Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cruz obtained a 60% holding in the 100,000 1 shares of Tom on 1 January 2019 when the retained earnings of Tom were 850,000.

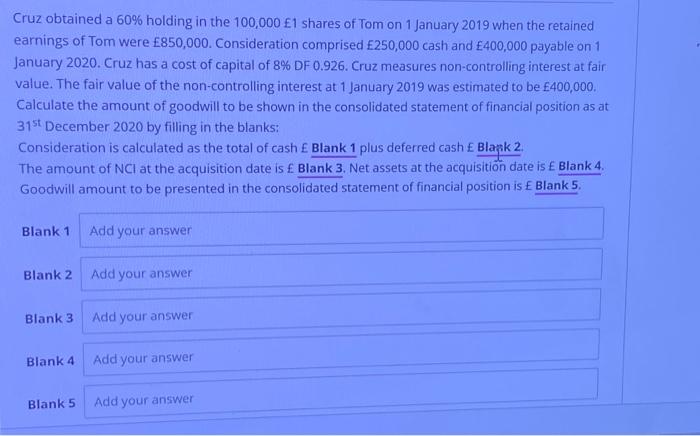

Cruz obtained a 60% holding in the 100,000 1 shares of Tom on 1 January 2019 when the retained earnings of Tom were 850,000. Consideration comprised 250,000 cash and 400,000 payable on 1 January 2020. Cruz has a cost of capital of 8% DF 0.926. Cruz measures non-controlling interest at fair value. The fair value of the non-controlling interest at 1 January 2019 was estimated to be 400,000. Calculate the amount of goodwill to be shown in the consolidated statement of financial position as at 31st December 2020 by filling in the blanks: Consideration is calculated as the total of cash Blank 1 plus deferred cash Blank 2. The amount of NCI at the acquisition date is Blank 3. Net assets at the acquisition date is Blank 4. Goodwill amount to be presented in the consolidated statement of financial position is Blank 5. Blank 1 Blank 2 Blank 3 Blank 4 Blank 5 Add your answer Add your answer Add your answer Add your answer Add your answer

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the blanks we can use the following steps 1 Calculate the total consideration paid by C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started