Question: Could you please help me to complete financial statement which consists of a balance sheet, an incone statement, and certain ratios? Thank you and have

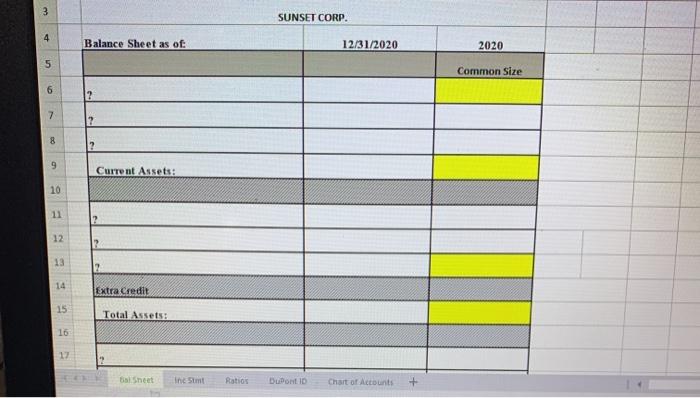

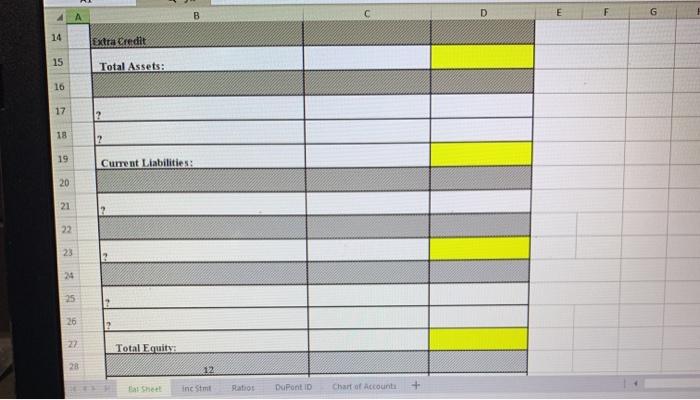

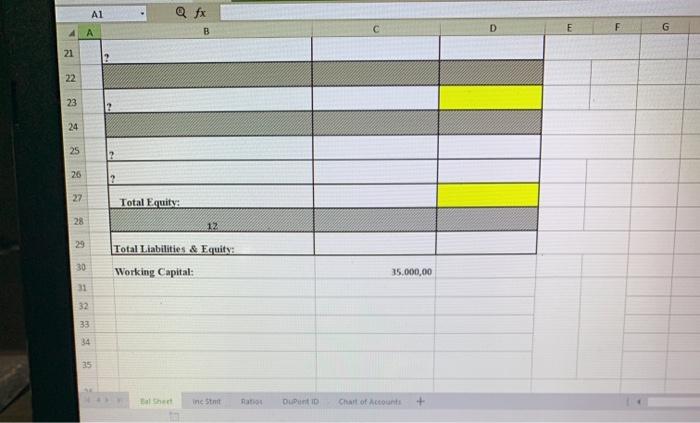

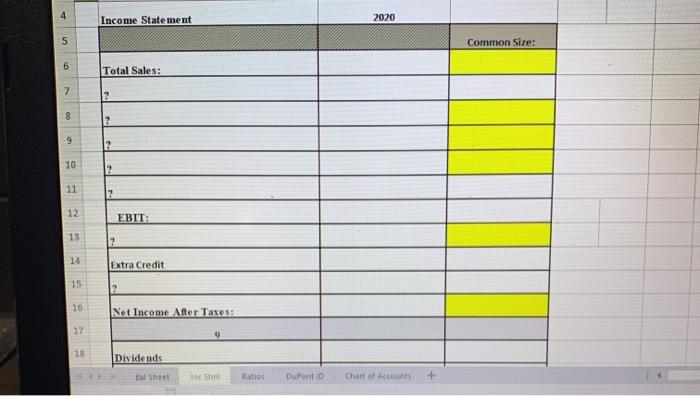

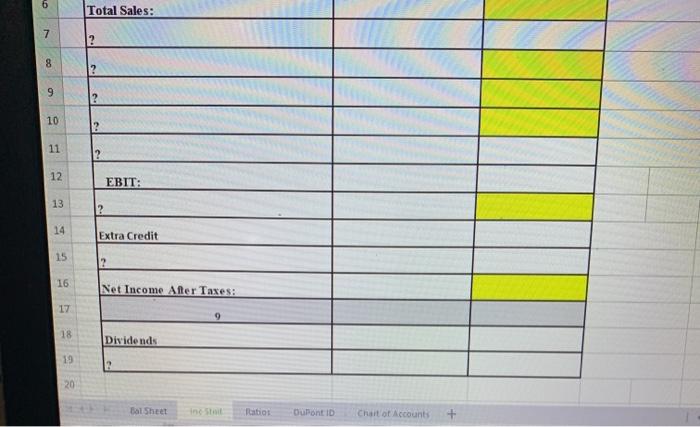

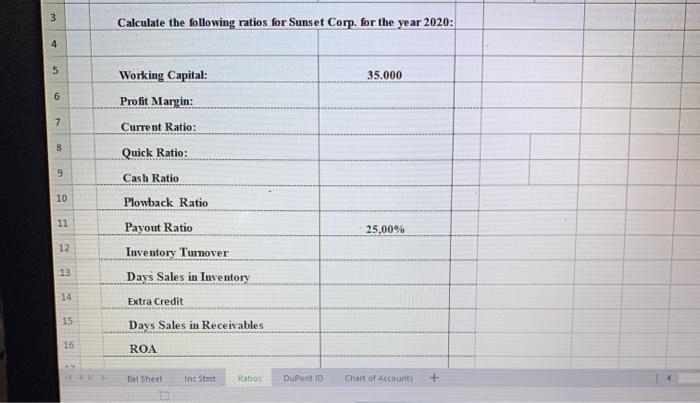

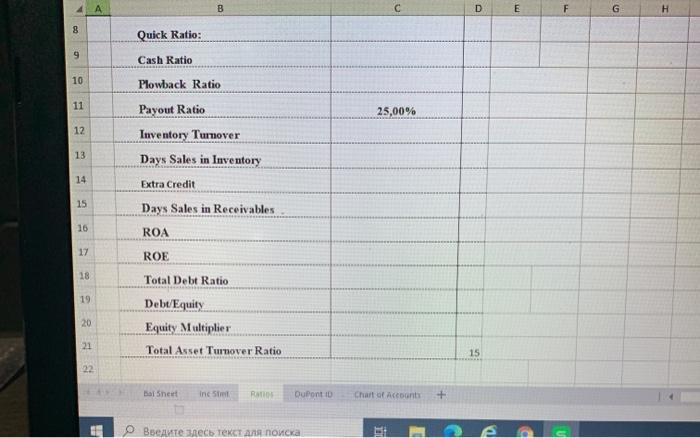

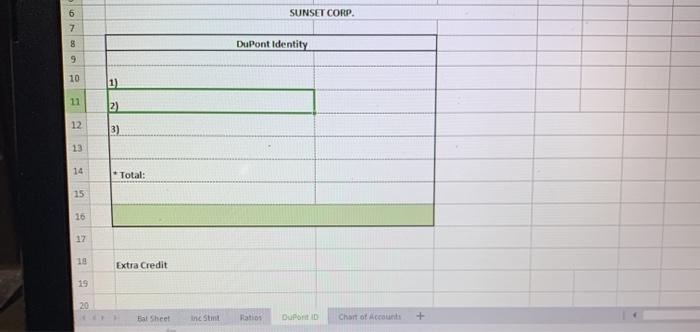

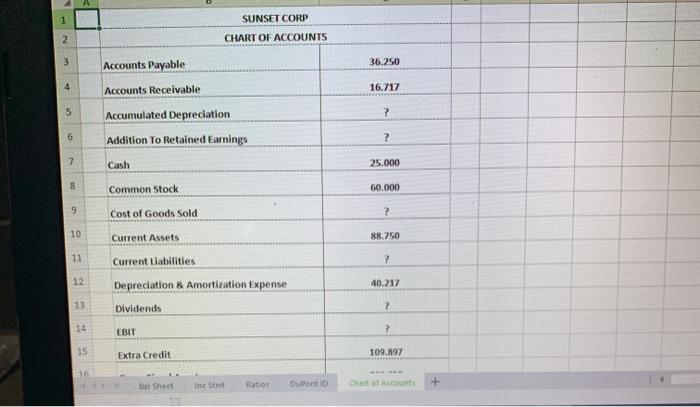

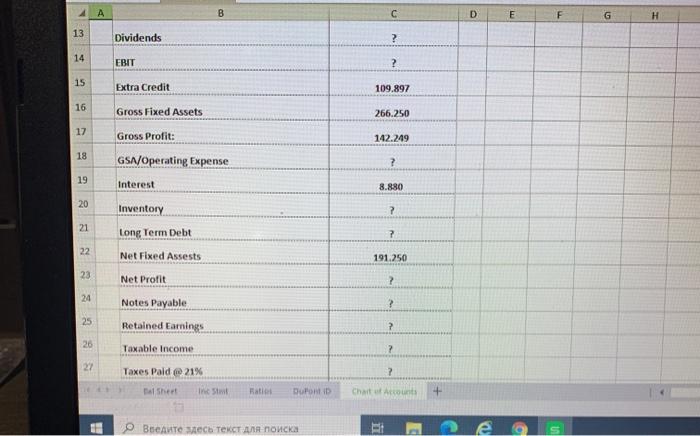

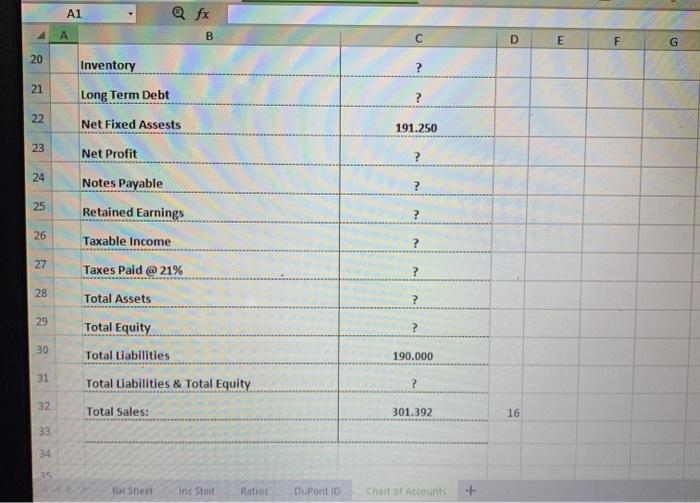

3 SUNSET CORP. 4 Balance Sheet as of 12/31/2020 2020 5 Common Size 6 2 7 ? 8 ? 9 Current Assets: 10 11 12 2 13 2 14 Extra Credit 15 Total Assets: 16 El Sheet The simt Ratios DUPOND Chart of Accounts + D B F G 14 Extra Credit 15 Total Assets: 16 17 ? 18 ? 19 Current Liabilities: 20 21 2 22 23 24 25 26 2 Total Equity 28 12 Inc Stm Ratios DuPont ID Chart of Account A1 Q fx D F B F G 21 22 23 24 25 26 2 27 Total Equity 28 12 Total Liabilities & Equity 30 Working Capital: 35.000,00 31 32 33 34 Balther Ine Sint OP D Chart of Account + 4 Income Statement 2020 5 Common Size: 6 Total Sales: 7 2 8 2 9 12 10 ? 11 12 EBIT: 13 ? 14 Extra Credit 15 2 16 Net Income After Taxes 12 . 18 Dividends at sheet incm Hati DuPont chant of Accounts 6 Total Sales: 7 2 8 ? 9 2 10 ? 11 2 12 EBIT: 13 ? 