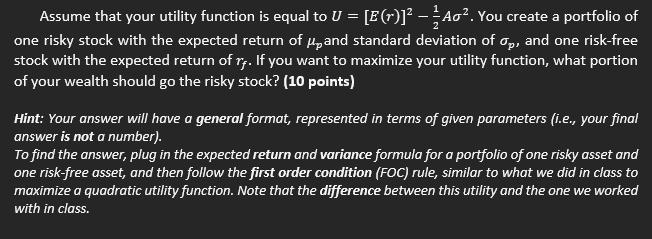

Assume that your utility function is equal to U = [E(r)] - Ao. You create a portfolio of one risky stock with the expected

Assume that your utility function is equal to U = [E(r)] - Ao. You create a portfolio of one risky stock with the expected return of and standard deviation of p, and one risk-free stock with the expected return of rf. If you want to maximize your utility function, what portion of your wealth should go the risky stock? (10 points) Hint: Your answer will have a general format, represented in terms of given parameters (i.e., your final answer is not a number). To find the answer, plug in the expected return and variance formula for a portfolio of one risky asset and one risk-free asset, and then follow the first order condition (FOC) rule, similar to what we did in class to maximize a quadratic utility function. Note that the difference between this utility and the one we worked with in class.

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

U Er A let to be weight of risky stock 1W be weight of riskfree stock Expected r...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started