Answered step by step

Verified Expert Solution

Question

1 Approved Answer

p May you plz answer it by yourself plz don't copy from another expert? On June 1, 2018, Bob Lutz opened Lutz Repair Service. Make

p

May you plz answer it by yourself plz don't copy from another expert?

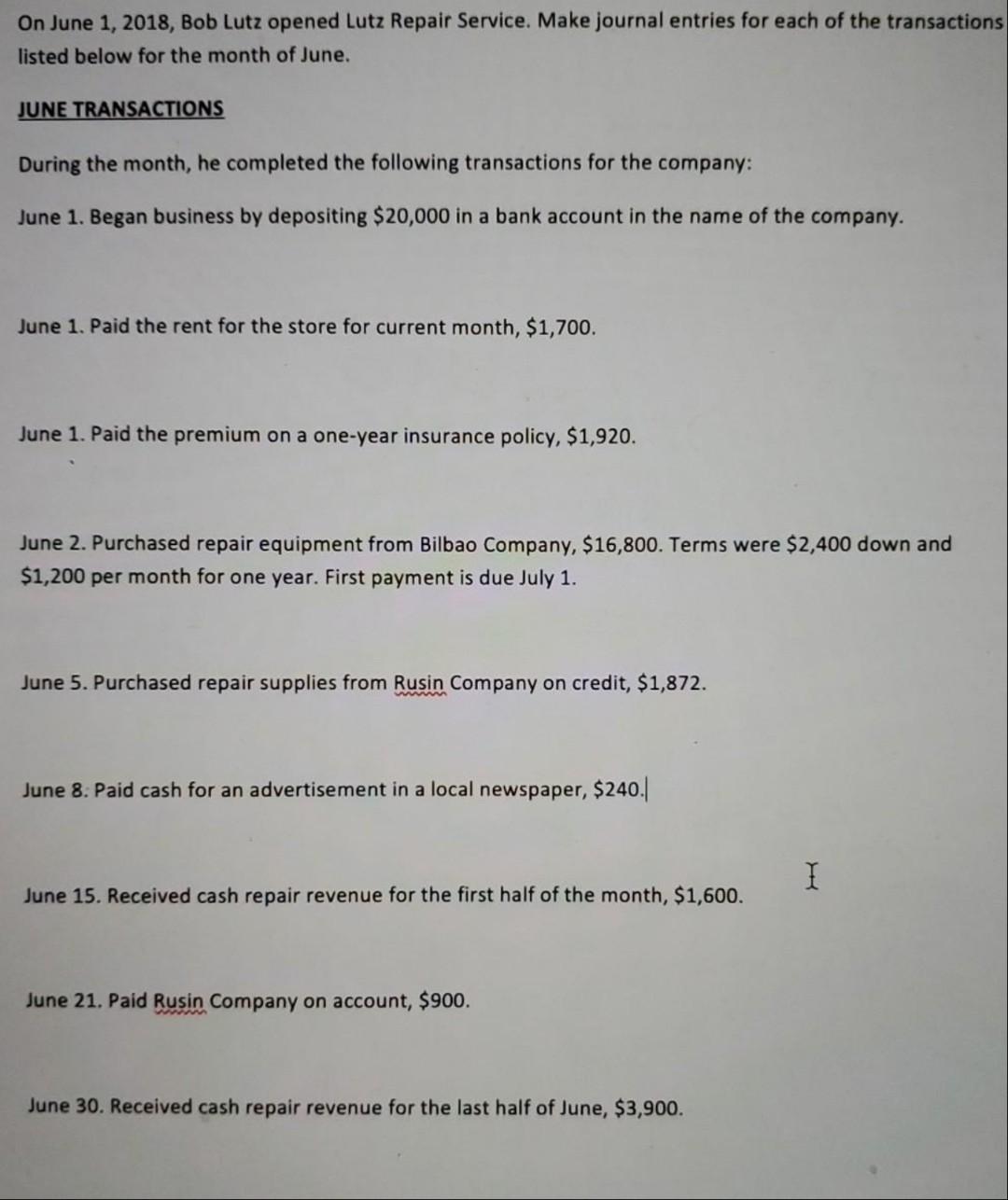

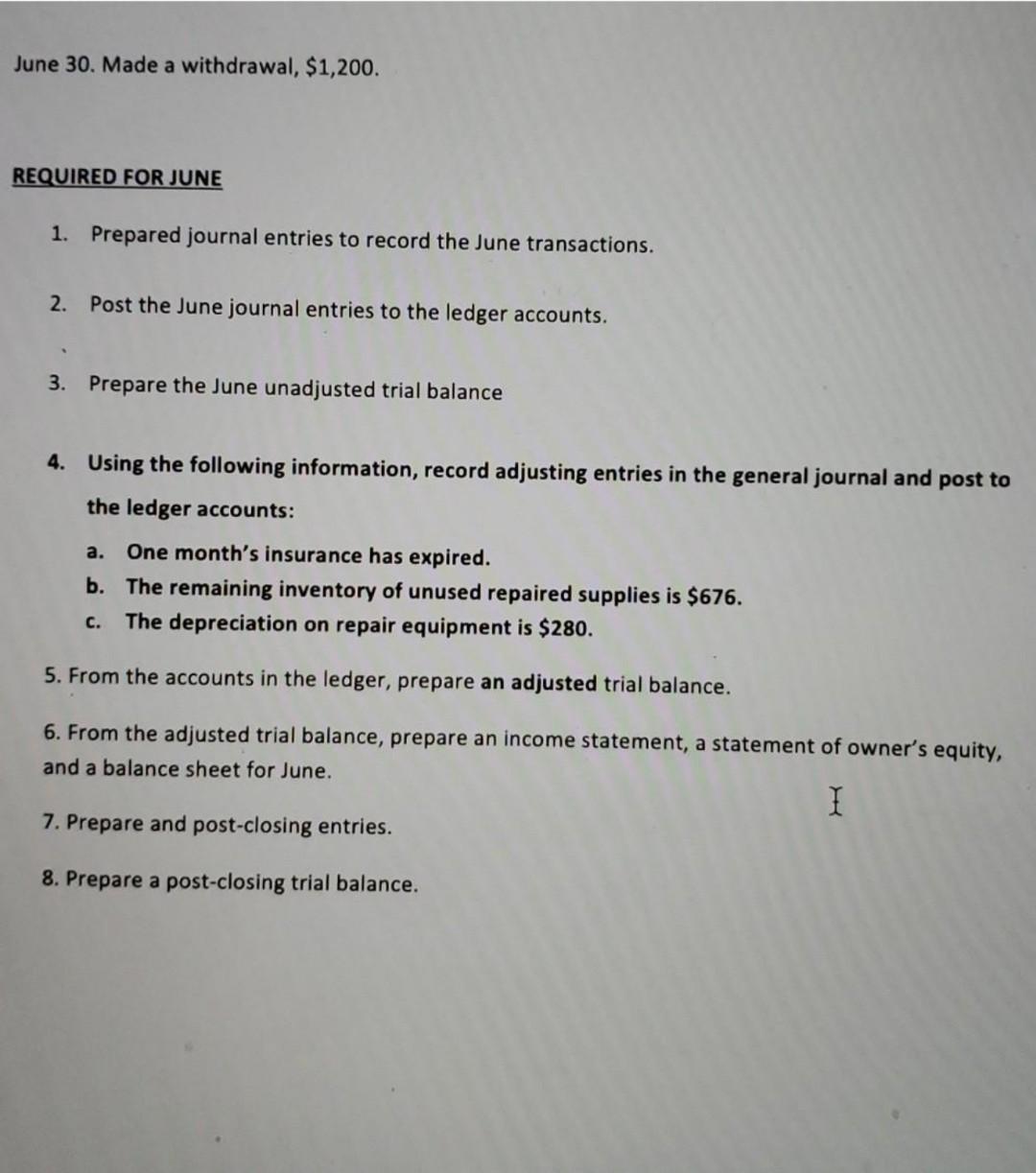

On June 1, 2018, Bob Lutz opened Lutz Repair Service. Make journal entries for each of the transactions listed below for the month of June. JUNE TRANSACTIONS During the month, he completed the following transactions for the company: June 1. Began business by depositing $20,000 in a bank account in the name of the company. June 1. Paid the rent for the store for current month, $1,700. June 1. Paid the premium on a one-year insurance policy, $1,920. June 2. Purchased repair equipment from Bilbao Company, $16,800. Terms were $2,400 down and $1,200 per month for one year. First payment is due July 1. June 5. Purchased repair supplies from Rusin Company on credit, $1,872. June 8. Paid cash for an advertisement in a local newspaper, $240. I June 15. Received cash repair revenue for the first half of the month, $1,600. June 21. Paid Rusin Company on account, $900. June 30. Received cash repair revenue for the last half of June, $3,900. June 30. Made a withdrawal, $1,200. REQUIRED FOR JUNE 1. Prepared journal entries to record the June transactions. 2. Post the June journal entries to the ledger accounts. 3. Prepare the June unadjusted trial balance 4. Using the following information, record adjusting entries in the general journal and post to the ledger accounts: One month's insurance has expired. b. The remaining inventory of unused repaired supplies is $676. c. The depreciation on repair equipment is $280. a. 5. From the accounts in the ledger, prepare an adjusted trial balance. 6. From the adjusted trial balance, prepare an income statement, a statement of owner's equity, and a balance sheet for June. I 7. Prepare and post-closing entries. 8. Prepare a post-closing trial balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started