Answered step by step

Verified Expert Solution

Question

1 Approved Answer

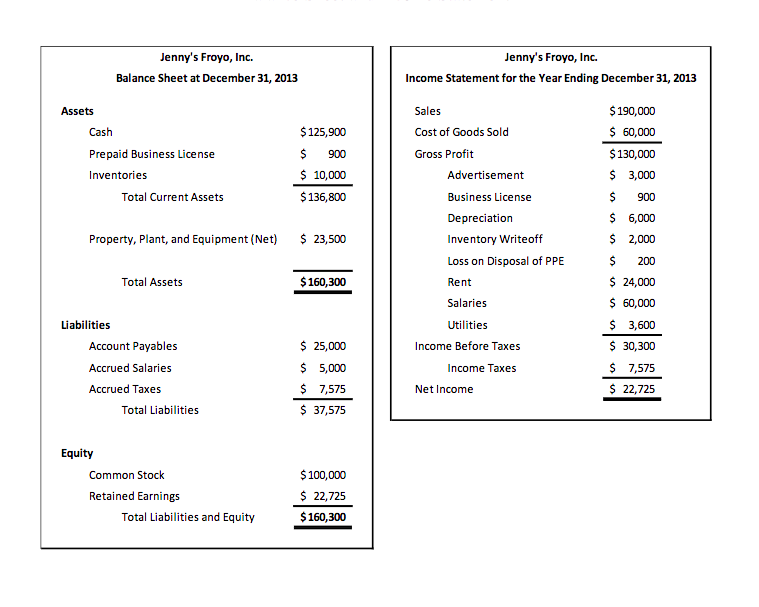

Create a balance sheet for 2014 and income statement 2014 please explain in summary if you can As a starting point, Branon retrieved the Balance

