Answered step by step

Verified Expert Solution

Question

1 Approved Answer

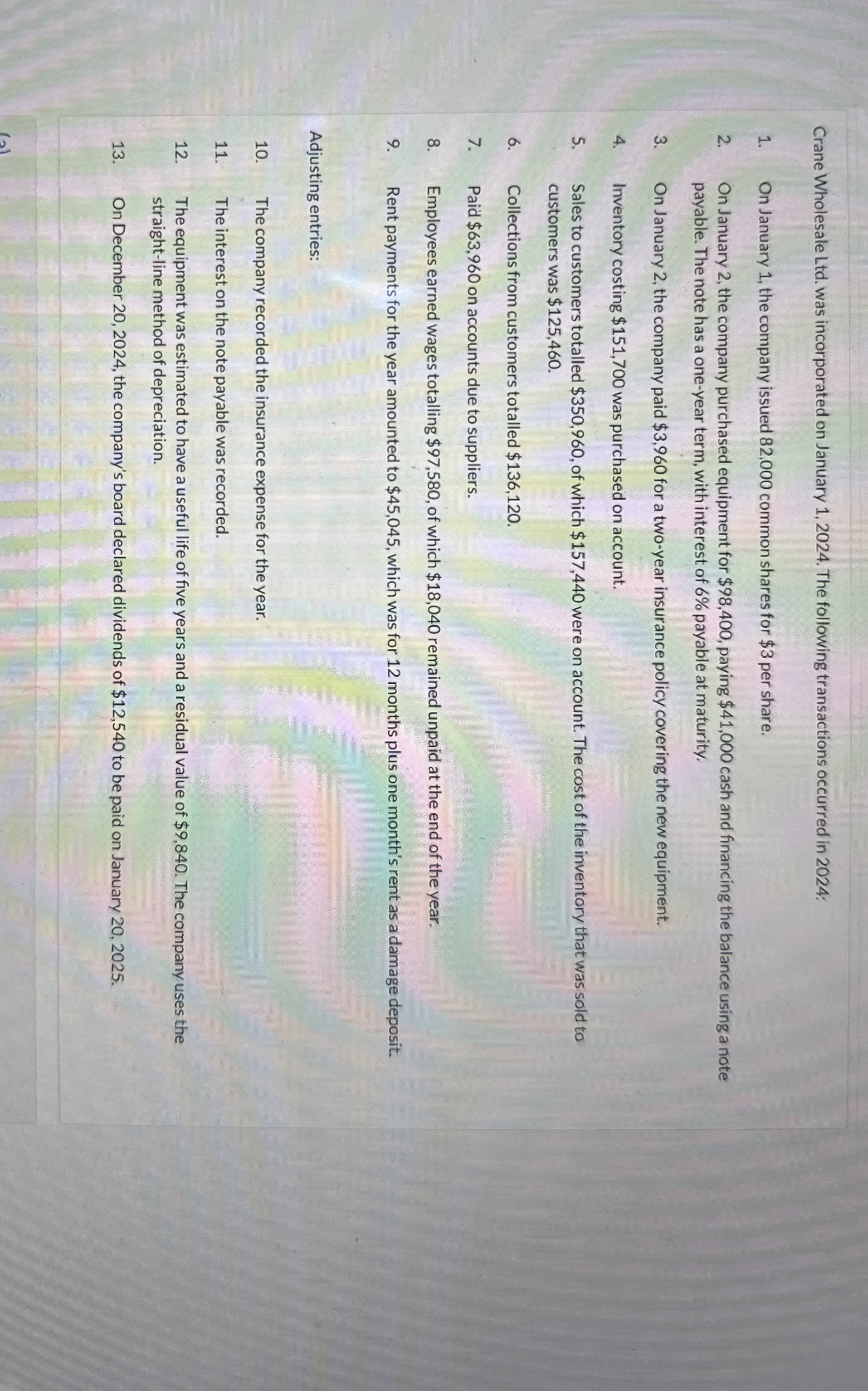

Crane Wholesale Ltd . was incorporated on January 1 , 2 0 2 4 . The following transactions occurred in 2 0 2 4 :

Crane Wholesale Ltd was incorporated on January The following transactions occurred in :

On January the company issued common shares for $ per share.

On January the company purchased equipment for $ paying $ cash and financing the balance using a note

payable. The note has a oneyear term, with interest of payable at maturity.

On January the company paid $ for a twoyear insurance policy covering the new equipment.

Inventory costing $ was purchased on account.

Sales to customers totalled $ of which $ were on account. The cost of the inventory that was sold to

customers was $

Collections from customers totalled $

Paid $ on accounts due to suppliers.

Employees earned wages totalling $ of which $ remained unpaid at the end of the year.

Rent payments for the year amounted to $ which was for months plus one month's rent as a damage deposit.

Adjusting entries:

The company recorded the insurance expense for the year.

The interest on the note payable was recorded.

The equipment was estimated to have a useful life of five years and a residual value of $ The company uses the

straightline method of depreciation.

On December the company's board declared dividends of $ to be paid on January

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started