Answered step by step

Verified Expert Solution

Question

1 Approved Answer

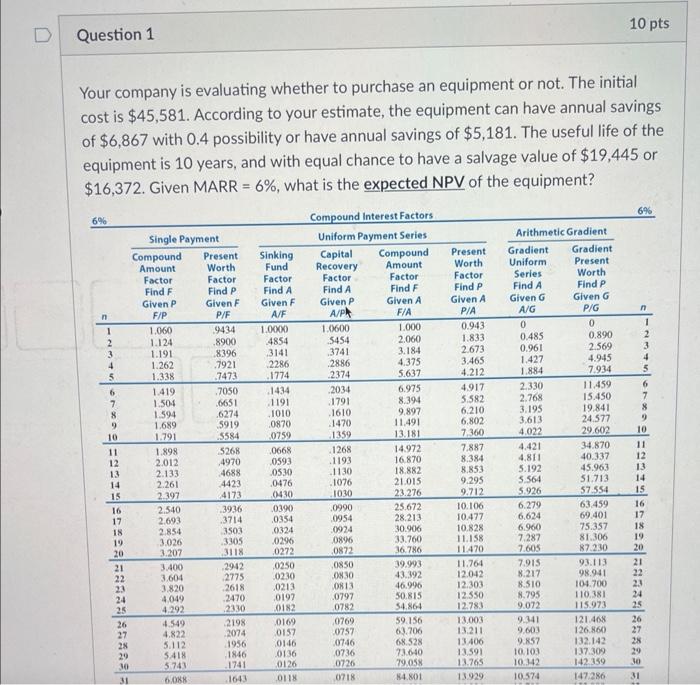

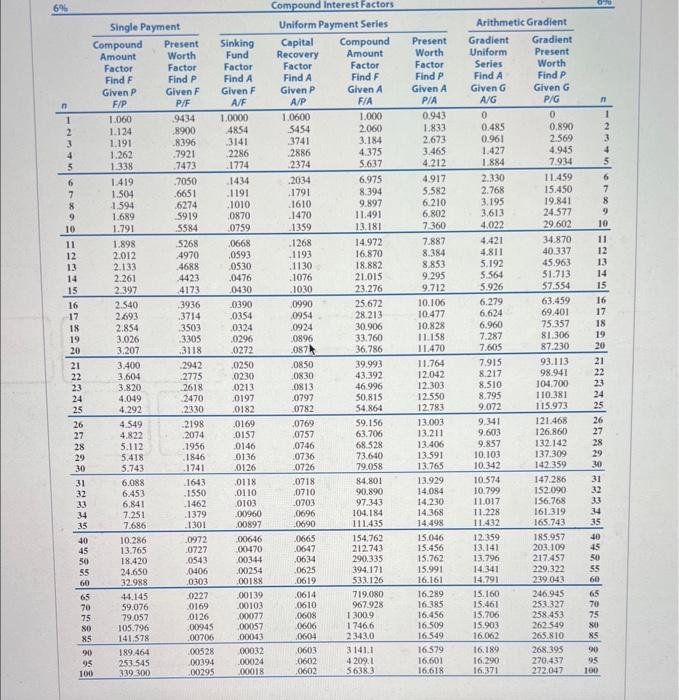

D Question 1 Your company is evaluating whether to purchase an equipment or not. The initial cost is $45,581. According to your estimate, the

