Question

1-Financial information of a company is as follows: Sales: 180 500 000 TL Cost of Sales: 46 200 000 TL. Selling, Marketing, Distribution Exp:enses:

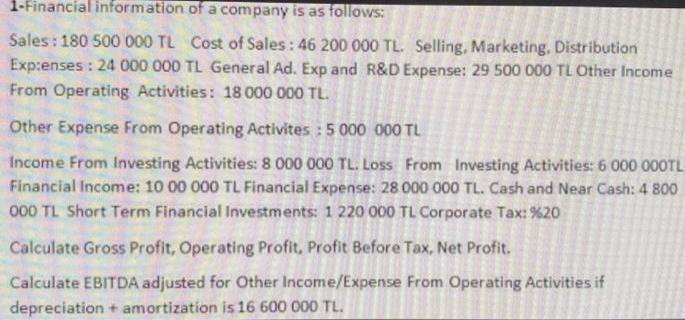

1-Financial information of a company is as follows: Sales: 180 500 000 TL Cost of Sales: 46 200 000 TL. Selling, Marketing, Distribution Exp:enses: 24 000 000 TL General Ad. Exp and R&D Expense: 29 500 000 TL Other Income From Operating Activities: 18 000 000 TL. Other Expense From Operating Activites: 5 000 000 TL Income From Investing Activities: 8 000 000 TL. Loss From Investing Activities: 6 000 000TL Financial Income: 10 00 000 TL Financial Expense: 28 000 000 TL. Cash and Near Cash: 4 800 000 TL Short Term Financial Investments: 1 220 000 TL Corporate Tax: %20 Calculate Gross Profit, Operating Profit, Profit Before Tax, Net Profit. Calculate EBITDA adjusted for Other Income/Expense From Operating Activities if depreciation + amortization is 16 600 000 TL.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Mathematical Statistics With Applications In R

Authors: Chris P. Tsokos, K.M. Ramachandran

2nd Edition

124171133, 978-0124171138

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App