Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Davis, an officer for a $501 (c)(3) organization, receives benefits in the form of an overly generous health insurance plan; these benefits are inappropriate in

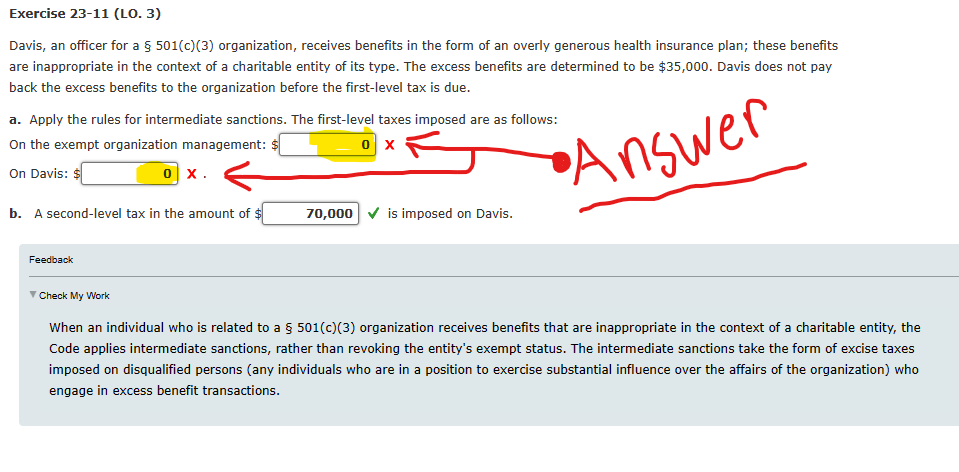

Davis, an officer for a $501 (c)(3) organization, receives benefits in the form of an overly generous health insurance plan; these benefits are inappropriate in the context of a charitable entity of its type. The excess benefits are determined to be $35,000. Davis does not pay back the excess benefits to the organization before the first-level tax is due. a. Apply the rules for intermediate sanctions. The first-level taxes imposed are as follows: On the exempt organization management: $ On Davis: \$ X. x ngwer b. A second-level tax in the amount of $ is imposed on Davis. Feedback Check My Work When an individual who is related to a 501(c)(3) organization receives benefits that are inappropriate in the context of a charitable entity, the Code applies intermediate sanctions, rather than revoking the entity's exempt status. The intermediate sanctions take the form of excise taxes imposed on disqualified persons (any individuals who are in a position to exercise substantial influence over the affairs of the organization) who engage in excess benefit transactions

Davis, an officer for a $501 (c)(3) organization, receives benefits in the form of an overly generous health insurance plan; these benefits are inappropriate in the context of a charitable entity of its type. The excess benefits are determined to be $35,000. Davis does not pay back the excess benefits to the organization before the first-level tax is due. a. Apply the rules for intermediate sanctions. The first-level taxes imposed are as follows: On the exempt organization management: $ On Davis: \$ X. x ngwer b. A second-level tax in the amount of $ is imposed on Davis. Feedback Check My Work When an individual who is related to a 501(c)(3) organization receives benefits that are inappropriate in the context of a charitable entity, the Code applies intermediate sanctions, rather than revoking the entity's exempt status. The intermediate sanctions take the form of excise taxes imposed on disqualified persons (any individuals who are in a position to exercise substantial influence over the affairs of the organization) who engage in excess benefit transactions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started