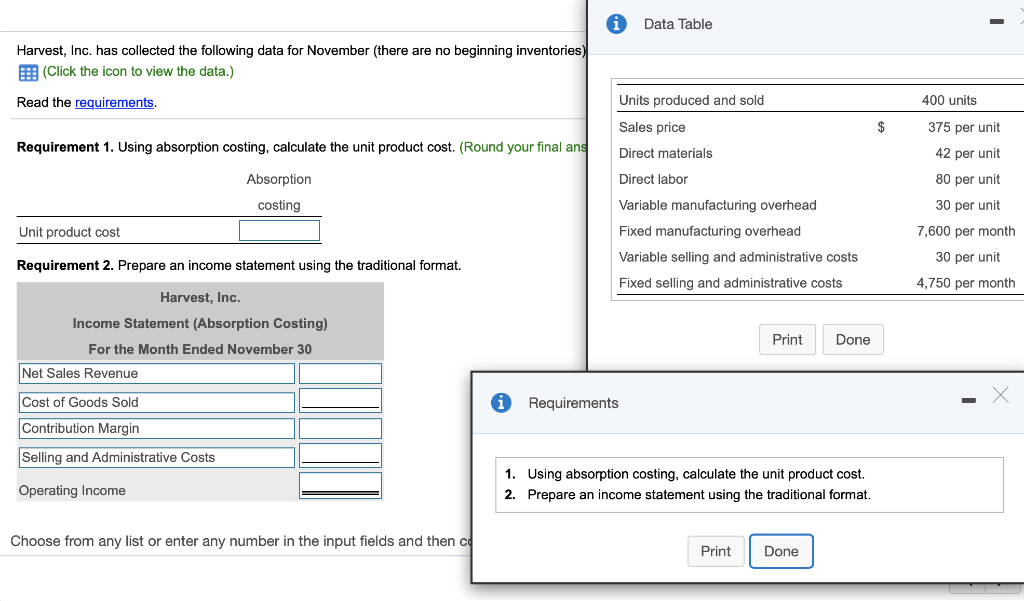

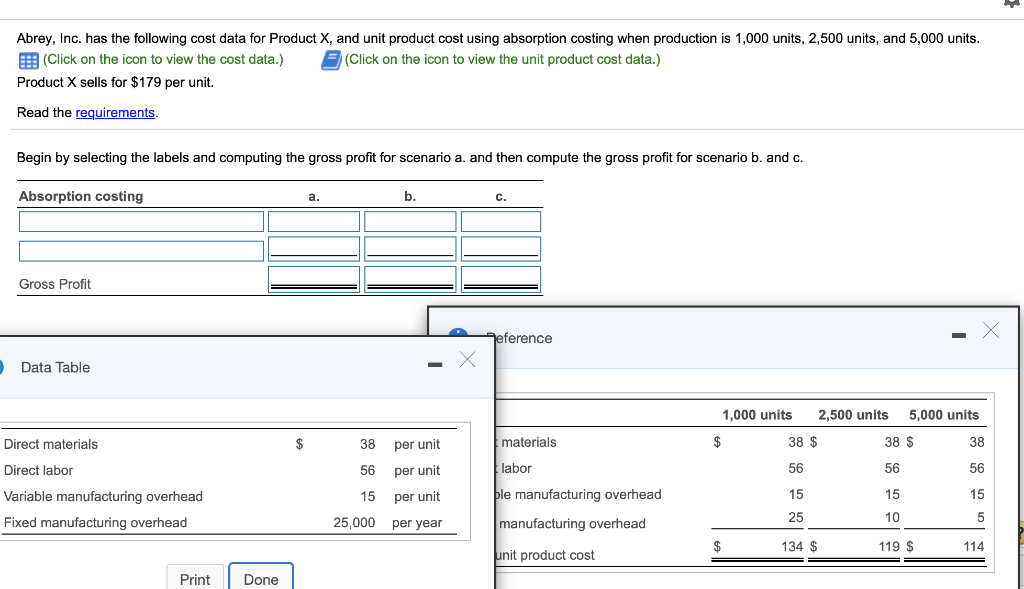

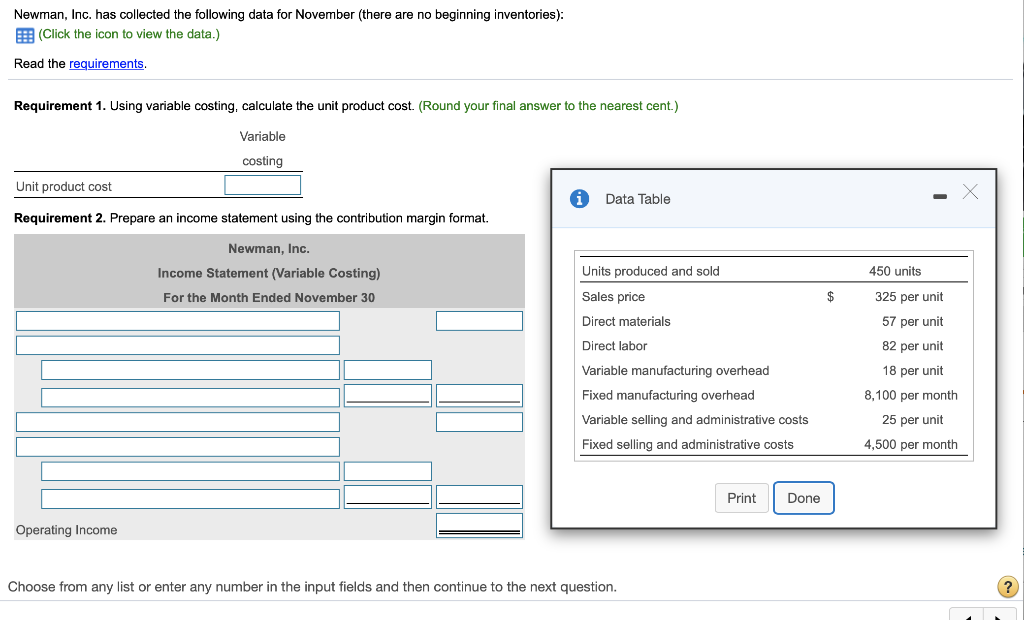

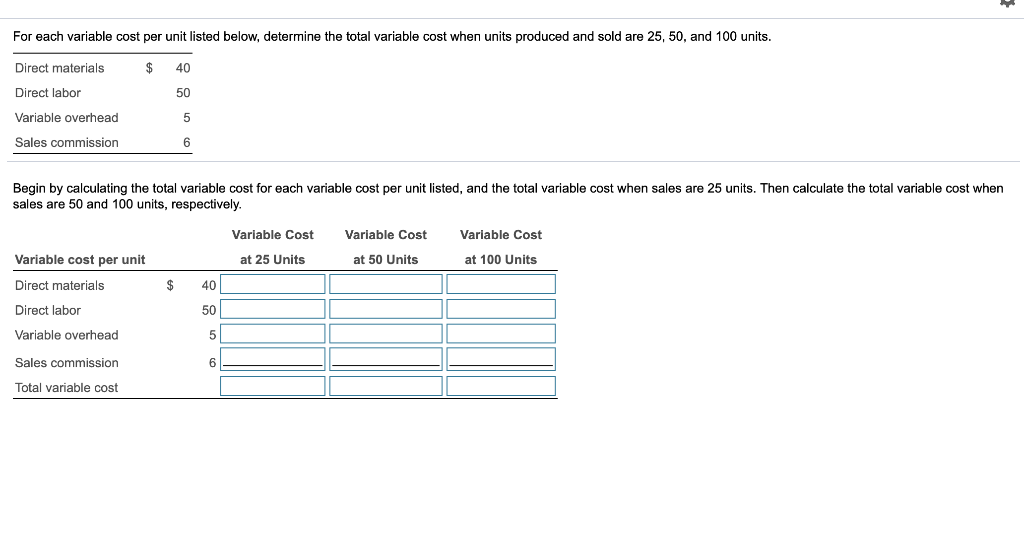

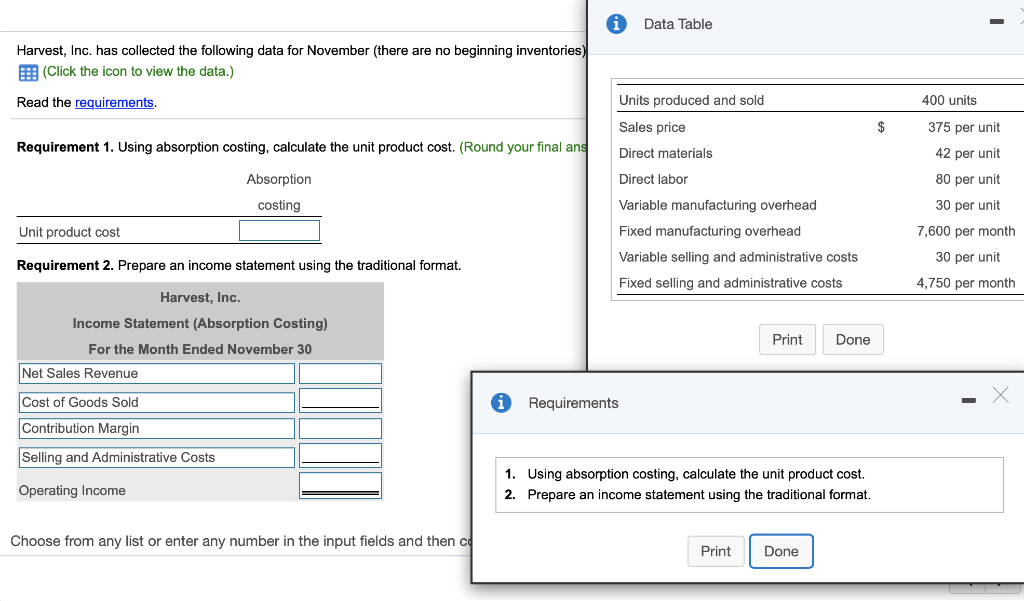

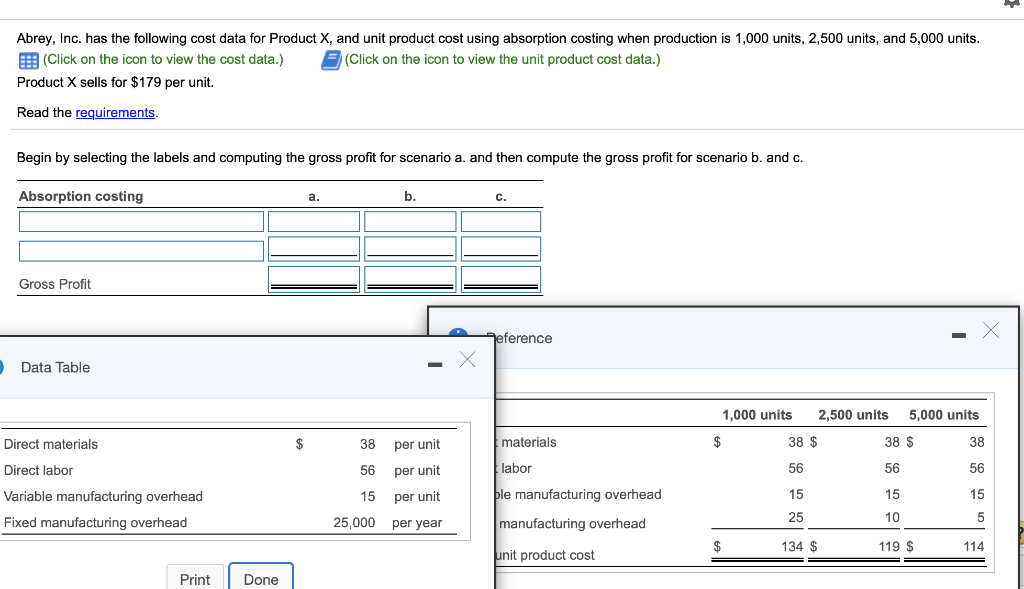

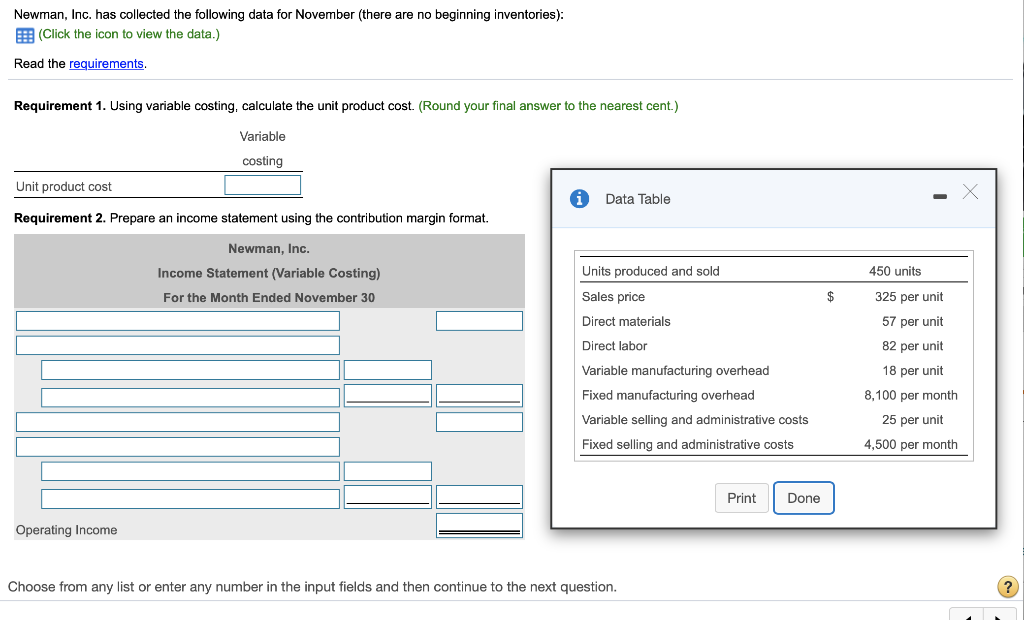

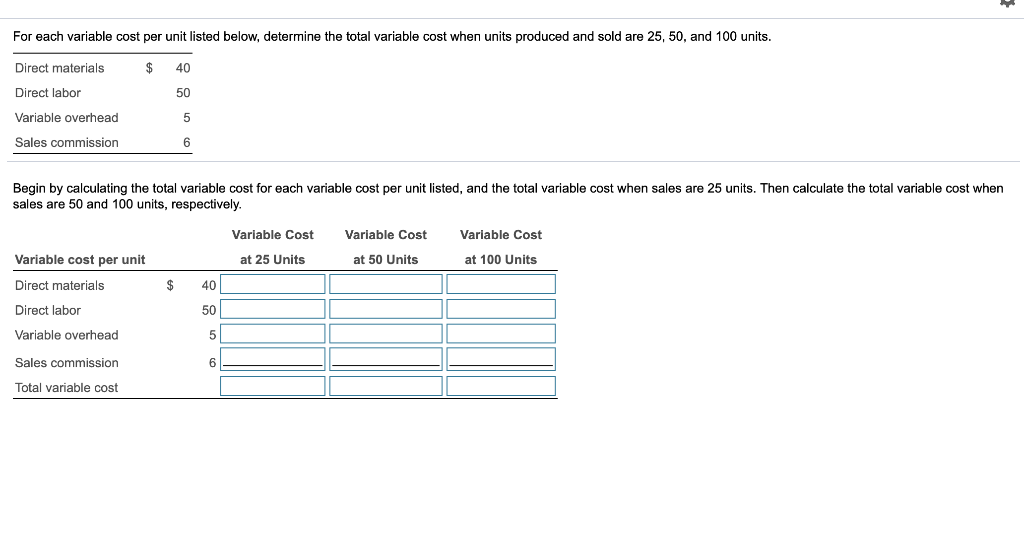

Data Table Harvest, Inc. has collected the following data for November (there are no beginning inventories) E(Click the icon to view the data.) Units produced and sold 400 units Read the requirements. Sales price 375 per unit Requirement 1. Using absorption costing, calculate the unit product cost. (Round your final ans Direct materials 42 per unit Direct labor Absorption 80 per unit Variable manufacturing overhead 30 per unit