Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dan and Beth are married and file a joint tax return in 2022. They have AGI of ( $ 50,000 ) and receive ( $

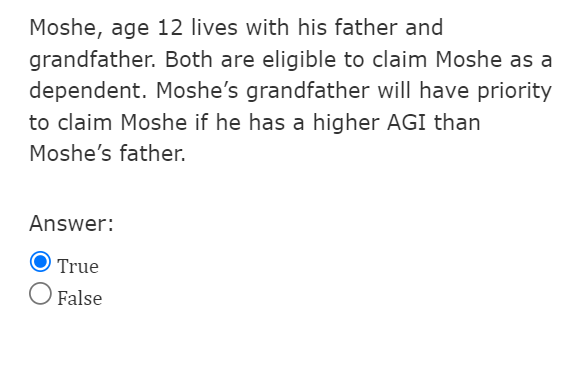

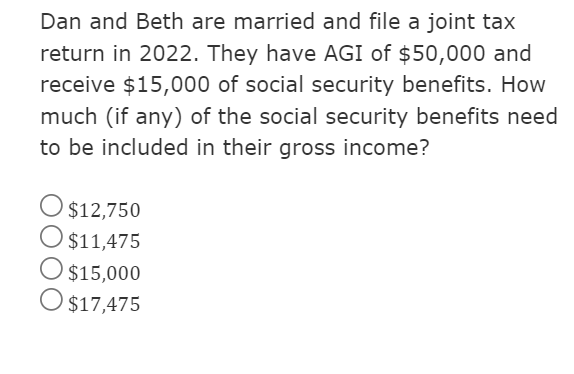

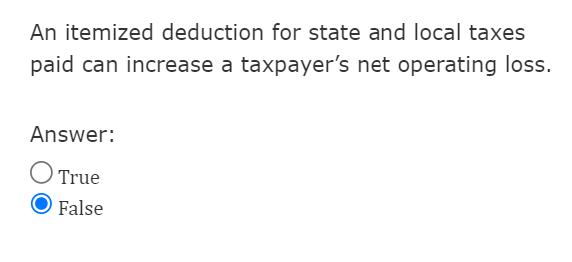

Dan and Beth are married and file a joint tax return in 2022. They have AGI of \\( \\$ 50,000 \\) and receive \\( \\$ 15,000 \\) of social security benefits. How much (if any) of the social security benefits need to be included in their gross income? \\[ \\begin{array}{l} \\$ 12,750 \\\\ \\$ 11,475 \\\\ \\$ 15,000 \\\\ \\$ 17,475 \\end{array} \\] Moshe, age 12 lives with his father and grandfather. Both are eligible to claim Moshe as a dependent. Moshe's grandfather will have priority to claim Moshe if he has a higher AGI than Moshe's father. Answer: True False An itemized deduction for state and local taxes paid can increase a taxpayer's net operating loss. Answer: True False

Dan and Beth are married and file a joint tax return in 2022. They have AGI of \\( \\$ 50,000 \\) and receive \\( \\$ 15,000 \\) of social security benefits. How much (if any) of the social security benefits need to be included in their gross income? \\[ \\begin{array}{l} \\$ 12,750 \\\\ \\$ 11,475 \\\\ \\$ 15,000 \\\\ \\$ 17,475 \\end{array} \\] Moshe, age 12 lives with his father and grandfather. Both are eligible to claim Moshe as a dependent. Moshe's grandfather will have priority to claim Moshe if he has a higher AGI than Moshe's father. Answer: True False An itemized deduction for state and local taxes paid can increase a taxpayer's net operating loss. Answer: True False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started