Create a balance sheet for 2014 and income statement 2014

please explain in summary if you can

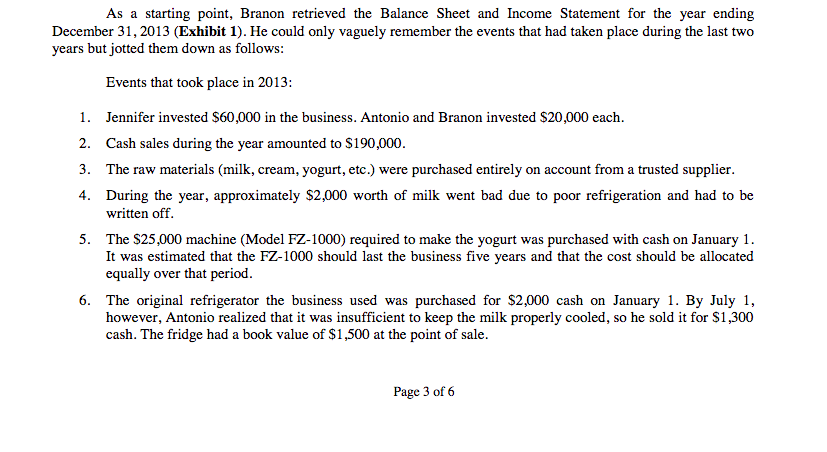

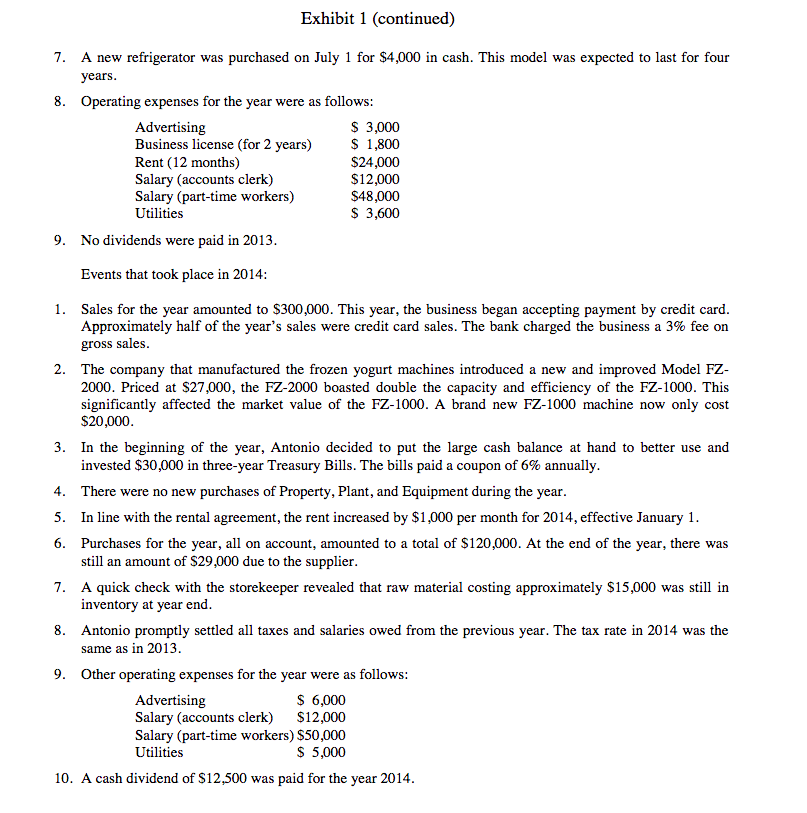

As a starting point, Branon retrieved the Balance Sheet and Income Statement for the year ending December 31, 2013 (Exhibit 1). He could only vaguely remember the events that had taken place during the last two years but jotted them down as follows: Events that took place in 2013 : 1. Jennifer invested $60,000 in the business. Antonio and Branon invested $20,000 each. 2. Cash sales during the year amounted to $190,000. 3. The raw materials (milk, cream, yogurt, etc.) were purchased entirely on account from a trusted supplier. 4. During the year, approximately $2,000 worth of milk went bad due to poor refrigeration and had to be written off. 5. The $25,000 machine (Model FZ-1000) required to make the yogurt was purchased with cash on January 1 . It was estimated that the FZ-1000 should last the business five years and that the cost should be allocated equally over that period. 6. The original refrigerator the business used was purchased for $2,000 cash on January 1. By July 1, however, Antonio realized that it was insufficient to keep the milk properly cooled, so he sold it for $1,300 cash. The fridge had a book value of $1,500 at the point of sale. 7. A new refrigerator was purchased on July 1 for $4,000 in cash. This model was expected to last for four years. 8. Operating expenses for the year were as follows: 9. No dividends were paid in 2013. Events that took place in 2014: 1. Sales for the year amounted to $300,000. This year, the business began accepting payment by credit card. Approximately half of the year's sales were credit card sales. The bank charged the business a 3% fee on gross sales. 2. The company that manufactured the frozen yogurt machines introduced a new and improved Model FZ2000. Priced at $27,000, the FZ-2000 boasted double the capacity and efficiency of the FZ-1000. This significantly affected the market value of the FZ-1000. A brand new FZ-1000 machine now only cost $20,000. 3. In the beginning of the year, Antonio decided to put the large cash balance at hand to better use and invested $30,000 in three-year Treasury Bills. The bills paid a coupon of 6% annually. 4. There were no new purchases of Property, Plant, and Equipment during the year. 5. In line with the rental agreement, the rent increased by $1,000 per month for 2014, effective January 1. 6. Purchases for the year, all on account, amounted to a total of $120,000. At the end of the year, there was still an amount of $29,000 due to the supplier. 7. A quick check with the storekeeper revealed that raw material costing approximately $15,000 was still in inventory at year end. 8. Antonio promptly settled all taxes and salaries owed from the previous year. The tax rate in 2014 was the same as in 2013. 9. Other operating expenses for the year were as follows: 10. A cash dividend of $12,500 was paid for the year 2014 . Equity Common Stock \begin{tabular}{l} $100,000 \\ $22,725 \\ \hline$160,300 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started