Question

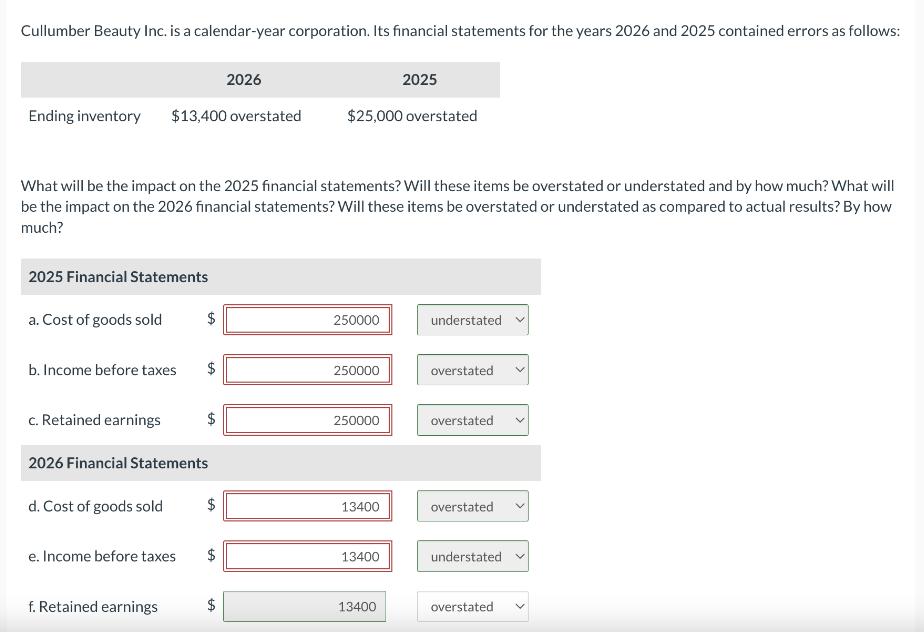

Cullumber Beauty Inc. is a calendar-year corporation. Its financial statements for the years 2026 and 2025 contained errors as follows: Ending inventory 2025 Financial

Cullumber Beauty Inc. is a calendar-year corporation. Its financial statements for the years 2026 and 2025 contained errors as follows: Ending inventory 2025 Financial Statements a. Cost of goods sold $13,400 overstated What will be the impact on the 2025 financial statements? Will these items be overstated or understated and by how much? What will be the impact on the 2026 financial statements? Will these items be overstated or understated as compared to actual results? By how much? b. Income before taxes c. Retained earnings 2026 Financial Statements $ d. Cost of goods sold $ e. Income before taxes f. Retained earnings 2026 $ $ $25,000 overstated 250000 250000 250000 13400 2025 13400 13400 understated overstated overstated overstated understated overstated

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur J. Keown, John H. Martin

13th edition

134417216, 978-0134417509, 013441750X, 978-0134417219

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App