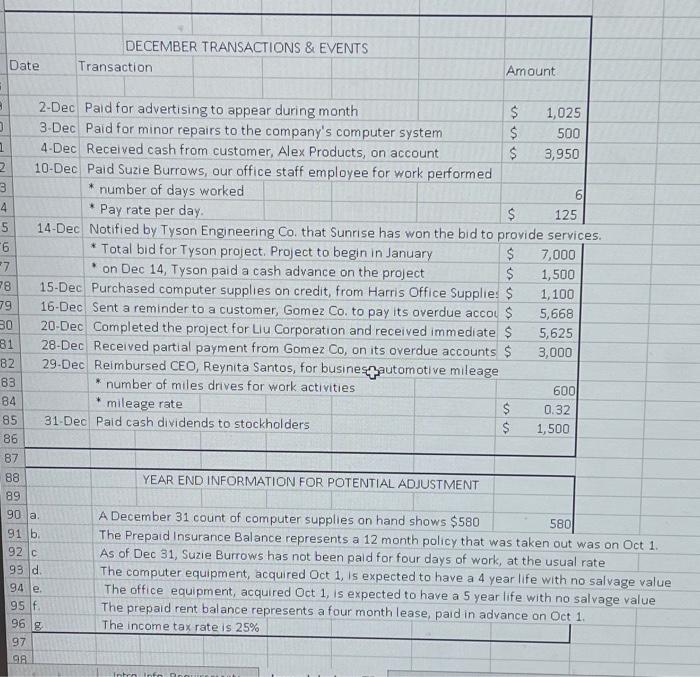

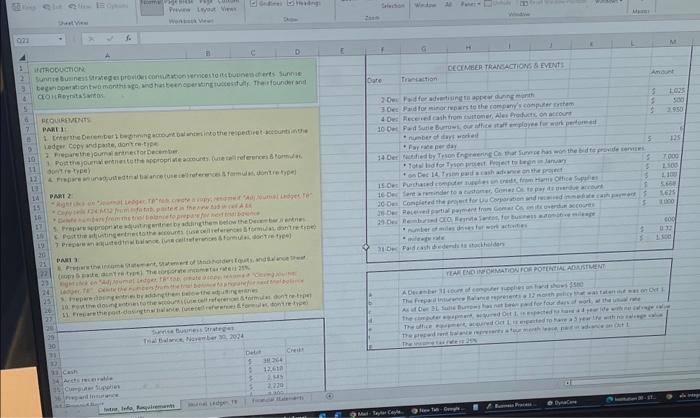

DECEMBER TRANSACTIONS \& EVENTS Date Transaction Amount 2-Dec Paid for advertising to appear during month 3-Dec Paid for minor repairs to the company's computer system 4-Dec Recelved cash from customer, Alex Products, on account 10-Dec Paid Suzie Burrows, our office staff employee for work performed * number of days worked * Pay rate per day. $$$$1,0255003,9506125 14-Dec Notified by Tyson Engineering Co. that Sunrise has won the bid to provide services. * Total bid for Tyson project. Project to begin in January - on Dec 14, Tyson paid a cash advance on the project 15-Dec Purchased computer supplies on credit, from Harris Office Supplie: $1,100 16-Dec Sent a reminder to a customer, Gomez Co. to pay its overdue accot $5,668 20-Dec Completed the project for Liu Corporation and received immediate $5,625 28-Dec Received partial payment from Gomez C0, on its overdue accounts $3,000 29-Dec Reimbursed CEO, Reynita Santos, for busineatomotive mileage * number of miles drives for work activities * mileage rate 31-Dec Paid cash dividends to stockholders \begin{tabular}{rr} $ & 7,000 \\ $ & 1,500 \\ $ & 1,100 \\ $ & 5,668 \\ $ & 5,625 \\ $ & 3,000 \\ & \\ $ & 600 \\ $ & 0.32 \\ $ & 1,500 \\ \hline \end{tabular} YEAR END INFORMATION FOR POTENTIAL ADJUSTMENT A December 31 count of computer supplies on hand shows $580 The Prepaid Insurance Balance represents a 12 month policy that was taken out was on Oct 1. As of Dec 31, Suzie Burrows has not been paid for four days of work, at the usual rate The computer equipment, acquired Oct 1 , is expected to have a 4 year life with no salvage value The office equipment, acquired Oct 1 , is expected to have a 5 year life with no salvage value The prepaid rent balance represents a four month lease, paid in advance on Oct 1. The income tax rate is 25% DECEMBER TRANSACTIONS \& EVENTS Date Transaction Amount 2-Dec Paid for advertising to appear during month 3-Dec Paid for minor repairs to the company's computer system 4-Dec Recelved cash from customer, Alex Products, on account 10-Dec Paid Suzie Burrows, our office staff employee for work performed * number of days worked * Pay rate per day. $$$$1,0255003,9506125 14-Dec Notified by Tyson Engineering Co. that Sunrise has won the bid to provide services. * Total bid for Tyson project. Project to begin in January - on Dec 14, Tyson paid a cash advance on the project 15-Dec Purchased computer supplies on credit, from Harris Office Supplie: $1,100 16-Dec Sent a reminder to a customer, Gomez Co. to pay its overdue accot $5,668 20-Dec Completed the project for Liu Corporation and received immediate $5,625 28-Dec Received partial payment from Gomez C0, on its overdue accounts $3,000 29-Dec Reimbursed CEO, Reynita Santos, for busineatomotive mileage * number of miles drives for work activities * mileage rate 31-Dec Paid cash dividends to stockholders \begin{tabular}{rr} $ & 7,000 \\ $ & 1,500 \\ $ & 1,100 \\ $ & 5,668 \\ $ & 5,625 \\ $ & 3,000 \\ & \\ $ & 600 \\ $ & 0.32 \\ $ & 1,500 \\ \hline \end{tabular} YEAR END INFORMATION FOR POTENTIAL ADJUSTMENT A December 31 count of computer supplies on hand shows $580 The Prepaid Insurance Balance represents a 12 month policy that was taken out was on Oct 1. As of Dec 31, Suzie Burrows has not been paid for four days of work, at the usual rate The computer equipment, acquired Oct 1 , is expected to have a 4 year life with no salvage value The office equipment, acquired Oct 1 , is expected to have a 5 year life with no salvage value The prepaid rent balance represents a four month lease, paid in advance on Oct 1. The income tax rate is 25%