Question

Crane had the following account balances at December 31, 2023: Cash $24,000 Accumulated Depreciation, Equipment 25,000 Accounts Receivable 25,000 Wages Payable 6,000 Supplies 50,000 Accounts

Crane had the following account balances at December 31, 2023:

Cash |

| $24,000 |

| Accumulated Depreciation, Equipment |

| 25,000 |

Accounts Receivable |

| 25,000 |

| Wages Payable |

| 6,000 |

Supplies |

| 50,000 |

| Accounts Payable |

| 50,000 |

Prepaid Insurance |

| 3,000 |

| Common Shares |

| 75,000 |

Inventory |

| 46,500 |

| Retained Earnings |

| 67,500 |

Equipment |

| 75,000 |

|

|

|

|

During 2024, the following transactions occurred:

1. |

| Sales of paninis for cash were $702,000, and sales of paninis on account were $60,000. |

2. |

| Purchases of ingredients were $189,000, all on account. |

3. |

| Collections from customers for sales on account totalled $19,400. |

4. |

| The company paid $48,600 for utilities expenses. |

5. |

| Ingredients with a cost of $200,000 were used in paninis that were sold. |

6. |

| Payments for ingredients purchased on account totalled $238,000. |

7. |

| The company paid $102,600 for wages. |

8. |

| A dividend of $37,800 was declared and paid at the end of the year. |

|

|

|

Information for adjusting entries: |

|

|

9. |

| The balance in the Supplies account at the end of 2024 was $1,200. |

10. |

| Wages owed to employees at the end of 2024 were $3,780. |

11. |

| At the end of 2024, the account balance in Prepaid Insurance was $1,500. |

12. |

| The equipment had an estimated useful life of eight years with a residual value of $3,000. |

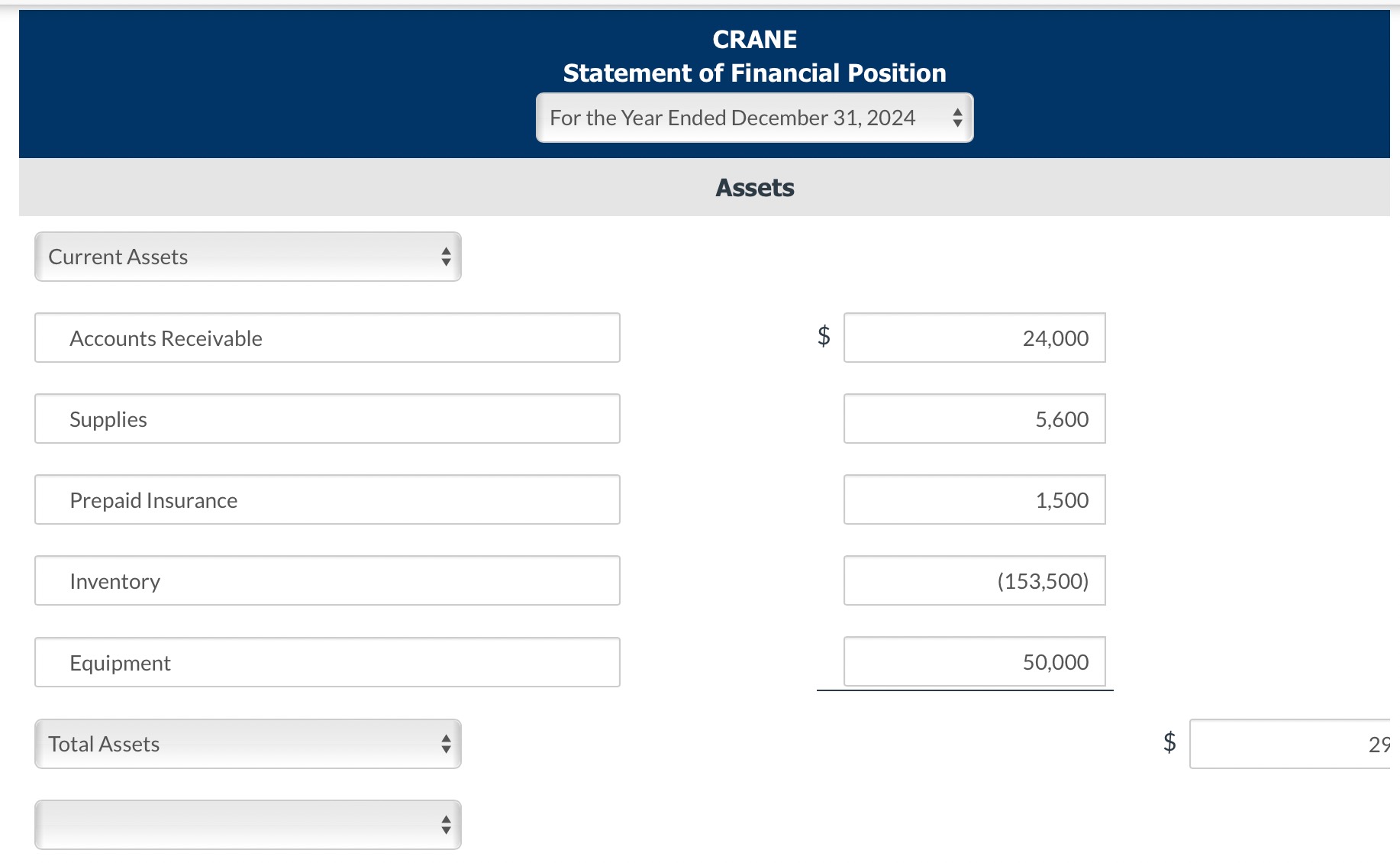

I have to use the following table to a classified statement of financial position for 2024. (List Current Assets in order of liquidity.)

Current Assets Accounts Receivable Supplies Prepaid Insurance Inventory Equipment Total Assets CRANE Statement of Financial Position For the Year Ended December 31, 2024 Assets +A 24,000 5,600 1,500 (153,500) 50,000 $ 29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure heres the classified statement of financial position for Crane for the year 2024 As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started