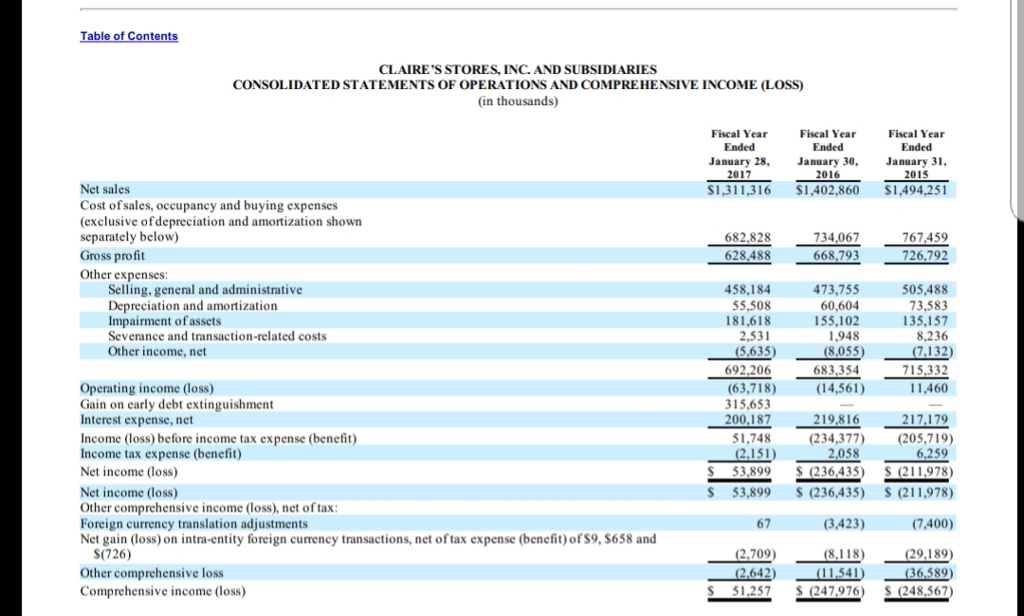

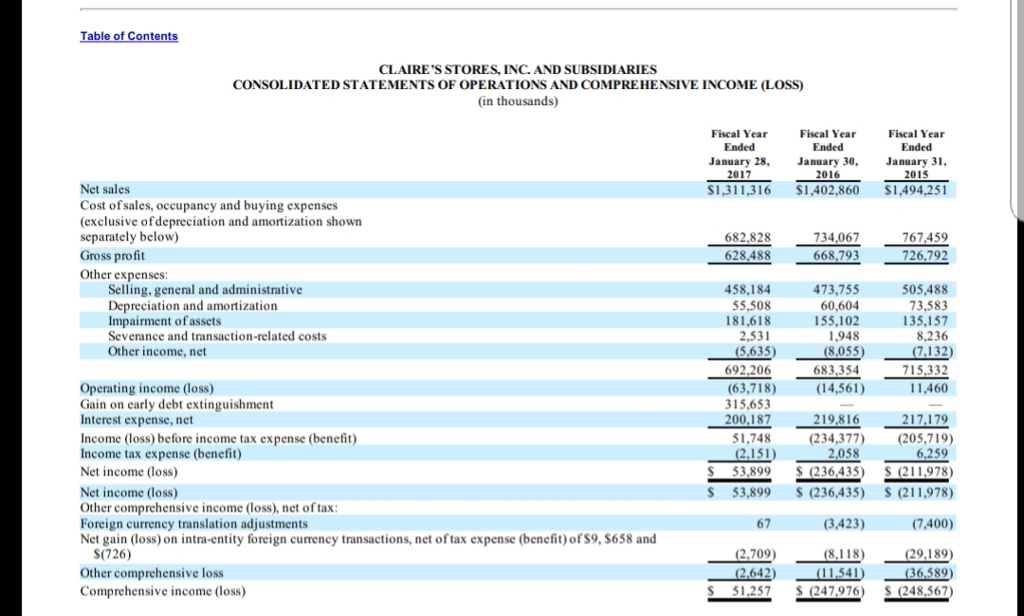

Create a common-size balance sheet and income statement

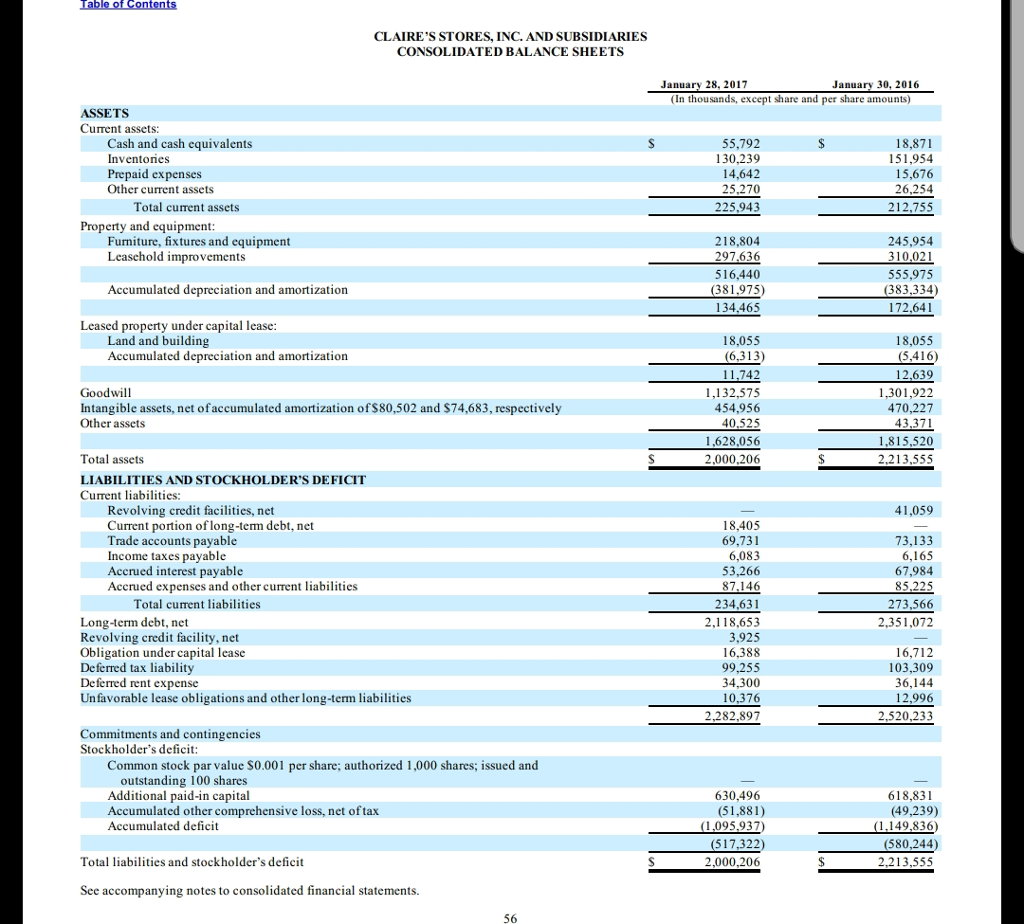

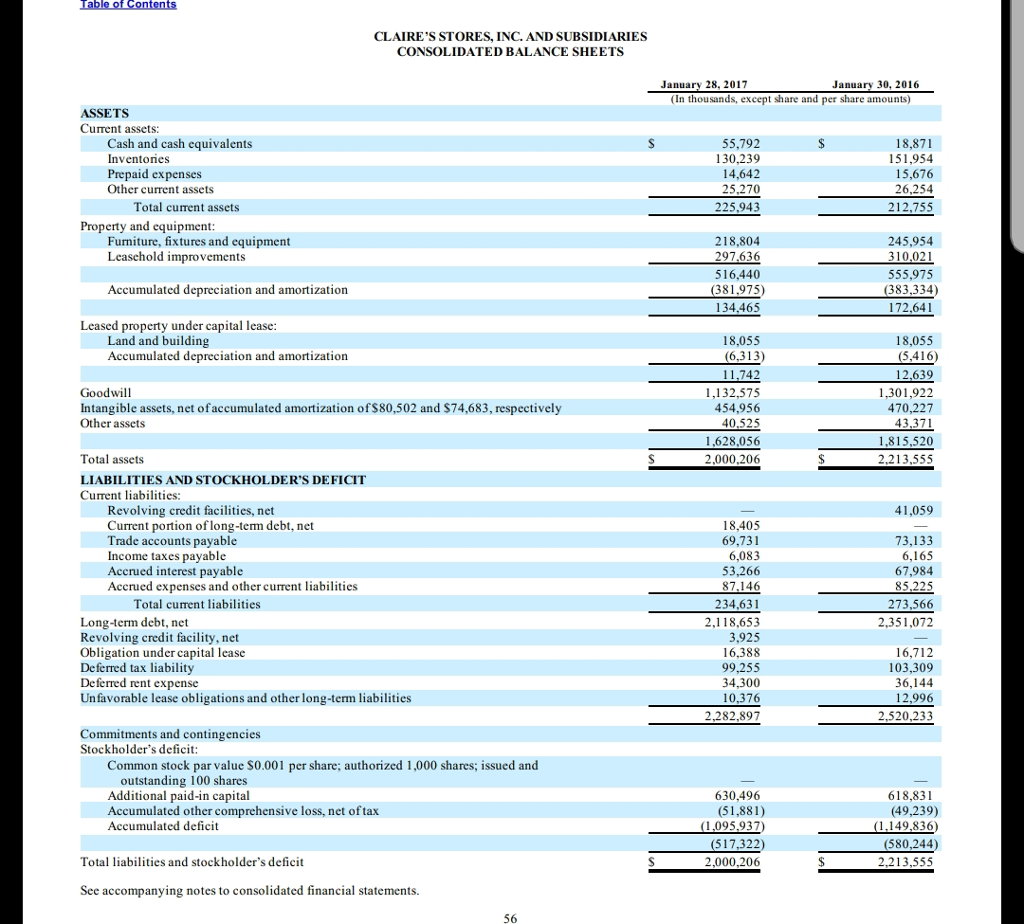

CLAIRE'S STORES, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS January 28, 2017 January 30, 2016 (In thousands, except share and per share amounts) ASSETS Current assets: Cash and cash equivalents Inventories Prepaid expenses Other current assets 55,792 130,239 14,642 18,871 151,954 15,676 Total current assets 225,943 212,755 245,954 555,975 172,641 Property and equipment Furniture, fixtures and equipment Leasehold improvements 218,804 297.636 516,440 Accumulated depreciation and amortization 134,465 Leased property under capital lease 18,055 Land and building Accumulated depreciation and an 18,05s amortization (5.416 1,132,575 454,956 12,639 1,301,922 470,227 Intangible assets, net ofaccumulated amortization of$80,502 and $74,683, respectively Other assets 1,628,056 2,000,206 Total assets LIABILITIES AND STOCKHOLDER'S DEFICIT Current liabilities: 2,213,555 Revolving credit facilities, net Current portion of long-term debt, net Trade accounts payable Income taxes payable Accrued interest payable Accrued expenses and other current liabilities 41,059 73,133 67,984 