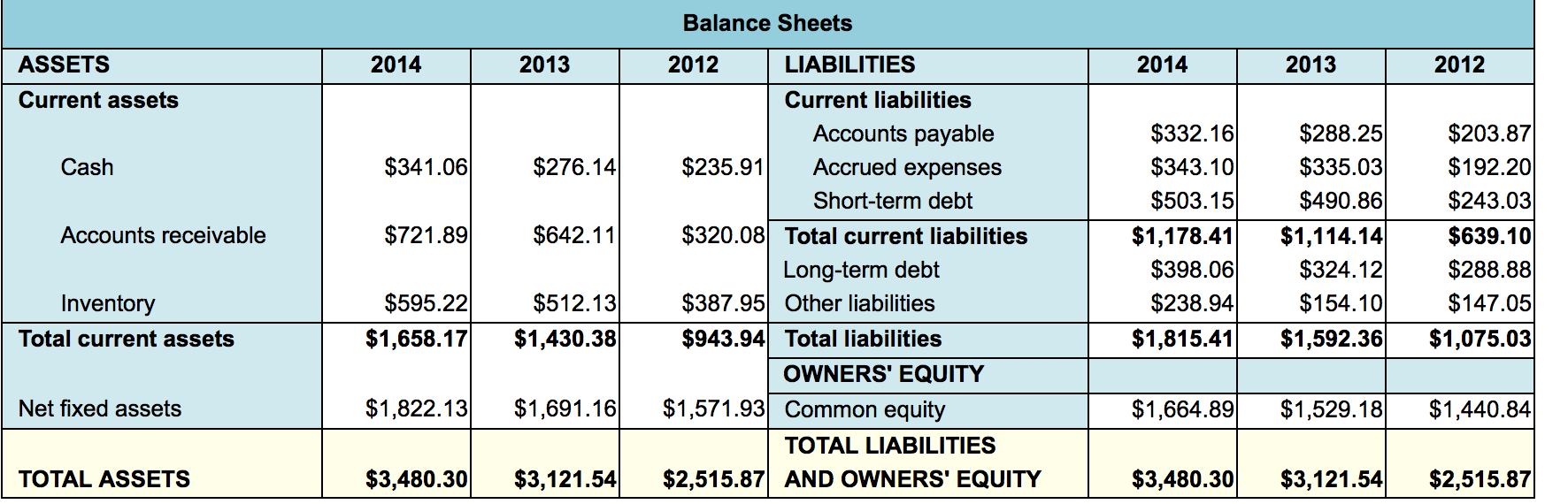

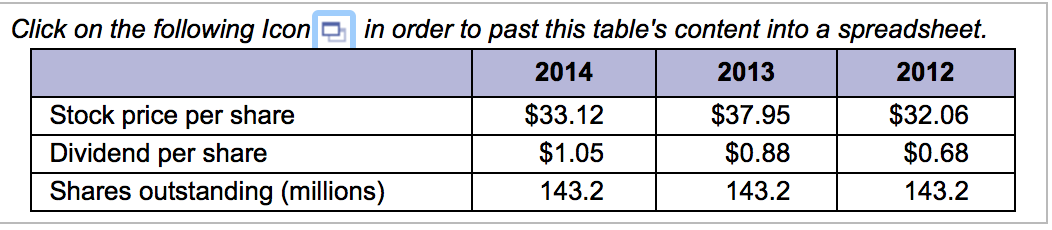

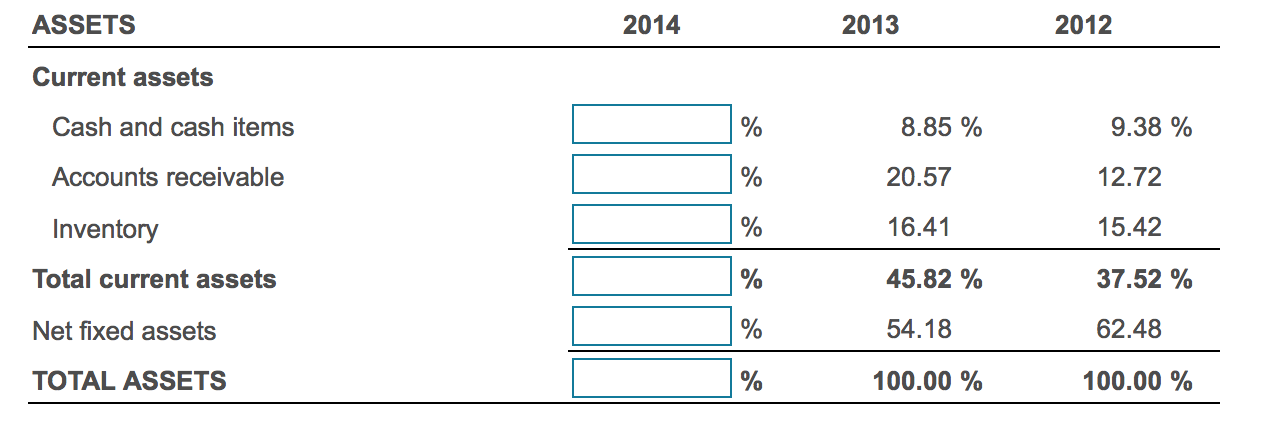

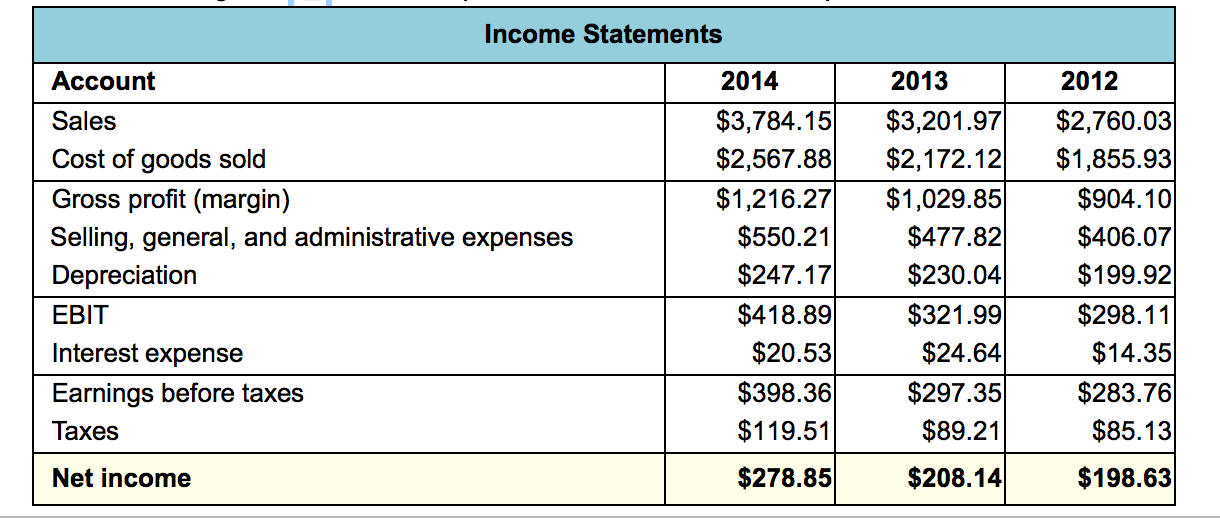

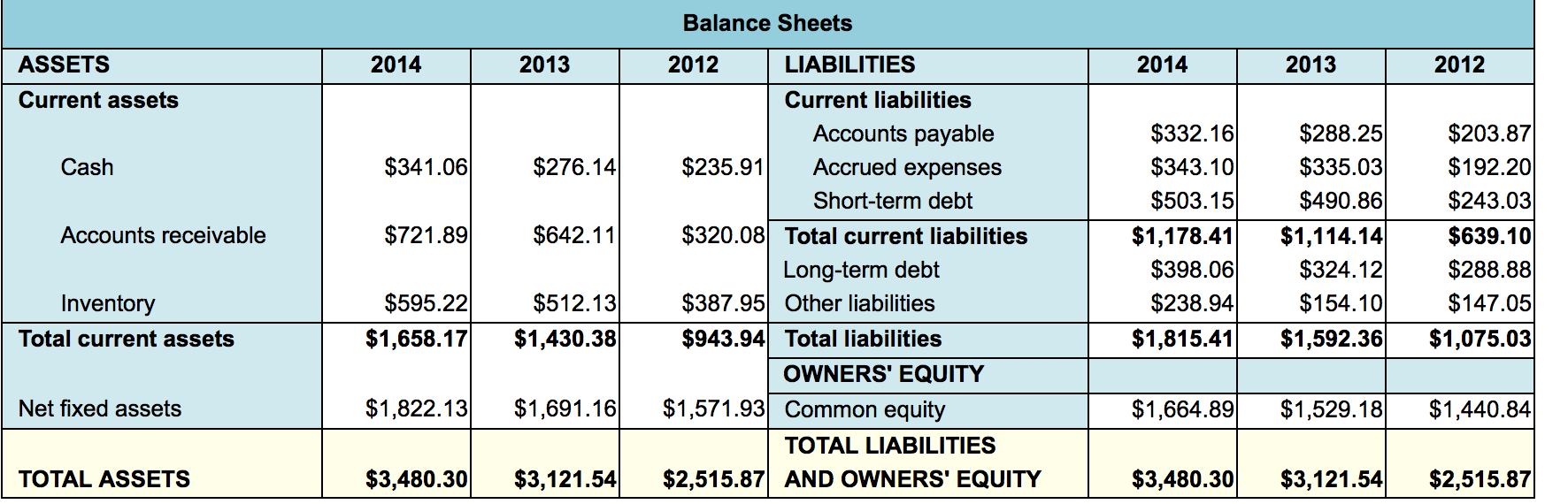

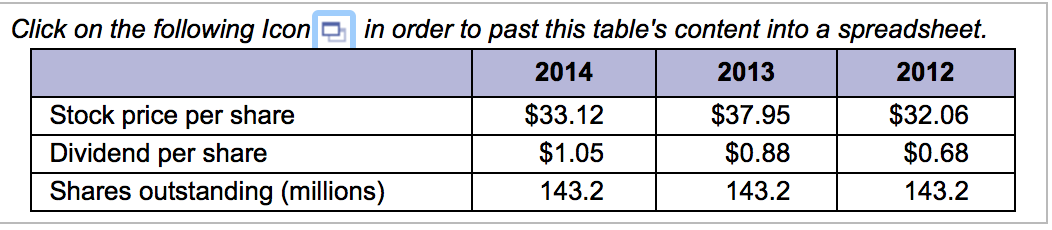

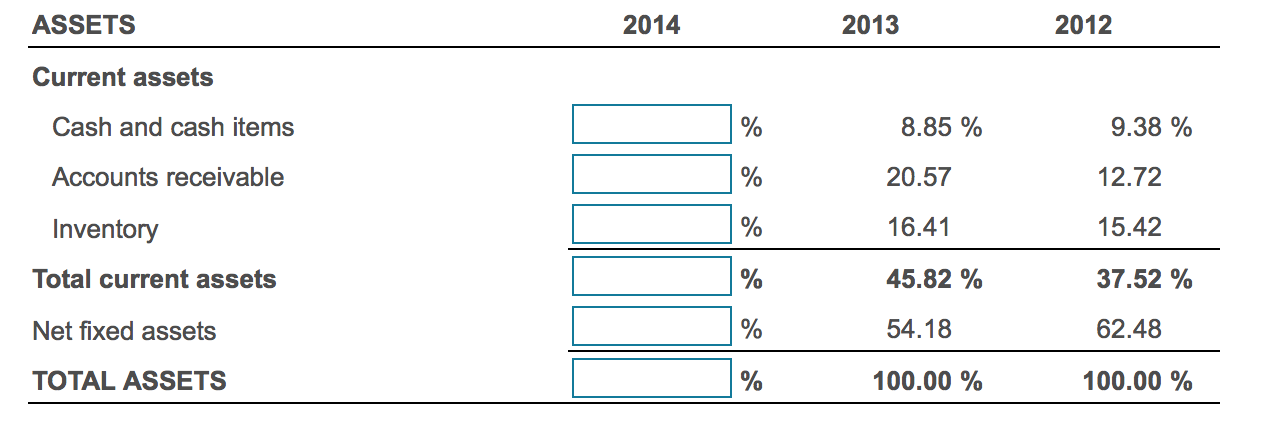

Cranston Dispensers, Inc.: Part 2 In the Chapter 13 mini-case, you learned that Cranston Dispensers, Inc. manufactures specialized pump and spray containers for a variety of products in the cosmetics, household cleaning supplies, and pharmaceutical industries. For most of 2013 and 2014, the price of Cranston's shares began falling, while shares of other companies in the industry were rising. The CFO has charged Susan McNulty, the recently appointed treasurer, with diagnosing Cranston's problems and improving the company's financial performance relative to its competitors. She has already reviewed Cranston's working capital management policies and will