Answered step by step

Verified Expert Solution

Question

1 Approved Answer

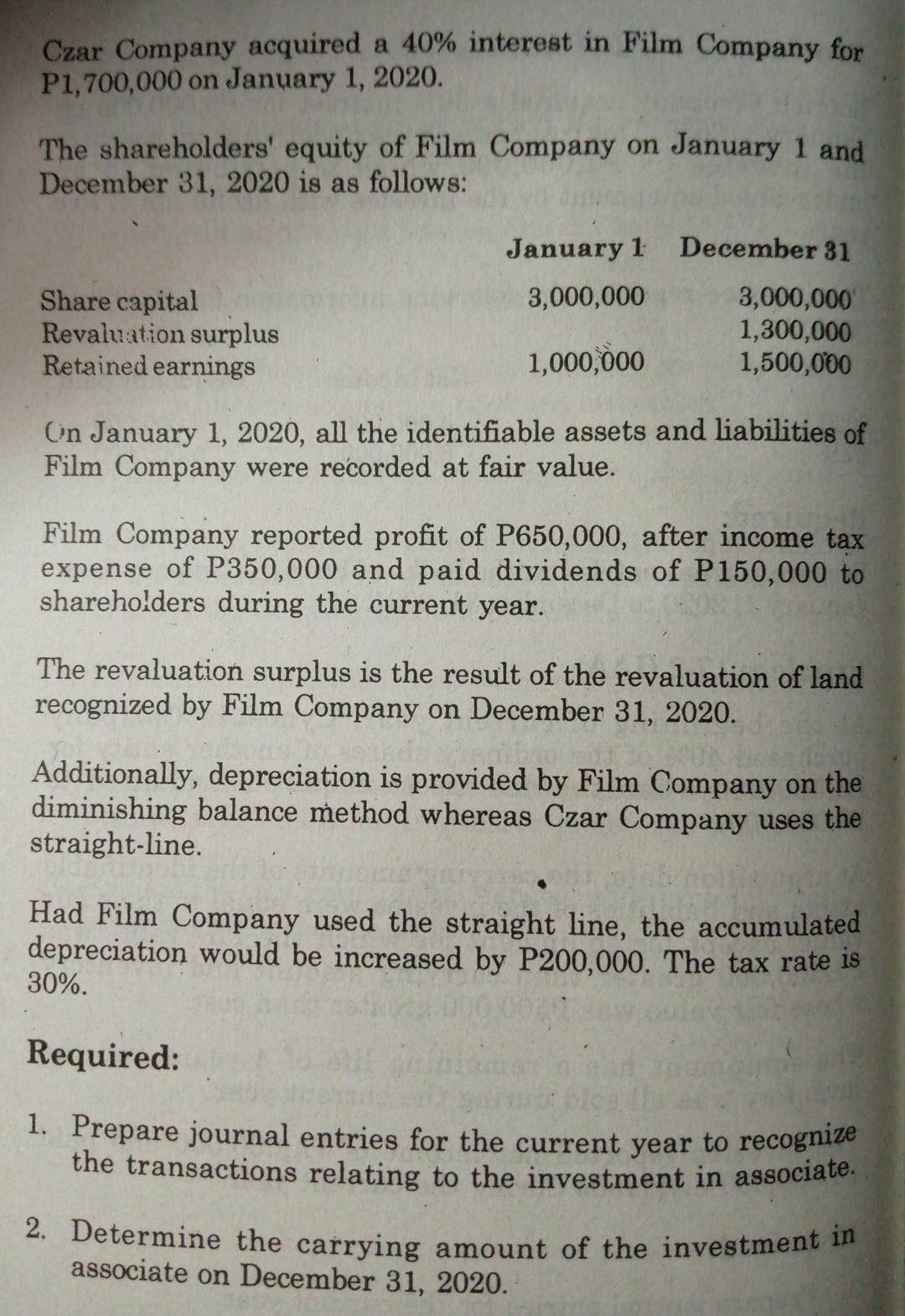

Czar Company acquired a 40% interest in Film Company for P1,700,000 on January 1, 2020. The shareholders' equity of Film Company on January 1 and

Czar Company acquired a 40% interest in Film Company for P1,700,000 on January 1, 2020. The shareholders' equity of Film Company on January 1 and December 31, 2020 is as follows: January 1 3,000,000 Share capital Revaluation surplus Retained earnings December 31 3,000,000 1,300,000 1,500,000 1,000,000 On January 1, 2020, all the identifiable assets and liabilities of Film Company were recorded at fair value. Film Company reported profit of P650,000, after income tax expense of P350,000 and paid dividends of P150,000 to shareholders during the current year. The revaluation surplus is the result of the revaluation of land recognized by Film Company on December 31, 2020. Additionally, depreciation is provided by Film Company on the diminishing balance method whereas Czar Company uses the straight-line. Had Film Company used the straight line, the accumulated depreciation would be increased by P200,000. The tax rate is 30%. Required: 1. Prepare journal entries for the current year to recognize the transactions relating to the investment in associate. 2. Determine the carrying amount of the investment in associate on December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started