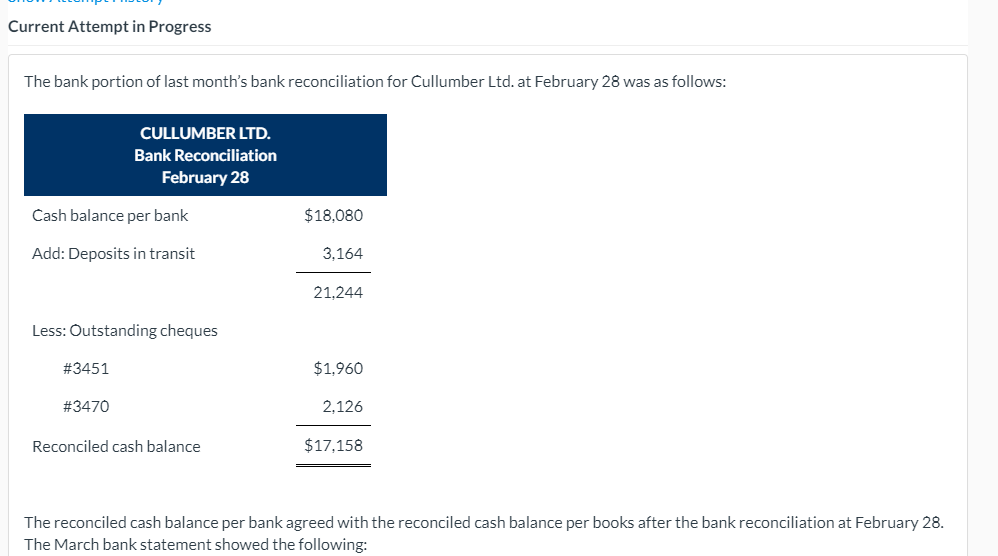

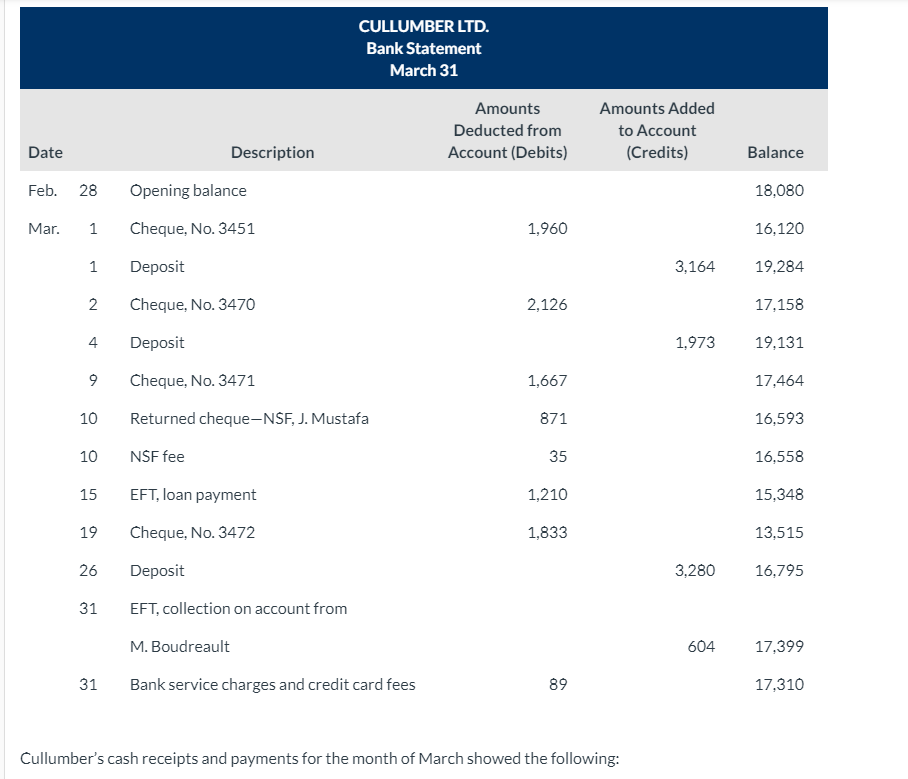

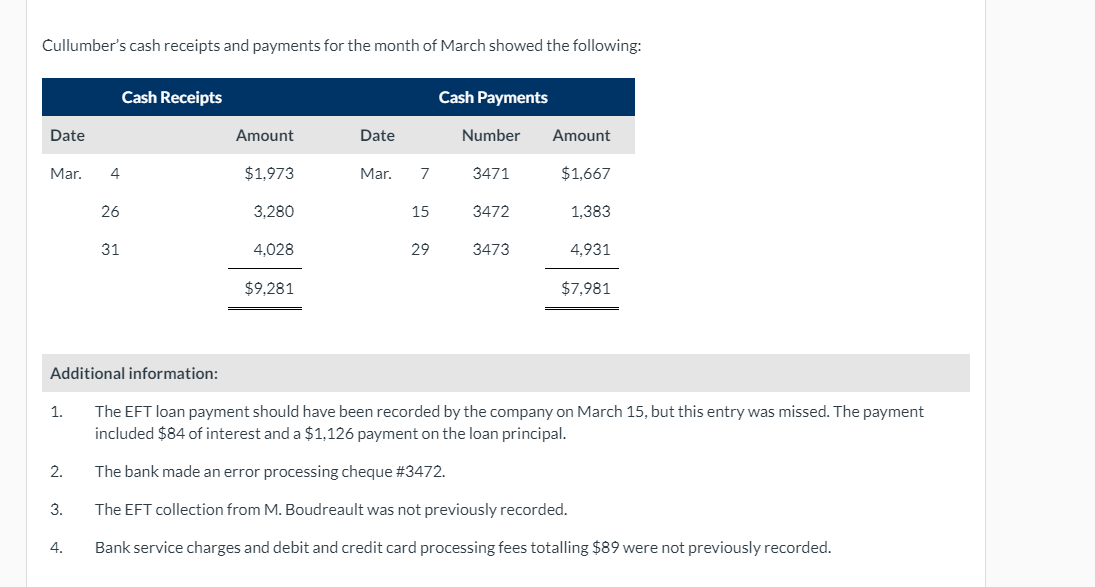

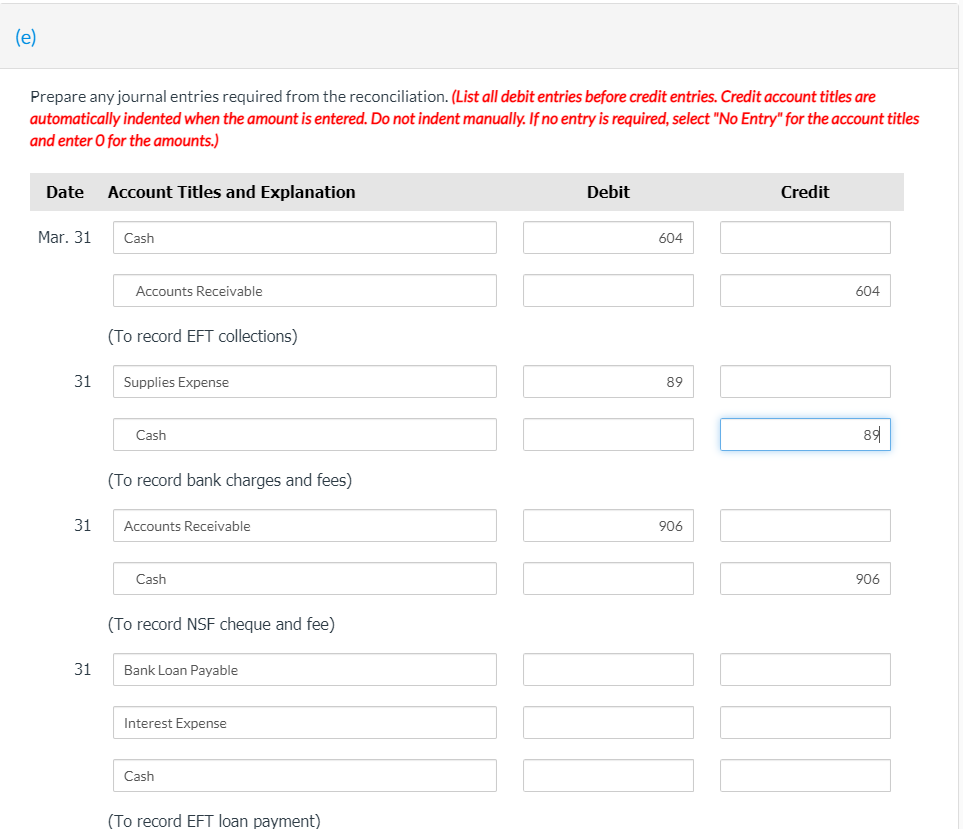

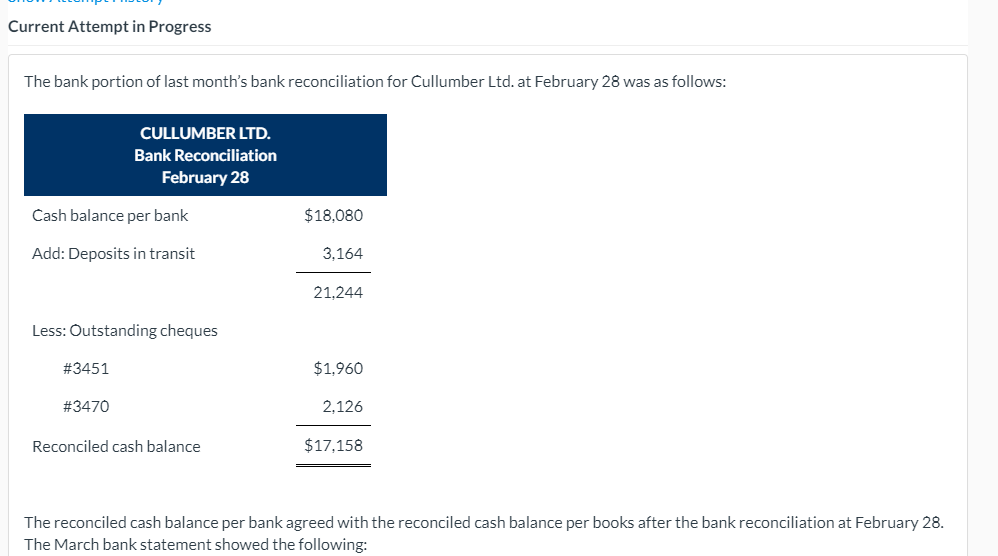

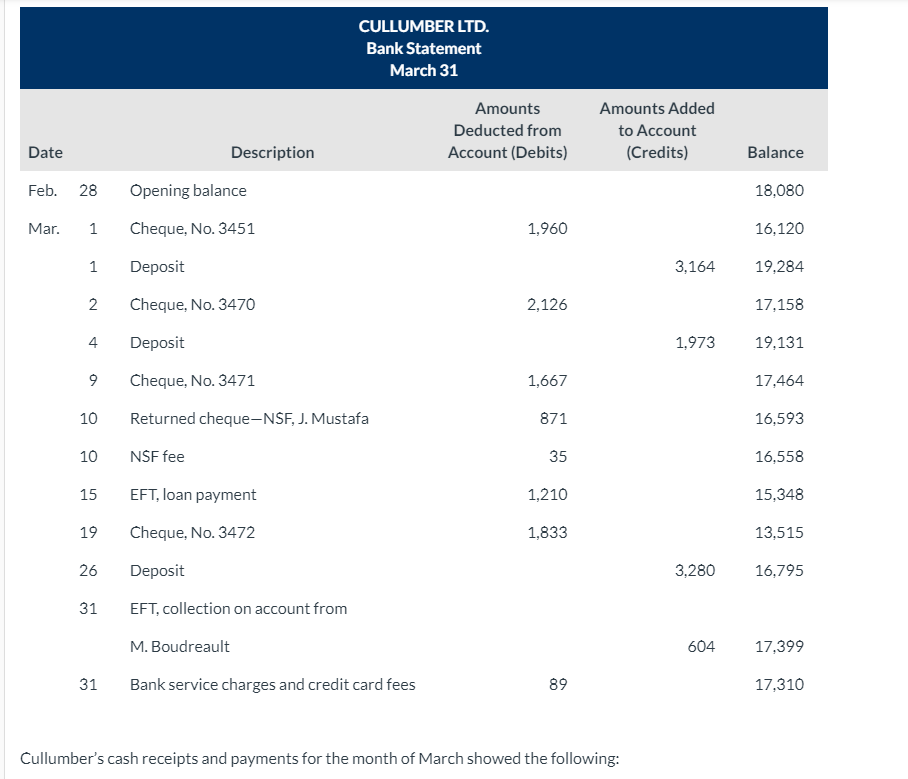

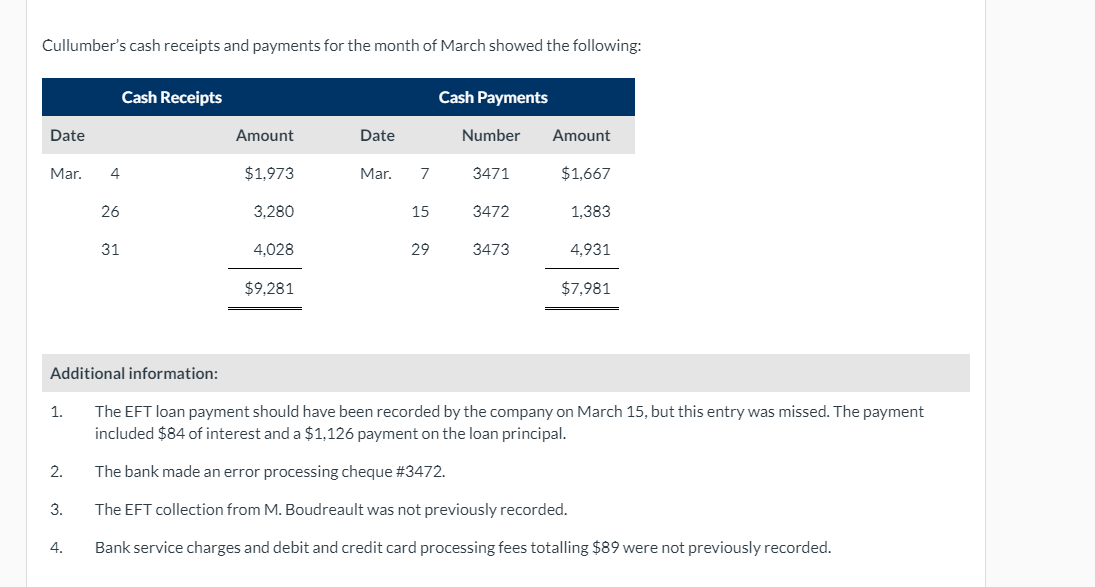

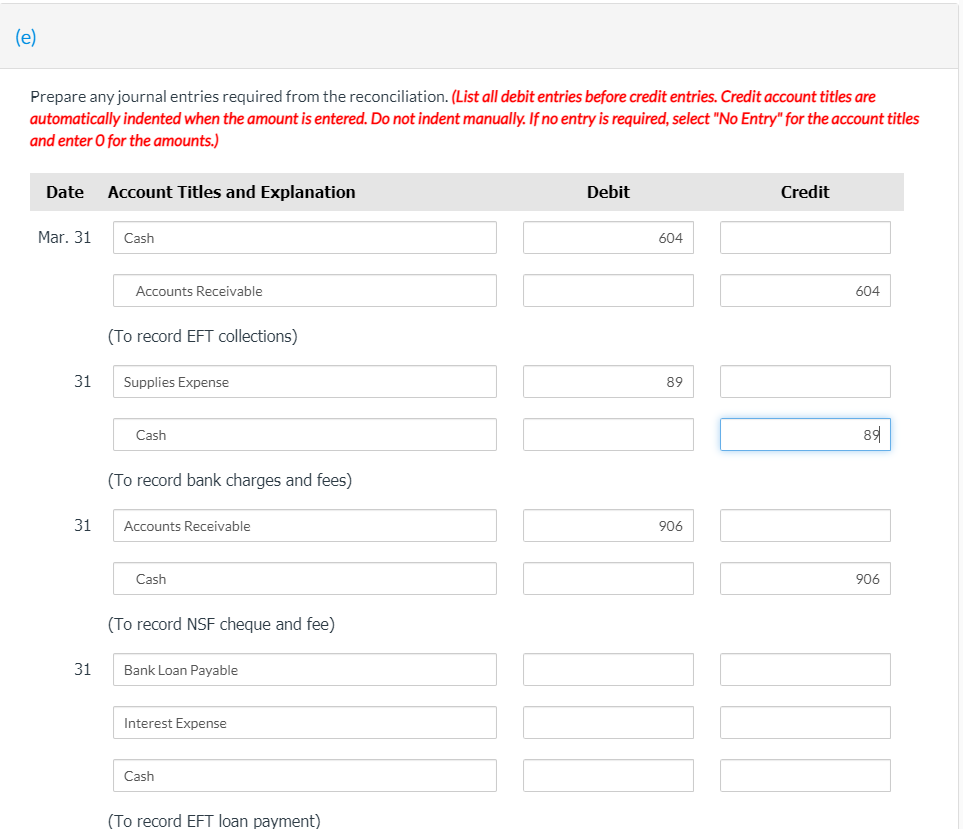

Current Attempt in Progress The bank portion of last month's bank reconciliation for Cullumber Ltd. at February 28 was as follows: CULLUMBER LTD. Bank Reconciliation February 28 Cash