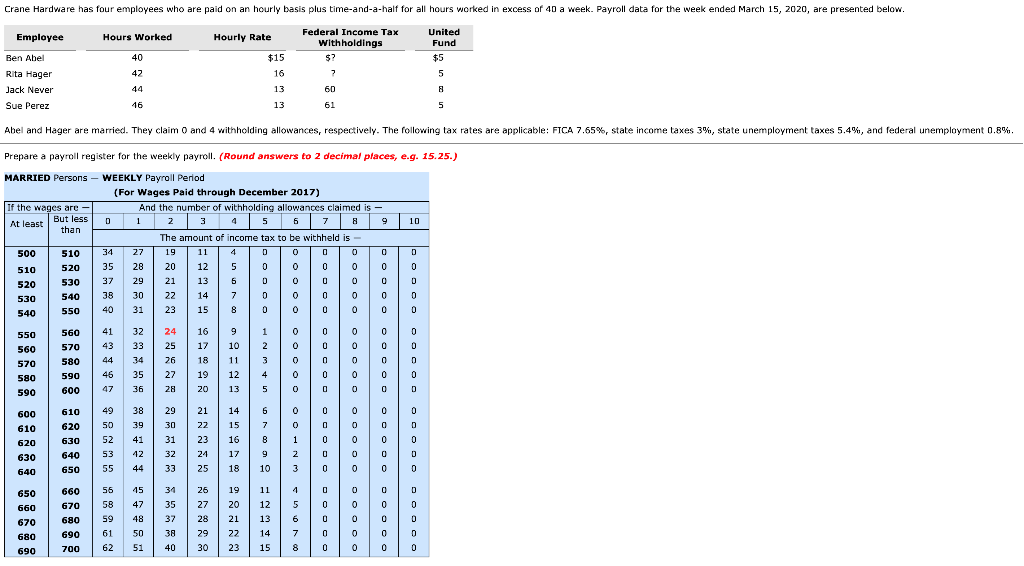

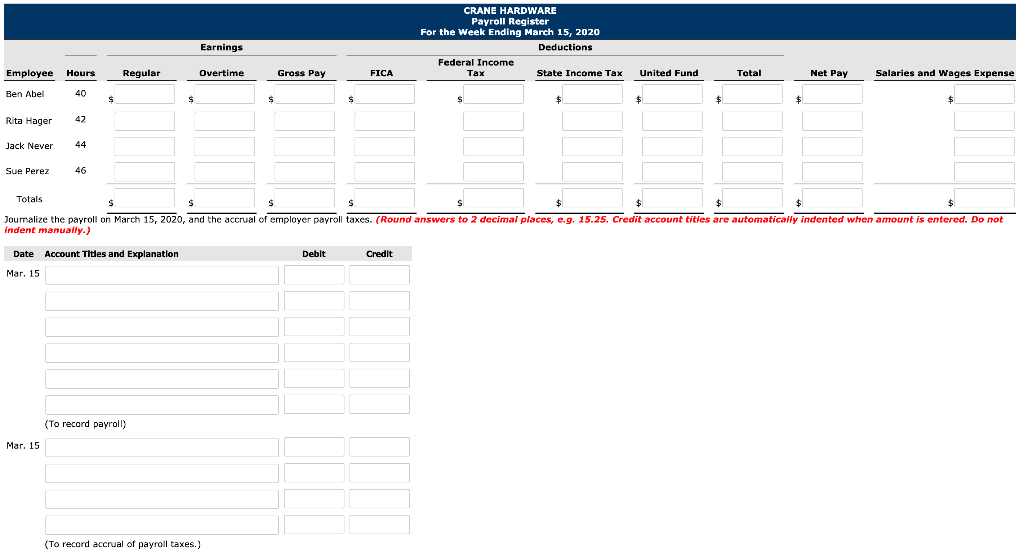

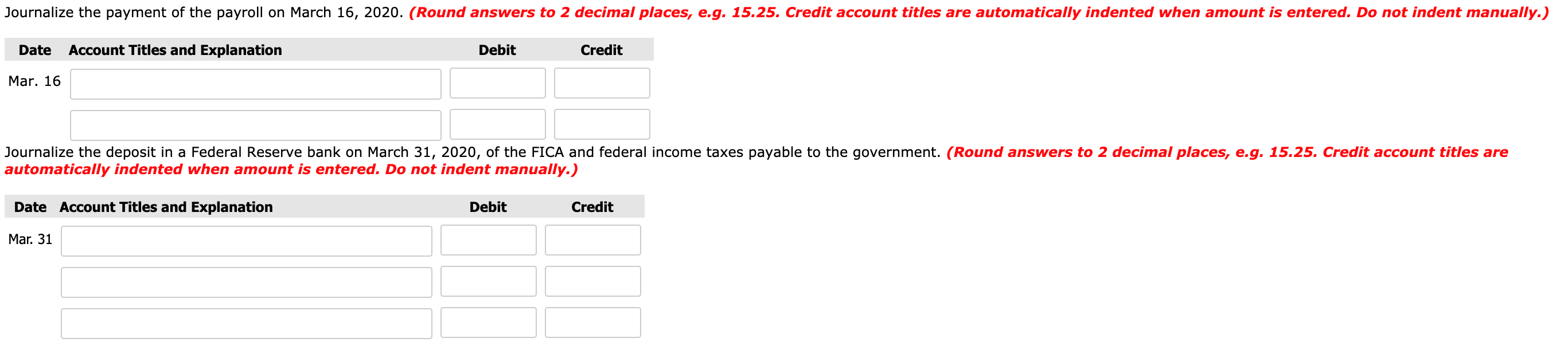

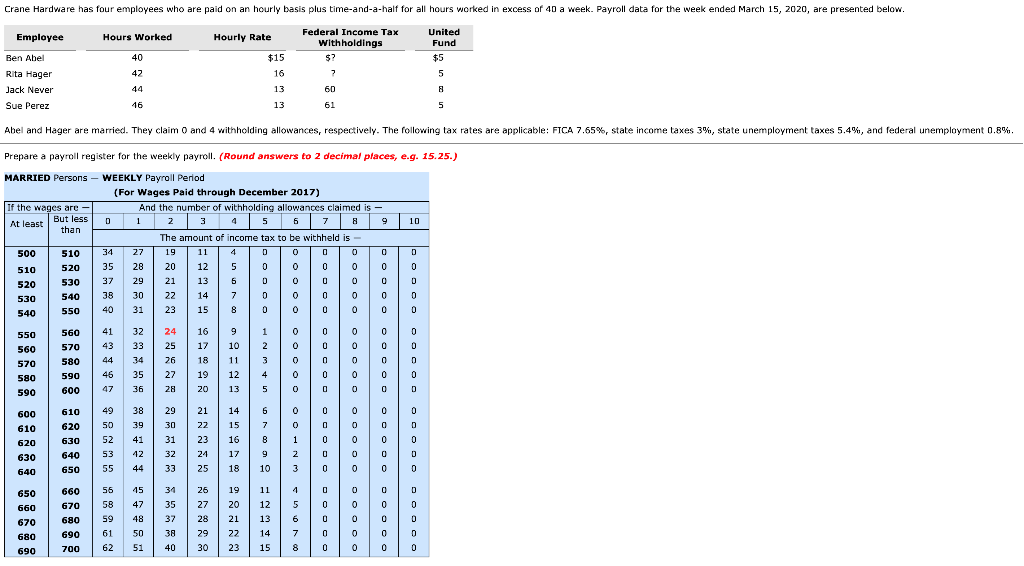

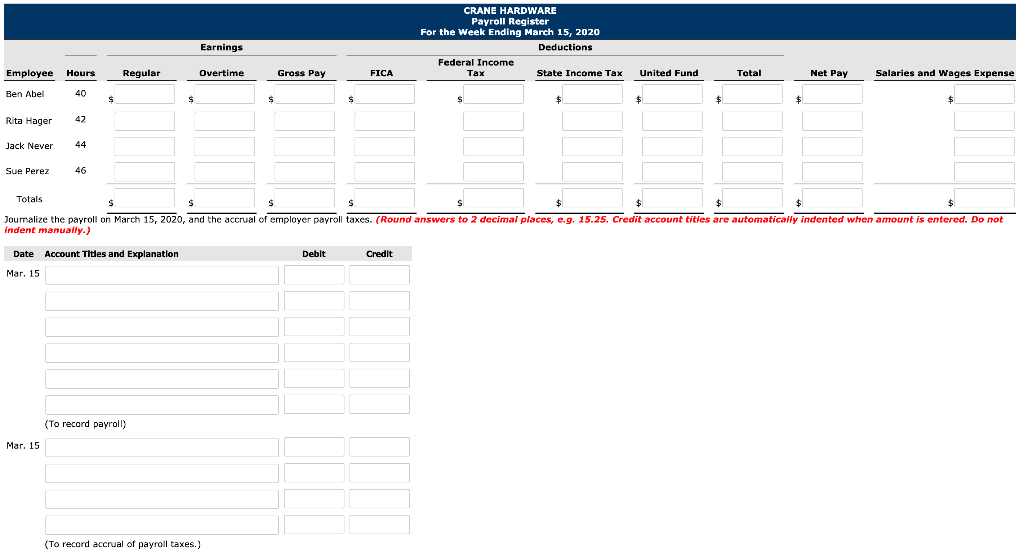

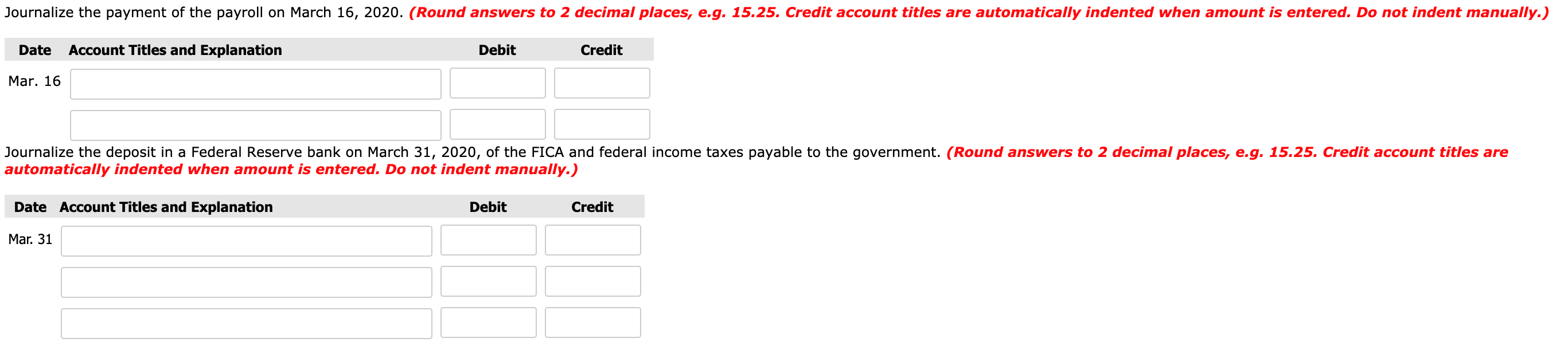

Crane Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2020, are presented below. Employee Hours Worked Hourly Rate Federal Income Tax withholdings $? United Fund $5 $15 Ben Abel Rita Hager Jack Never 40 42 7 5 44 16 13 13 60 8 Sue Perez 61 5 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.8%. Prepare a payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) 1 10 MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2017) If the wages are And the number of withholding allowances claimed is At least But less D 2 3 4 5 6 7 6 7 8 9 than The amount