Question

Blue Spruce Company produces plastic that is used for injection-moulding applications such as gears for small motors. In 2022, the first year of operations, Blue

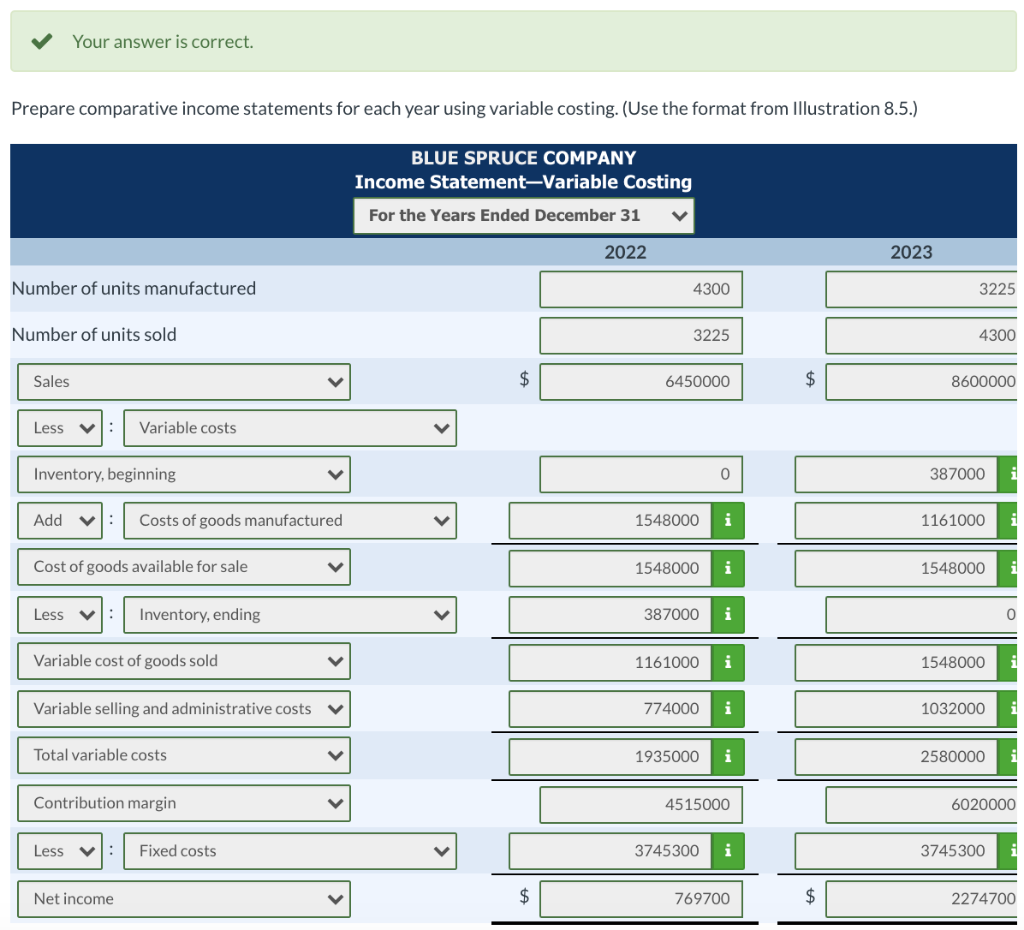

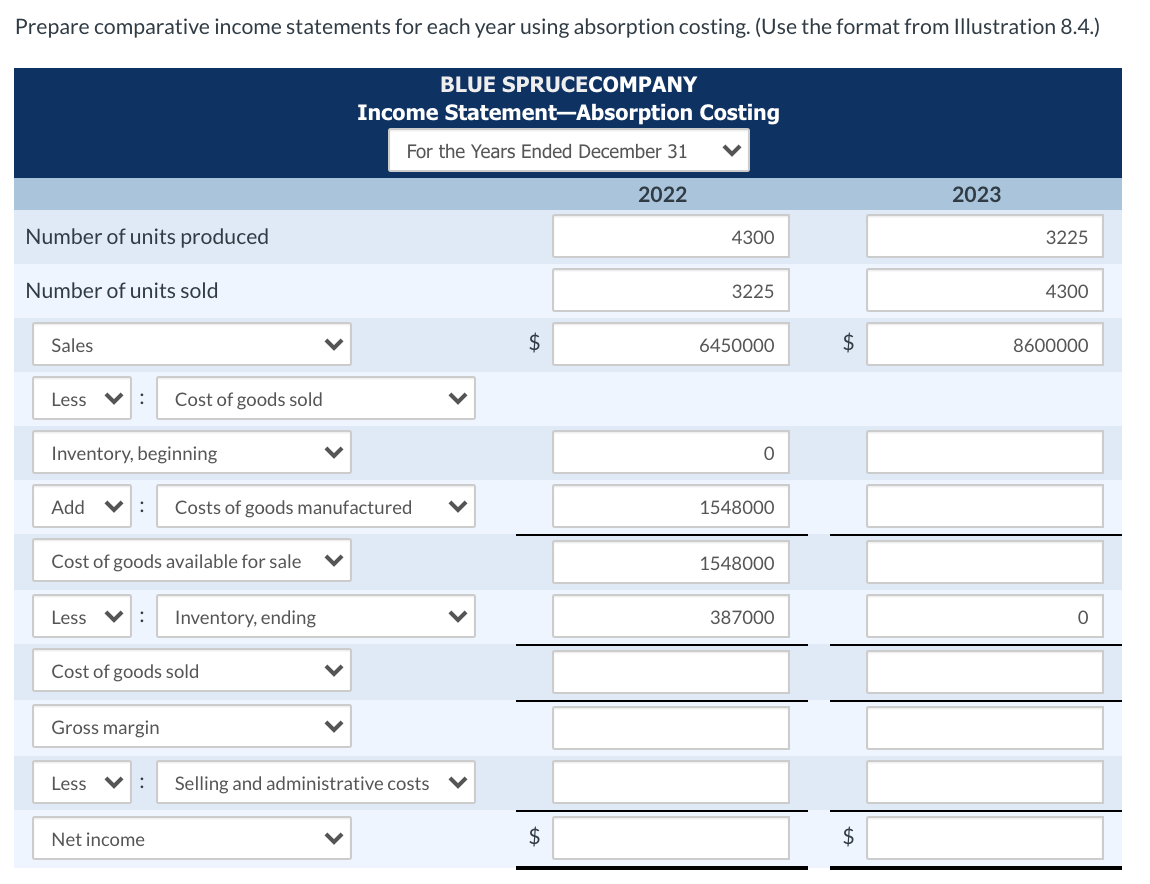

Blue Spruce Company produces plastic that is used for injection-moulding applications such as gears for small motors. In 2022, the first year of operations, Blue Spruce Company produced 4,300 tonnes of plastic and sold 3,225 tonnes. In 2023, the production and sales results were exactly reversed. In each year, the selling price per tonne was $2,000; variable manufacturing costs were 18% of the sales price for the units produced; variable selling expenses were 12% of the selling price of the units sold; fixed manufacturing costs were $3,225,000; and fixed administrative expenses were $520,300.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started