Answered step by step

Verified Expert Solution

Question

1 Approved Answer

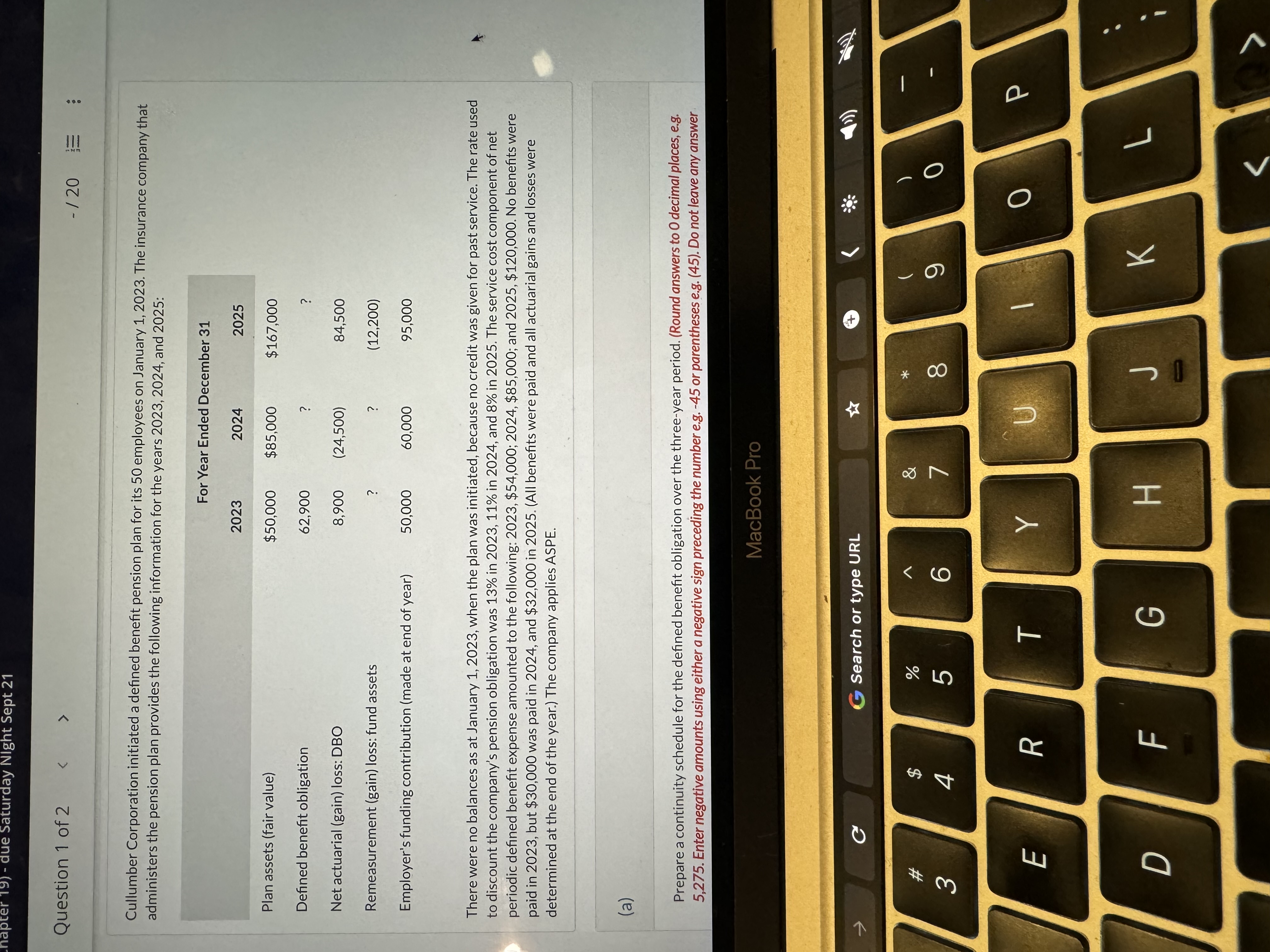

Cullumber Corporation initiated a defined benefit pension plan for its 5 0 employees on January 1 , 2 0 2 3 . The insurance company

Cullumber Corporation initiated a defined benefit pension plan for its employees on January The insurance company that

administers the pension plan provides the following information for the years and :

There were no balances as at January when the plan was initiated, because no credit was given for past service. The rate used

to discount the company's pension obligation was in in and in The service cost component of net

periodic defined benefit expense amounted to the following: $;$; and $ No benefits were

paid in but $ was paid in and $ in All benefits were paid and all actuarial gains and losses were

determined at the end of the year. The company applies ASPE.

a

Prepare a continuity schedule for the defined benefit obligation over the threeyear period. Round answers to decimal places, eg

Enter negative amounts using either a negative sign preceding the number eg or parentheses eg Do not leave any answer Prepare a continuity schedule for the plan assets over the threeyear period. Round answers to decimal places, eg Enter

negative amounts using either a negative sign preceding the number eg or parentheses eg Do not leave any answer field blank.

Enter for amounts. Your answer is correct.

Prepare a continuity schedule for the defined benefit obligation over the threeyear period. Round answers to decimal place

Enter negative amounts using either a negative sign preceding the number eg or parentheses eg Do not leave any a

field blank. Enter O for amounts.

CULLUMBER CORPORATION

Continuity Schedule of Defined Benefit Obligation

Defined Benefit Obligation at Beginning of Year

Current Service Cost

Interest Cost

Benefits Paid Out

Net Actuarial Loss Gain

Defined Benefit Obligation at End of Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started