D Question 1 Your company is evaluating whether to purchase an equipment or not. The initial cost is $45,581. According to your estimate, the equipment can have annual savings of $6,867 with 0.4 possibility or have annual savings of $5,181. The useful life of the equipment is 10 years, and with equal chance to have a salvage value of $19,445 or $16,372. Given MARR = 6%, what is the expected NPV of the equipment? 6% 1 2 3 4 5 6 7 8 9 10. 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Single Payment Compound Present Amount Factor Find F Given P F/P 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 1.898 2.012 2.133 2.261 2.397 2.540 2.693 2.854 3.026 3.207 3.400 3.604 3.820 4,049 4.292 4.549 4.822 5.112 5.418 5.743 6.088 Worth Factor Find P Given F P/F 9434 .8900 8396 7921 7473 7050 .6651 .6274 5919 5584 5268 4970 4688 4423 4173 3936 3714 3503 3305 3118 2942 2775 2618 2470 2330 2198 2074 1956 1846 1741 1643 Sinking Fund Factor Find A Given F A/F 1.0000 4854 3141 2286 .1774 1434 1191 1010 0870 0759 0668 0593 0530 0476 0430 0390 0354 0324 0296 0272 0250 0230 0213 0197 0182 0169 0157 0146 0136 0126 0118 Compound Interest Factors Uniform Payment Series Capital Recovery Factor Find A Given P A/P 1.0600 5454 3741 2886 2374 2034 1791 1610 1470 1359 1268 1193 1130 1076 1030 .0990 0954 0924 0896 0872 0850 08.30 0813 0797 0782 0769 0757 0746 0736 0726 0718 Compound Amount Factor Find F Given A F/A 1.000 2.060 3.184 4.375 5.637 6.975 8.394 9.897 11.491 13.181 14.972 16.870 18.882 21.015 23.276 25.672 28.213 30.906 33.760 36.786 39.993 43.392 46.996 50.815 54.864 59.156 63.706 68.528 73.640 79,058 84.801 Present Worth Factor Find P Given A P/A 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 11.764 12.042 12.303 12.550 12.783 13.003 13.211 13.406 13,591 13.765 13.929 Arithmetic Gradient Gradient Present Worth Find P Given G P/G 0 0.890 2.569 4.945 7.934 Gradient Uniform Series Find A Given G A/G 0 0.485 0.961 1.427 1.884 2.330 2.768 3.195 3.613 4.022 4.421 4.811 5.192 5.564 5.926 6.279 6,624 6.960 7.287 7.605 7.915 8.217 8.510 8.795 9.072 9.341 9,603 9.857 10.103 10.342 10.574 11.459 15.450 19.841 24.577 29.602 34.870 40.337 45.963 51.713 57.554 63.459 69.401 75.357 81.306 87.230 93.113 98.941 104.700 110.381 115.973 10 pts 121.468 126.860 132.142 137.309 142.359 147.286 6% 10 11 12 13 14 15 16 17 18 19 20 21 23 24 25 26 27 28 29 30 31 6% n 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 40 45 50 55 60 65 70 75 80 85 Single Payment Compound Amount Factor Find F Given P F/P 90 95 100 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 1.898 2.012 2.133 2.261 2.397 2.540 2.693 2.854 3.026 3.207 3.400 3.604 3.820 4.049 4.292 4.549 4.822 5.112 5.418 5.743 6.088 6.453 6,841 7.251 7.686 10.286 13.765 18,420 24.650 32.988 44.145 59.076 79.057 105.796 141.578 189.464 253.545 339.300 Present Worth Factor Find P Given F P/F 9434 8900 8396 7921 7473 .7050 .6651 6274 5919 5584 5268 4970 4688 4423 4173 3936 3714 3503 3305 3118 2942 2775 2618 2470 2330 2198 2074 1956 1846 1741 1643 1550 1462 1379 1301 0972 0727 0543 0406 0303 0227 0169 0126 00945 00706 Sinking Fund Factor Find A Given F A/F 1.0000 4854 3141 2286 1774 1434 1191 .1010 0870 0759 0668 0593 0530 0476 0430 0390 0354 0324 0296 0272 ,0250 0230 0213 0197 0182 0169 0157 0146 0136 0126 0118 0110 0103 00960 00897 00646 00470 00344 00254 00188 00139 00103 00077 00057 00043 00528 00032 00394 00024 00295 00018 Compound Interest Factors Uniform Payment Series Capital Recovery Factor Find A Given P A/P 1.0600 5454 3741 2886 2374 2034 1791 1610 1470 1359 1268 1193 1130 1076 1030 0990 0954 0924 0896 087 0850 0830 0813 0797 0782 0769 0757 0746 0736 0726 0718 0710 0703 0696 0690 .0665 0647 0634 0625 .0619 0614 0610 0608 0606 0604 0603 0602 0602 Compound Amount Factor Find F Given A F/A 1.000 2.060 3.184 4.375 5.637 6.975 8.394 9.897 11.491 13.181 14.972 16.870 18.882 21.015 23.276 25.672 28.213 30.906 33.760 36.786 39.993 43.392 46.996 50.815 54.864 59.156 63.706 68.528 73.640 79.058 84.801 90.890 97.343 104.184 111.435 154.762 212.743 290.335 394.171 533.126 719.080 967.928 1300.9 1746.6 2343.0 3141.1 4 209.1 5638.3 Present Worth Factor Find P Given A P/A 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295. 9.712 10.106 10.477 10.828 11.158 11.470 11.764 12.042 12.303. 12.550 12.783 13.003 13.211 13.406 13.591 13.765 13.929 14.084 14.230 14.368 14.498 15.046 15.456 15.762 15.991 16.161 16.289 16.385 16.456 16.509 16.549 16.579 16.601 16.618 Arithmetic Gradient Gradient Present Worth Find P Given G P/G Gradient Uniform Series Find A Given G A/G 0 0.485 0.961 1.427 1.884 2.330 2.768 3.195 3.613 4.022 4.421 4.811 5.192 5.564 5.926 6.279 6.624 6.960 7.287 7.605 7.915 8.217 8.510 8.795 9.072 9.341 9.603 9.857 10.103 10.342 10.574 10.799 11.017 11.228 11.432 12.359 13.141 13.796 14.341 14.791 15.160 15.461 15.706 15.903 16.062 16.189 16.290 16.371 0 0.890 2.569 4.945 7.934 11.459 15.450 19.841 24.577 29.602 34.870 40.337 45.963 51.713 57.554 63.459 69.401 75.357 81.306 87.230 93.113 98.941 104.700 110.381 115.973 121.468 126.860 132.142 137.309 142.359 147.286 152.090 156.768 161.319 165.743 185.957 203.109 217.457 229.322 239.043 246.945 253.327 258.453 262.549 265.810 268.395 270.437 272.047 n 10 11 12 1 2 3 4 5 13 14 15 6 7 8 9 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 34 35 31 32 33 40 45 50 55 60 65 70 75 80 85 90 95 100

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve this stepbystep Initial cost of equipment 45581 There is a 04 probability of annual savin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started