Answered step by step

Verified Expert Solution

Question

1 Approved Answer

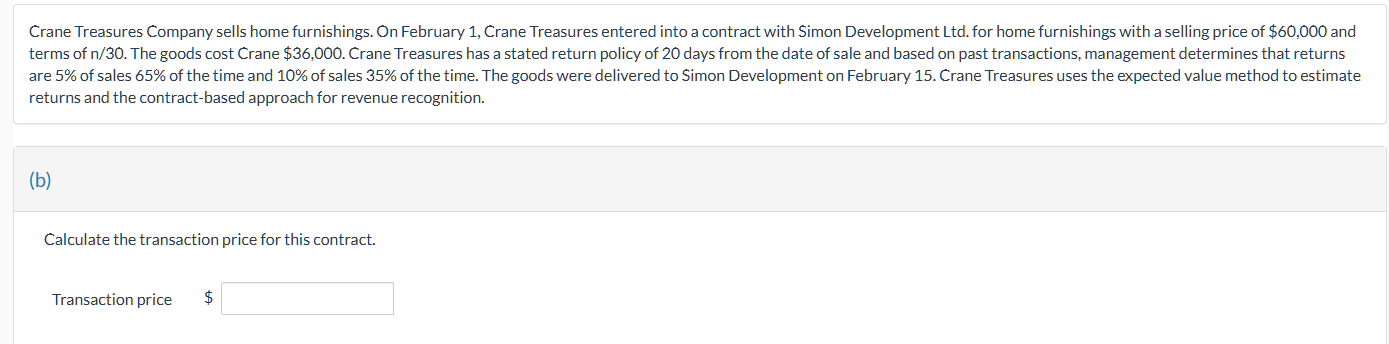

Crane Treasures Company sells home furnishings. On February 1 , Crane Treasures entered into a contract with Simon Development Ltd . for home furnishings with

Crane Treasures Company sells home furnishings. On February Crane Treasures entered into a contract with Simon Development Ltd for home furnishings with a selling price of $ and

terms of The goods cost Crane $ Crane Treasures has a stated return policy of days from the date of sale and based on past transactions, management determines that returns

are of sales of the time and of sales of the time. The goods were delivered to Simon Development on February Crane Treasures uses the expected value method to estimate

returns and the contractbased approach for revenue recognition.

b

Calculate the transaction price for this contract.

Transaction price $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started