Answered step by step

Verified Expert Solution

Question

1 Approved Answer

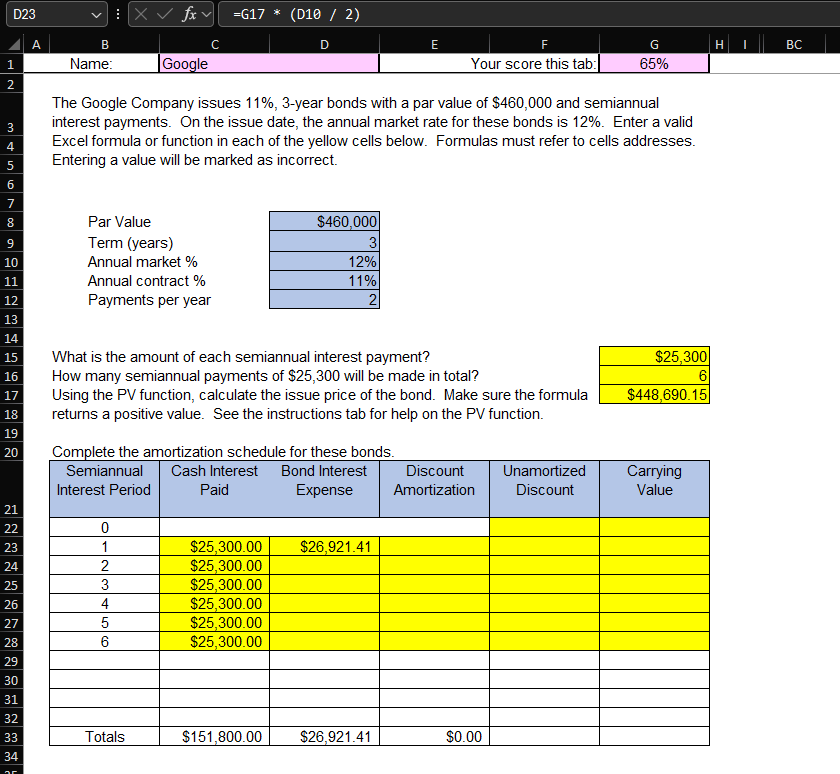

D 2 3 A B Name: Google C D E F G = G 1 7 * ( D 1 0 1 2 The Google

D

A

B

Name:

Google

C

D

E

F

G

GD

The Google Company issues year bonds with a par value of $ and semiannual interest payments. On the issue date, the annual market rate for these bonds is Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses. Entering a value will be marked as incorrect.

Par Value

Term years

Annual market

Annual contract

Payments per year

What is the amount of each semiannual interest payment?

How many semiannual payments of $ will be made in total?

Using the PV function, calculate the issue price of the bond. Make sure the formula

table$$

returns a positive value. See the instructions tab for help on the PV function.

Complete the amortization schedule for these bonds.

tabletableSemiannualInterest PeriodtableCash InterestPaidtableBond InterestExpensetableDiscountAmortizationtableUnamortizedDiscounttableCarryingValue$$$$$$$Totals$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started