costing Fixed manufacturing overhead 7,600 per month Unit product cost 30 per unit Variable selling and administrative costs Requirement 2. Prepare an income statement using the traditional format 4,750 per month Fixed selling and administrative costs Harvest, Inc. Income Statement (Absorption Costing) Print Done For the Month Ended November 30 Net Sales Revenue Cost of Goods Sold i Requirements Contribution Margin Selling and Administrative Costs 1. Using absorption costing, calculate the unit product cost. Operating Income 2. Prepare an income statement using the traditional format. Choose from any list or enter any number in the input fields and then c Print Done Abrey, Inc. has the following cost data for Product X, and unit product cost using absorption costing when production is 1,000 units, 2,500 units, and 5,000 units. B(Click on the icon to view the cost data.) (Click on the icon to view the unit product cost data.) Product X sells $179 per unit. Read the requirements. Begin by selecting the labels and computing the gross profit for scenario a. and then compute the gross profit for scenario b. and c. Absorption costing a. C. Gross Profit eference Data Table 2,500 units 5,000 units 1,000 units materials 38 $ 38 $ 38 Direct materials $ 38 per unit 56 56 labor 56 Direct labor 56 per unit ble manufacturing overhead 15 15 15 Variable manufacturing overhead 15 per unit 25 10 5 manufacturing overhead Fixed manufacturing overhead 25,000 per year $ 134 119 114 unit product cost Print Done Newman, Inc. has