAX CAUTILUW AND ATHER Year U 1 2 1 1 5 5 1. 10 Tarn - Taxes 12 AT 13 14 Pin 15 15 wore TR Fim 17 Con IB TE 9490 120 ATG 122 AT 125 126 127 ti A AIR 129 ATI HI-TAX CASHFLOW AND ATIR. AFTER 130 131 Year 0 1 12 Deur 133 DO 12 TAM 135 Tavs 738 AC- 197 2 5 59 199 140 BTC FM 141 con 142 TCE 113 AC 144 TANATE Sheet1 Sheet2 Sheet3 Reacy H A ENG IN 18:32 20-11-2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started