of income tax to be withheld is - 500 510 34 27 19 11 4 D 0 0 0 0 510 520 35 28 20 12 5 0 0 0 0 0 520 530 37 29 21 13 6 D 0 0 0 0 540 38 30 530 22 14 7 0 0 0 0 0 550 40 540 31 23 15 8 0 0 0 0 0 D 0 D 0 0 9 0 0 550 0 560 570 580 1 2 24 25 26 O 0 41 43 44 46 32 33 34 35 36 16 17 18 19 20 560 570 580 590 10 11 12 0 0 0 0 3 0 0 0 0 0 D 590 4 0 0 0 27 28 0 0 0 600 47 13 5 0 0 610 14 6 0 0 600 610 29 30 38 39 41 0 0 21 22 23 0 D 7 0 0 0 ********%$&* **** 620 49 50 52 53 55 620 630 640 650 1 15 16 17 18 31 32 33 630 42 0 0 8 9 10 24 25 0 0 0 0 0 0 44 640 3 0 0 11 0 650 660 670 55 58 34 35 19 20 0 0 D 0 0 660 670 680 690 45 47 48 50 51 26 27 28 29 30 59 61 62 6 37 38 0 21 22 VOG 12 13 14 15 0 0 0 o 0 0 0 0 7 680 0 0 0 0 700 690 40 23 CRANE HARDWARE Payroll Register For the Week Ending March 15, 2020 Deductions Federal Income Tax State Income Tax Earnings Employee Hours Regular Overtime Gross Pay FICA United Fund Total Net Pay Salaries and Wages Expense Ben Abel 40 $ $ $ Rita Hager 42 Jack Never 44 Sue Perez 46 $ s entered. Do not Totals $ Joumalize the payroll on March 15, 2020, and the accrual of employer payroll taxes. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount indent manually.) Date Account Titles and Explanation Debit Credit Mar. 15 (To record payroll) Mar. 15 (To record accrual of payroll taxes.) Journalize the payment of the payroll on March 16, 2020. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 16 Journalize the deposit in a Federal Reserve bank on March 31, 2020, of the FICA and federal income taxes payable to the government. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 31