collected the following data for November (there are no beginning inventories) EEB(Click the icon to view the data.) Read the requirements. Requirement 1. Using variable costing, calcu late the unit product cost. (Round your final answer to the nearest cent.) Variable costing Unit product cost i Data Table Requirement 2. Prepare an income statement using the contribution margin format Newman, Inc Units produced and sold 450 units Income Statement (Variable Costing) Sales price For the Month Ended November 30 325 per unit Direct materials 57 per unit Direct labor 82 per unit 18 per unit Variable manufacturing overhead Fixed manufacturing overhead 8,100 per month 25 per unit Variable selling and administrative costs 4,500 per month Fixed selling and administrative costs Print Done Operating Income Choose from any list or enter any number in the input fields and then continue to the next question. For each variable cost per unit listed below, determine the total variable cost when units produced and sold are 25, 50, and 100 units. Direct materials 40 Direct labor 50 Variable overhead 5 Sales commission 6 Begin by calculating the total variable cost for each variable cost per unit listed, and the total variable cost when sales are 25 units. Then calculate the total variable cost when sales are 50 and 100 units, respectively. Variable Cost Variable Cost Variable Cost Variable cost per unit at 25 Units at 50 Units at 100 Units Direct materials 40 Direct labor 50 Variable overhead 5 Sales commission 6 Total variable cost