Answered step by step

Verified Expert Solution

Question

1 Approved Answer

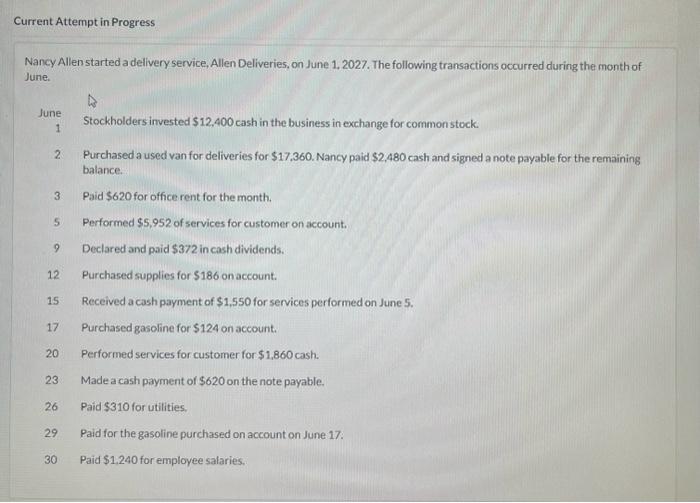

Current Attempt in Progress Nancy Allen started a delivery service, Allen Deliveries, on June 1, 2027. The following transactions occurred during the month of June.

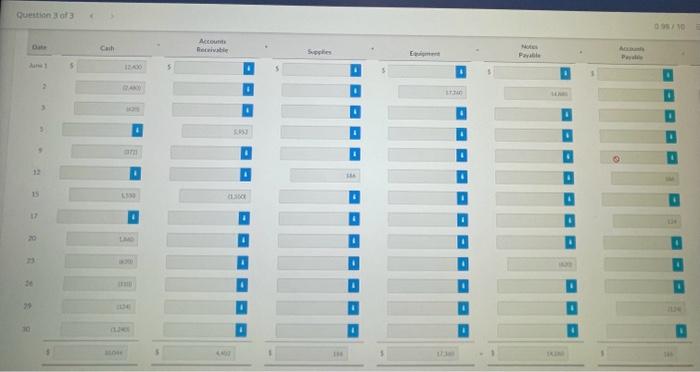

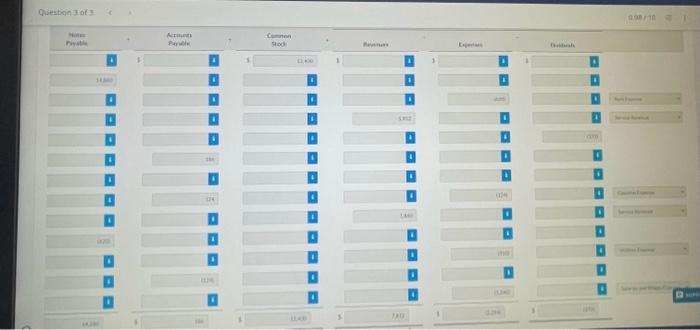

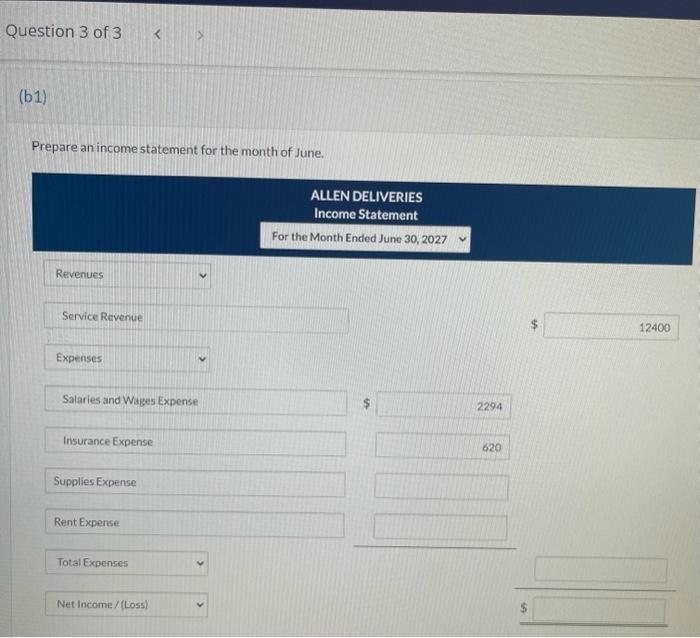

Current Attempt in Progress Nancy Allen started a delivery service, Allen Deliveries, on June 1, 2027. The following transactions occurred during the month of June. June 1 2 3 5 9 12 15 17 20 23 26 29 30 4 Stockholders invested $12,400 cash in the business in exchange for common stock. Purchased a used van for deliveries for $17,360. Nancy paid $2,480 cash and signed a note payable for the remaining balance. Paid $620 for office rent for the month. Performed $5,952 of services for customer on account. Declared and paid $372 in cash dividends. Purchased supplies for $186 on account. Received a cash payment of $1,550 for services performed on June 5. Purchased gasoline for $124 on account. Performed services for customer for $1,860 cash. Made a cash payment of $620 on the note payable. Paid $310 for utilities. Paid for the gasoline purchased on account on June 17. Paid $1,240 for employee salaries. I need help with only b1) incone statement ended june 30,2027

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started