Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Currently there is a consensus, 93% probability, that in the September 20 meeting the Federal Reserve will not change the Fed Funds Rate (FFR). Thus,

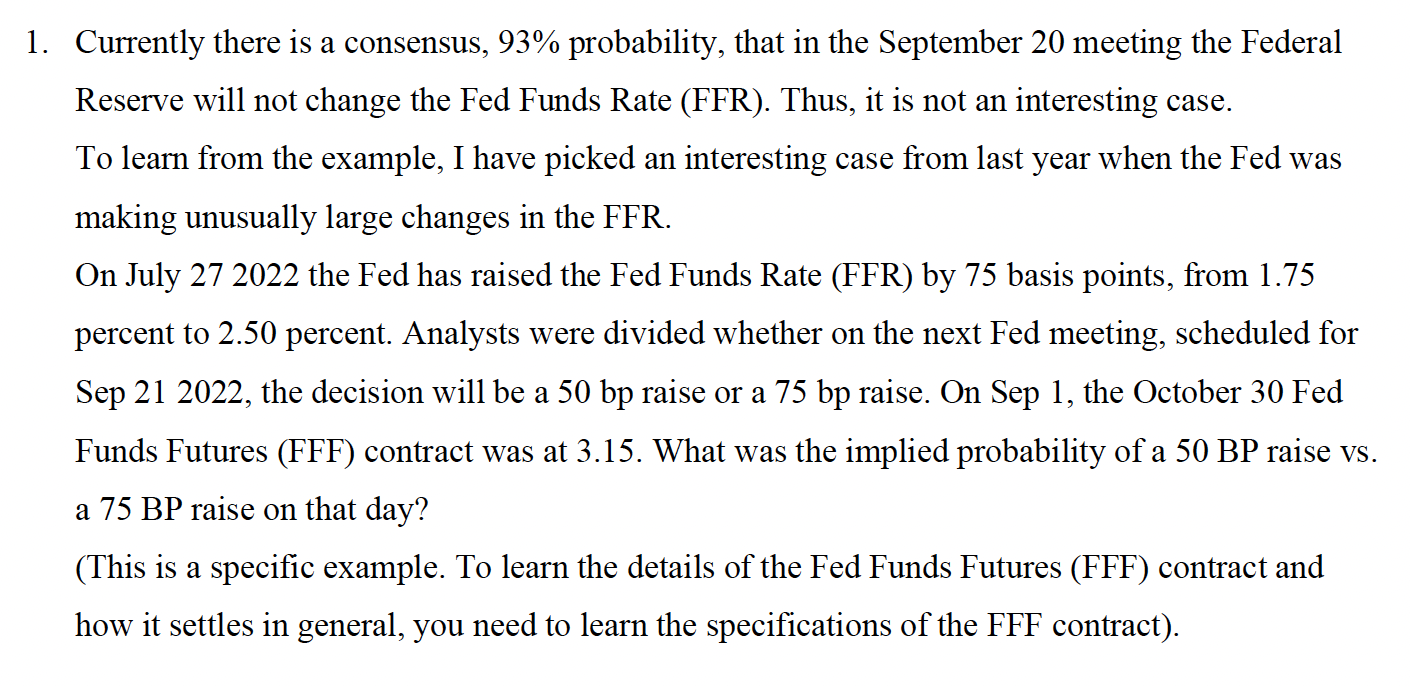

Currently there is a consensus, 93% probability, that in the September 20 meeting the Federal Reserve will not change the Fed Funds Rate (FFR). Thus, it is not an interesting case. To learn from the example, I have picked an interesting case from last year when the Fed was making unusually large changes in the FFR. On July 272022 the Fed has raised the Fed Funds Rate (FFR) by 75 basis points, from 1.75 percent to 2.50 percent. Analysts were divided whether on the next Fed meeting, scheduled for Sep 21 2022, the decision will be a 50 bp raise or a 75 bp raise. On Sep 1, the October 30 Fed Funds Futures (FFF) contract was at 3.15. What was the implied probability of a 50BP raise vs. a 75BP raise on that day? (This is a specific example. To learn the details of the Fed Funds Futures (FFF) contract and how it settles in general, you need to learn the specifications of the FFF contract)

Currently there is a consensus, 93% probability, that in the September 20 meeting the Federal Reserve will not change the Fed Funds Rate (FFR). Thus, it is not an interesting case. To learn from the example, I have picked an interesting case from last year when the Fed was making unusually large changes in the FFR. On July 272022 the Fed has raised the Fed Funds Rate (FFR) by 75 basis points, from 1.75 percent to 2.50 percent. Analysts were divided whether on the next Fed meeting, scheduled for Sep 21 2022, the decision will be a 50 bp raise or a 75 bp raise. On Sep 1, the October 30 Fed Funds Futures (FFF) contract was at 3.15. What was the implied probability of a 50BP raise vs. a 75BP raise on that day? (This is a specific example. To learn the details of the Fed Funds Futures (FFF) contract and how it settles in general, you need to learn the specifications of the FFF contract) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started