continue her analysis with a thorough review of the financial statements. She has gathered income statements, E, balance sheets, and additional information, B3, for the three most recent years. Her assistant also has found a ratio analysis for fiscal 2012 and 2013 and updated industry benchmarks from published sources. athene Questions 1. Following are Cranston's common-size income statements and balance sheets for 2013 and 2012. Prepare a common-size income statement and balance sheet for 2014. 2. Complete the 2014 table of financial ratios for Cranston. 3. Use the common-size statements and the ratio analysis that you have prepared to comment on Cranston's: a. liquidity. b. solvency. c. asset management. d. profitability. e. market performance. Indicate whether the ratios are improving or deteriorating over the three-year period and whether they are better or worse than the 2014 industry averages. 4. Express Cranston's ROE in terms of the DuPont identity. Which ratios are contributing to Cranston's below-average ROE? 5. Based on your analyses in Questions 1 through 4, why do you think Cranston's recent stock performance has been disappointing? Income Statements Account Sales Cost of goods sold Gross profit (margin) Selling, general, and administrative expenses Depreciation EBIT Interest expense Earnings before taxes Taxes 2014 $3,784.15 $2,567.88 $1,216.27 $550.21 $247.17 $418.89 $20.53 $398.36 $119.51 2013 $3,201.97 $2,172.12 $1,029.85 $477.82 $230.04 $321.99 $24.64 $297.35) $89.21 $208.14 2012 $2,760.03 $1,855.93 $904.10 $406.07 $199.92 $298.11 $14.35 $283.76 $85.13 Net income $278.85 $198.63 Balance Sheets ASSETS 2014 2013 2014 2013 2012 Current assets Cash $341.06 $276.14 Accounts receivable $721.89 $642.11 2012 LIABILITIES Current liabilities Accounts payable $235.91 Accrued expenses Short-term debt $320.08 Total current liabilities Long-term debt $387.95 Other liabilities $943.94 Total liabilities OWNERS' EQUITY $1,571.93 Common equity TOTAL LIABILITIES $2,515.87 AND OWNERS' EQUITY $332.16 $343.10 $503.15 $1,178.41 $398.06 $238.94 $1,815.41 $288.25 $335.03 $490.86 $1,114.14 $324.12 $154.100 $1,592.36 $203.87 $192.20 $243.03 $639.10 $288.88 $147.05 $1,075.03 Inventory Total current assets $595.22 $1,658.17 $512.13 $1,430.38 Net fixed assets $1,822.13 $1,691.16 $1,664.89 $1,529.18 $1,440.84 TOTAL ASSETS $3,480.30 $3,121.54 $3,480.30 $3,121.54 $2,515.87 Click on the following Icon in order to past this table's content into a spreadsheet. 2014 2013 2012 Stock price per share Dividend per share Shares outstanding (millions) $33.12 $1.05 143.2 $37.95 $0.88 143.2 $32.06 $0.68 143.2 ASSETS 2014 2013 2012 Current assets Cash and cash items % 8.85 % 9.38 % Accounts receivable % 20.57 12.72 Inventory % 16.41 15.42 Total current assets % 45.82 % 37.52 % Net fixed assets % 54.18 62.48 TOTAL ASSETS % 100.00 % 100.00 %