balance per bank $18.080 Add: Deposits in transit 3,164 21.244 Less: Outstanding cheques #3451 $1,960 #3470 2,126 Reconciled cash balance $17,158 The reconciled cash balance per bank agreed with the reconciled cash balance per books after the bank reconciliation at February 28. The March bank statement showed the following: CULLUMBER LTD. Bank Statement March 31 Amounts Deducted from Account (Debits) Amounts Added to Account (Credits) Date Description Balance Feb. 28 Opening balance 18.080 Mar. 1 Cheque, No. 3451 1,960 16,120 1 Deposit 3,164 19,284 2 Cheque, No. 3470 2,126 17,158 4 Deposit 1,973 19,131 9 Cheque, No. 3471 1,667 17,464 10 Returned cheque-NSF, J. Mustafa 871 16,593 10 NSF fee 35 16,558 15 EFT, loan payment 1,210 15,348 19 Cheque, No. 3472 1,833 13,515 26 3,280 16,795 Deposit EFT, collection on account from 31 M. Boudreault 604 17,399 31 Bank service charges and credit card fees 89 17,310 Cullumber's cash receipts and payments for the month of March showed the following: Cullumber's cash receipts and payments for the month of March showed the following: Cash Receipts Cash Payments Date Amount Date Number Amount Mar. 4 $1,973 Mar. 7 3471 $1,667 26 3.280 15 3472 1,383 31 4,028 29 3473 4,931 $9,281 $7,981 Additional information: 1. The EFT loan payment should have been recorded by the company on March 15, but this entry was missed. The payment included $84 of interest and a $1,126 payment on the loan principal. 2. The bank made an error processing cheque #3472. 3. The EFT collection from M. Boudreault was not previously recorded. 4. Bank service charges and debit and credit card processing fees totalling $89 were not previously recorded. (e) Prepare any journal entries required from the reconciliation. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Mar. 31 Cash 604 Accounts Receivable 604 (To record EFT collections) 31 Supplies Expense 89 Cash 89 (To record bank charges and fees) 31 Accounts Receivable 906 Cash 906 (To record NSF cheque and fee) 31 Bank Loan Payable Interest Expense Cash (To record EFT loan payment)