Answered step by step

Verified Expert Solution

Question

1 Approved Answer

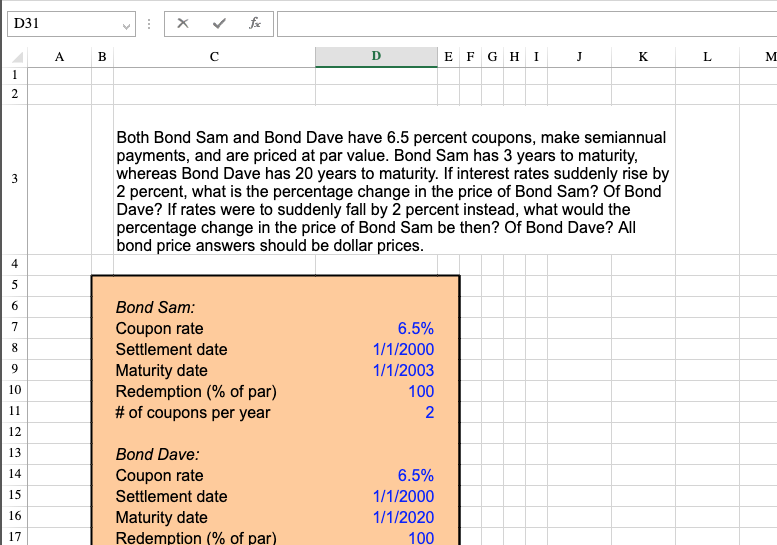

D31 fi A B D E F G H I J K L M 1 2 3 3 Both Bond Sam and Bond Dave have

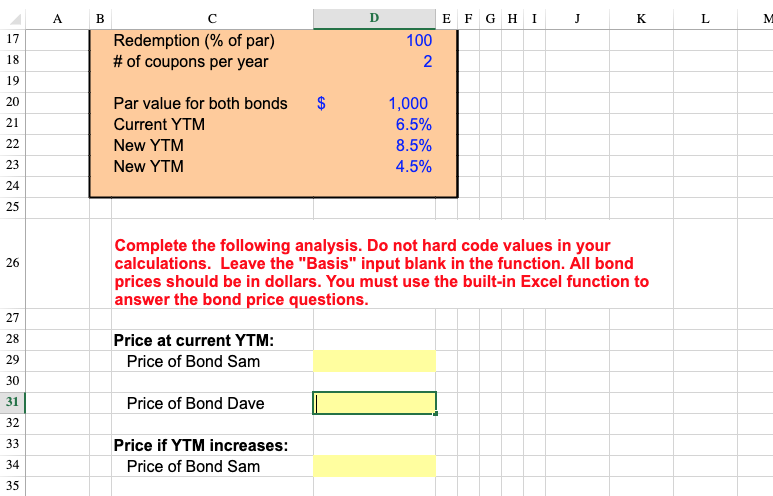

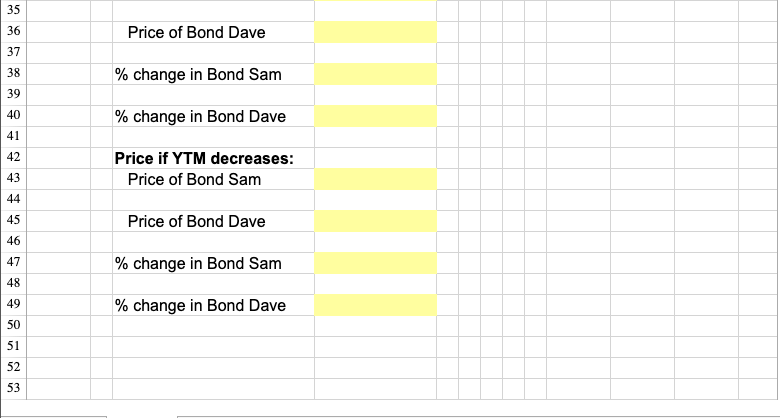

D31 fi A B D E F G H I J K L M 1 2 3 3 Both Bond Sam and Bond Dave have 6.5 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has 3 years to maturity, whereas Bond Dave has 20 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Sam? Of Bond Dave? If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Sam be then? Of Bond Dave? All bond price answers should be dollar prices. 4 5 6 7 8 Bond Sam: Coupon rate Settlement date Maturity date Redemption (% of par) # of coupons per year 9 6.5% 1/1/2000 1/1/2003 100 2 10 11 12 13 14 15 Bond Dave: Coupon rate Settlement date Maturity date Redemption (% of par) 6.5% 1/1/2000 1/1/2020 100 16 17 D J K L M 17 Redemption (% of par) # of coupons per year E F G H I 100 2 18 19 20 $ 21 Par value for both bonds Current YTM New YTM New YTM 1,000 6.5% 8.5% 4.5% 22 23 24 25 26 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. All bond prices should be in dollars. You must use the built-in Excel function to answer the bond price questions. 27 28 Price at current YTM: Price of Bond Sam 29 30 31 Price of Bond Dave 32 33 Price if YTM increases: Price of Bond Sam 34 35 35 36 Price of Bond Dave 37 38 % change in Bond Sam 39 40 % change in Bond Dave 41 42 Price if YTM decreases: Price of Bond Sam 43 44 45 Price of Bond Dave 46 47 % change in Bond Sam 48 49 % change in Bond Dave 50 51 52 53

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started