14 Extra Credit 15 2 16 Net Income After Taxes: 17 9 18 Dividends 19 2 20 Bol Sheet Ratios DuPont ID Chat of Account 3 Calculate the following ratios for Sunset Corp. for the year 2020: 4 5 35.000 Working Capital: Profit Margin: 6 7 Current Ratio: 8 Quick Ratio: 9 Cash Ratio 10 11 25,00% Plowback Ratio Payout Ratio Inventory Turnover Days Sales in Inventory 12 13 14 Extra Credit 15 Days Sales in Receivables 16 ROA te Sheet Ine Sint Ratio DuPont ID Chart of Accounts + A D E F G H 8 Quick Ratio: 9 Cash Ratio 10 11 25,00% 12 Plowback Ratio Payout Ratio Inventory Turnover Days Sales in Inventory Extra Credit Days Sales in Receivables 13 14 15 16 ROA 17 ROE 18 19 Total Debt Ratio Debt/Equity Equity Multiplier Total Asset Turnover Ratio 20 21 15 22 Barnet inc Srl RO Dupont 10 Chart of Accounts + Q SUNSET CORP. 6 7 8 DuPont Identity 9 10 1) 11 2) 12 3) 13 14 * Total: 15 10 12 Extra Credit 19 20 Bat Sheet instint Ratio Dupont Chart of Account + 1 SUNSET CORP 2 CHART OF ACCOUNTS 3 36.250 Accounts Payable 4 Accounts Receivable 16.717 5 ? 6 Accumulated Depreciation Addition to retained Earnings Cash ? 7 25.000 8 Common Stock 60.000 9 Cost of Goods Sold ? 10 Current Assets 88.750 11 Current Liabilities ? 12 Depreciation & Amortization Expense 40.217 13 Dividends ? 14 EBIT ? 15 Extra Credit 109.897 16 Bal heel indstot Ratios thutontio + Chat of Account 4 A B D E F G H 13 Dividends ? 14 EBIT ? 15 Extra Credit 109.897 16 Gross Fixed Assets 266.250 17 Gross Profit: 142.249 18 GSN/Operating Expense ? 19 Interest 8.880 20 Inventory ? 21 Long Term Debt ? 22 Net Fixed Assests 191.250 23 Net Profit ? 24 ? Notes Payable Retained Earnings 25 ? 26 Taxable income 2 27 Taxes Paid ( 21% ? Daher Rati DuPont Chat of Arco + D A1 Qfx B A D E F G 20 Inventory 21 Long Term Debt ? 22 Net Fixed Assests 191.250 23 Net Profit ? 