Question

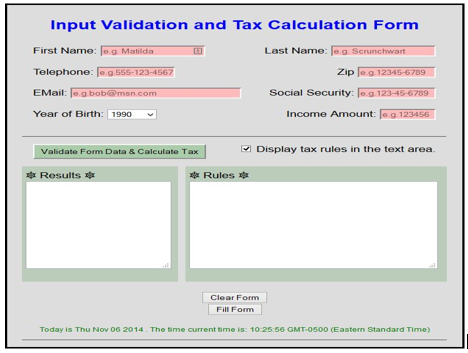

Create an input Validation and Tax Calculation form. (Javascript codes written in Notepad, Notepad ++ or any text editor) something that looks like what is

Create an input Validation and Tax Calculation form. (Javascript codes written in Notepad, Notepad ++ or any text editor)

something that looks like what is in the pictures below.

The form should be based on:

Header: THREE components.

Identification: NAME! / Date / Class

Purpose: Why is the program being written?

Algorithsm/Overview:

Show steps taken to solve the problem.

Write in bullets .

Body: FOUR components

Meaningful Names: Names should reflect their purpose.

Indent: indent code in loops and if statements.

White Space: Use horizontal & vertical white space.

Comments: explain WHY. Don't repeat the obvious. Insight!

Additional Functions / Methods:

1. Identification: Name / Date / Class (if in separate file)

2. Purpose:What does it DO?

3. Indent, Naming, White Space, Comments

Create a form with inputs & selections as follows:

First Name: Betty [Letters only, first letter capitalized.]

Last Name: Betters [Letters only, first letter capitalized.]

Challenge: If first letter of name not capitalized, CAPITALIZE the first letter! (onblur, charAt, substr)

Telephone: 123-456-7890 [length 12, digits and hyphen separator only]

Zip: 12345 [length 10, digits only]

12345-7890 [length 10, digits and hyphen separator only] ? How do you reject 12345-22 ?

E-Mail: type="email"

SS#: 123-45-6789 [length 11, digits and hyphen separator only]

Income: 0-999999 [check for number, range ]

> text, password, email, tel, checkbox, radio, submit

id=" "

name=" "

size=" " maxlength=" "

title=" "

placeholder=" what the user sees"

pattern=" " ==>> regex quick start regex overview pattern reference!

tabindex=" "

required

/>

BirthDate: ONE Dropdown (Year): 1990-2000. Check? None

select

option

====================================================================

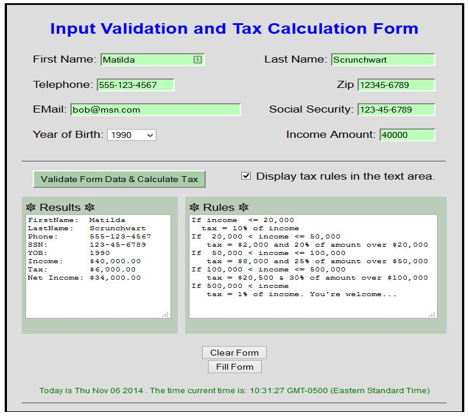

Tax Rate Calculated from Income:

1. 10% of amount between $0 - 20,000.00

2. 20% of amount between $20,000.01 - 50,000.00 + 2,000(from line 1)

3. 25% of amount between $50,000.01 - 100,000.00 + 6,000(from line 2) + 2,000

(from line 1)

30% of amount between $100,000.01 - 500,000.00 + 12,500(from line 3) + 6,000

(from line 2) + 2,000(from line 1)

If income is over $500,000 = 1% flat rate on all income. :) The 1%

NOTE: .toFixed(2) ==> forces 2 decimal places

Explained:

Income is your "Gross Income".

To calculate "Net Income" (take home pay):

Tax is subtracted from income.

Income: $500.00

Tax: $50.00

Net Income: $450.00

(see more examples at end of page)

Validate form before calculating and submitting!!!

Do not allow bad data onto the form.

Report any error and allow the user to correct that input.

Put focus where error was detected.

DO NOT clear entire form on error!

Use pseudo-classes to style input boxes

:valid

:invalid

(NOTE these will throw css validation errors - ok)

Do not calculate until all data fields are valid.

Note that calculation is separate from submission

but should occur at the same time.

How?

if ( $(formId).checkValidity() )

{

code to execute if all fields valid

...

}

A checkbox will determine if tax rules are displayed (see example).

if ( $(id).checked)

{

code to execute if checked

}

'Clear' resets all fields to blank (default in drop down).

'Fill' fills all fields to valid values (default in drop down).

USE THIS for form:

target="_blank"

class="someClass"

action="http://www.example.com/review.php"

method="get">

Validation: HTML CSS

Validate and document HTML ! Explain(cryptic stuff)

Validate CSS and use CSS organizaton as we talked about. Style so form fields float with appropriate margins!

JS: Use $ function. Create "Clear()", "Fill()" and "Calculate()" functions. Document!

EXAMPLES:

Income: $500.00

Tax: $ 50.00

Net Income: $450.00

------------------------------------------

Income: $10,000.00

Tax: $ 1,000.00 (10% of 10,000)

Net Income: $ 9,000.00

---------------------------------------------

Income: $20,000.00

Tax: $ 2,000.00 (10% of 20,000)

Net Income: $18,000.00

-------------------------------------------

Income: $30,000.00

Tax: $ 4,000.00 (10% of 20,000 plus 20% of 10,000)

Net Income: $26,000.00

---------------------------------------------

Income: $40,000.00

Tax: $ 6,000.00 (10% of 20,000 plus 20% of 20,000)

Net Income: $34,000.00

---------------------------------------------

Income: $50,000.00

Tax: $ 8,000.00 (10% of 20,000 plus 20% of 30,000)

Net Income: $42,000.00

---------------------------------------------

Income: $60,000.00

Tax: $10,500.00 (10% of 20,000 plus 20% of 30,000 plus 25% of 10,000)

Net Income: $49,500.00

input validation and Tax Calculation Form Last Name: leg Scrunchwart First Name: le g Matilda Telephone g 555 123 4567 Zip leg 12345 6789 EMail: le g boba msn.com Social Security Ieg 123 45 6789 Year of Birth: 1990 Income Amount: le g 123456 Display tax rules in the text area. Validate Form Data & Calculate Tax Results Rules Clear Form Today is Thu Nov 06 2014. The time current time is: 10C25:56 GMT 0500 Eastern Standard Time)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started