273,566 18.405 6,083 53,266 87.146 234,631 2,118,653 3,925 Total current liabilities Long-term debt, net Revolving credit facility, net Obligation under capital lease Deferred tax liability Deferred rent expense Unfavorable lease obligations and other long-term liabilities 2,351,072 99,255 34,300 10,376 2,282,897 103,309 36,144 12,996 2,520,233 Commitments and contingencies Stockholder's deficit: Common stock par value $0.001 per share; authorized 1,000 shares; issued and outstanding 100 shares Additional paid-in capital Accumulated other comprehensive loss, net oftax Accumulated deficit 61 8,831 (49,239) 1,149,836 (580.244) 630,496 1,095,937) Total liabilities and stockholder's deficit 2,000,206 See accompanying notes to consolidated financial statements. CLAIRE'S STORES, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS January 28, 2017 January 30, 2016 (In thousands, except share and per share amounts) ASSETS Current assets: Cash and cash equivalents Inventories Prepaid expenses Other current assets 55,792 130,239 14,642 18,871 151,954 15,676 Total current assets 225,943 212,755 245,954 555,975 172,641 Property and equipment Furniture, fixtures and equipment Leasehold improvements 218,804 297.636 516,440 Accumulated depreciation and amortization 134,465 Leased property under capital lease 18,055 Land and building Accumulated depreciation and an 18,05s amortization (5.416 1,132,575 454,956 12,639 1,301,922 470,227 Intangible assets, net ofaccumulated amortization of$80,502 and $74,683, respectively Other assets 1,628,056 2,000,206 Total assets LIABILITIES AND STOCKHOLDER'S DEFICIT Current liabilities: 2,213,555 Revolving credit facilities, net Current portion of long-term debt, net Trade accounts payable Income taxes payable Accrued interest payable Accrued expenses and other current liabilities 41,059 73,133 67,984 273,566 18.405 6,083 53,266 87.146 234,631 2,118,653 3,925 Total current liabilities Long-term debt, net Revolving credit facility, net Obligation under capital lease Deferred tax liability Deferred rent expense Unfavorable lease obligations and other long-term liabilities 2,351,072 99,255 34,300 10,376 2,282,897 103,309 36,144 12,996 2,520,233 Commitments and contingencies Stockholder's deficit: Common stock par value $0.001 per share; authorized 1,000 shares; issued and outstanding 100 shares Additional paid-in capital Accumulated other comprehensive loss, net oftax Accumulated deficit 61 8,831 (49,239) 1,149,836 (580.244) 630,496 1,095,937) Total liabilities and stockholder's deficit 2,000,206 See accompanying notes to consolidated financial statements