24 Notes Payable ? 25 Retained Earnings ? 26 Taxable income ? 27 Taxes Paid @ 21% ? 28 Total Assets ? 29 Total Equity ? 30 Total Liabilities 190.000 31 Total Liabilities & Total Equity ? 32 Total Sales: 301.392 16 33 34 25 Bar Sheet Inc Sim Ratios DuPont ID Chat of Account + 3 SUNSET CORP. 4 Balance Sheet as of 12/31/2020 2020 5 Common Size 6 2 7 ? 8 ? 9 Current Assets: 10 11 12 2 13 2 14 Extra Credit 15 Total Assets: 16 El Sheet The simt Ratios DUPOND Chart of Accounts + D B F G 14 Extra Credit 15 Total Assets: 16 17 ? 18 ? 19 Current Liabilities: 20 21 2 22 23 24 25 26 2 Total Equity 28 12 Inc Stm Ratios DuPont ID Chart of Account A1 Q fx D F B F G 21 22 23 24 25 26 2 27 Total Equity 28 12 Total Liabilities & Equity 30 Working Capital: 35.000,00 31 32 33 34 Balther Ine Sint OP D Chart of Account + 4 Income Statement 2020 5 Common Size: 6 Total Sales: 7 2 8 2 9 12 10 ? 11 12 EBIT: 13 ? 14 Extra Credit 15 2 16 Net Income After Taxes 12 . 18 Dividends at sheet incm Hati DuPont chant of Accounts 6 Total Sales: 7 2 8 ? 9 2 10 ? 11 2 12 EBIT: 13 ? 14 Extra Credit 15 2 16 Net Income After Taxes: 17 9 18 Dividends 19 2 20 Bol Sheet Ratios DuPont ID Chat of Account 3 Calculate the following ratios for Sunset Corp. for the year 2020: 4 5 35.000 Working Capital: Profit Margin: 6 7 Current Ratio: 8 Quick Ratio: 9 Cash Ratio 10 11 25,00% Plowback Ratio Payout Ratio Inventory Turnover Days Sales in Inventory 12 13 14 Extra Credit 15 Days Sales in Receivables 16 ROA te Sheet Ine Sint Ratio DuPont ID Chart of Accounts + A D E F G H 8 Quick Ratio: 9 Cash Ratio 10 11 25,00% 12 Plowback Ratio Payout Ratio Inventory Turnover Days Sales in Inventory Extra Credit Days Sales in Receivables 13 14 15 16 ROA 17 ROE 18 19 Total Debt Ratio Debt/Equity Equity Multiplier Total Asset Turnover Ratio 20 21 15 22 Barnet inc Srl RO Dupont 10 Chart of Accounts + Q SUNSET CORP. 6 7 8 DuPont Identity 9 10 1) 11 2) 12 3) 13 14 * Total: 15 10 12 Extra Credit 19 20 Bat Sheet instint Ratio Dupont Chart of Account + 1 SUNSET CORP 2 CHART OF ACCOUNTS 3 36.250 Accounts Payable 4 Accounts Receivable 16.717 5 ? 6 Accumulated Depreciation Addition to retained Earnings Cash ? 7 25.000 8 Common Stock 60.000 9 Cost of Goods Sold ? 10 Current Assets 88.750 11 Current Liabilities ? 12 Depreciation & Amortization Expense 40.217 13 Dividends ? 14 EBIT ? 15 Extra Credit 109.897 16 Bal heel indstot Ratios thutontio + Chat of Account 4 A B D E F G H 13 Dividends ? 14 EBIT ? 15 Extra Credit 109.897 16 Gross Fixed Assets 266.250 17 Gross Profit: 142.249 18 GSN/Operating Expense ? 19 Interest 8.880 20 Inventory ? 21 Long Term Debt ? 22 Net Fixed Assests 191.250 23 Net Profit ? 24 ? Notes Payable Retained Earnings 25 ? 26 Taxable income 2 27 Taxes Paid ( 21% ? Daher Rati DuPont Chat of Arco + D A1 Qfx B A D E F G 20 Inventory 21 Long Term Debt ? 22 Net Fixed Assests 191.250 23 Net Profit ? 24 Notes Payable ? 25 Retained Earnings ? 26 Taxable income ? 27 Taxes Paid @ 21% ? 28 Total Assets ? 29 Total Equity ? 30 Total Liabilities 190.000 31 Total Liabilities & Total Equity ? 32 Total Sales: 301.392 16 33 34 25 Bar Sheet Inc Sim Ratios DuPont ID Chat of Account +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts