Question: Decide if each transaction requires the journal entry or not. If needed, please show the journal entry in detail Mar 1 1 2 2 32

Decide if each transaction requires the journal entry or not. If needed, please show the journal entry in detail

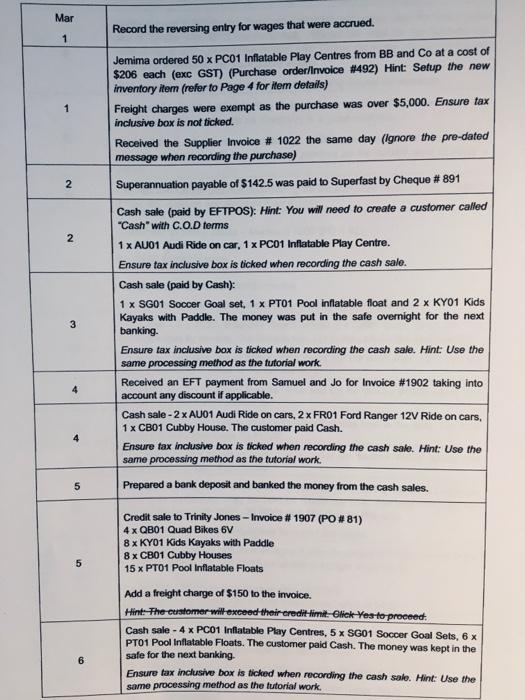

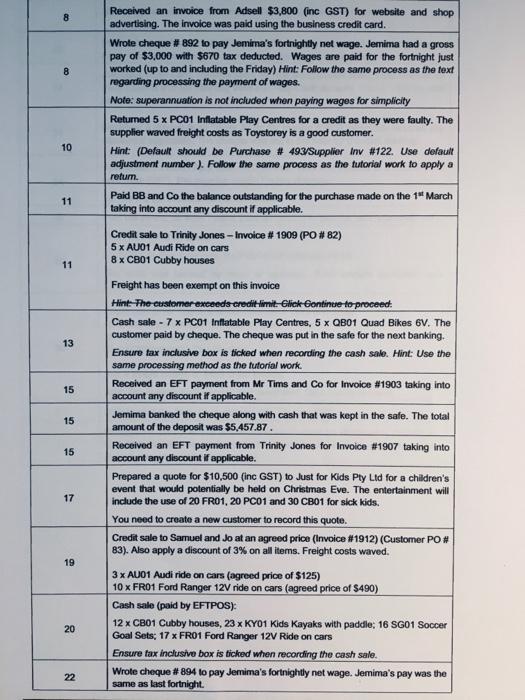

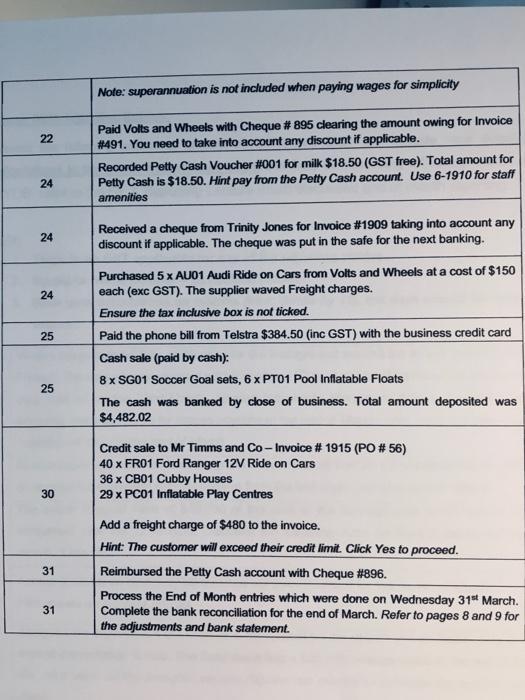

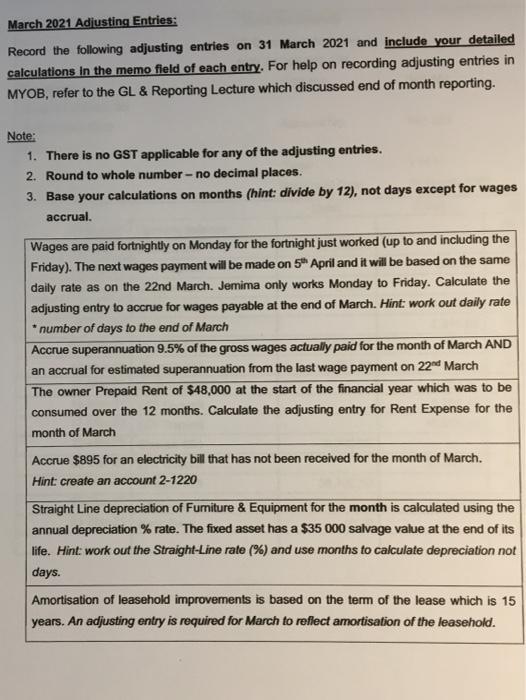

Mar 1 1 2 2 32 4 4 5 5 6 Record the reversing entry for wages that were accrued. Jemima ordered 50 x PC01 Inflatable Play Centres from BB and Co at a cost of $206 each (exc GST) (Purchase order/Invoice #492) Hint: Setup the new inventory item (refer to Page 4 for item details) Freight charges were exempt as the purchase was over $5,000. Ensure tax inclusive box is not ticked. Received the Supplier Invoice # 1022 the same day (Ignore the pre-dated message when recording the purchase) Superannuation payable of $142.5 was paid to Superfast by Cheque # 891 Cash sale (paid by EFTPOS): Hint: You will need to create a customer called "Cash" with C.O.D terms 1 x AU01 Audi Ride on car, 1 x PC01 Inflatable Play Centre. Ensure tax inclusive box is ticked when recording the cash sale. Cash sale (paid by Cash): 1 x SG01 Soccer Goal set, 1 x PT01 Pool inflatable float and 2 x KY01 Kids Kayaks with Paddle. The money was put in the safe overnight for the next banking. Ensure tax inclusive box is ticked when recording the cash sale. Hint: Use the same processing method as the tutorial work. Received an EFT payment from Samuel and Jo for Invoice # 1902 taking into account any discount if applicable. Cash sale - 2 x AU01 Audi Ride on cars, 2 x FR01 Ford Ranger 12V Ride on cars, 1 x CB01 Cubby House. The customer paid Cash. Ensure tax inclusive box is ticked when recording the cash sale. Hint: Use the same processing method as the tutorial work. Prepared a bank deposit and banked the money from the cash sales. Credit sale to Trinity Jones-Invoice # 1907 (PO # 81) 4 x QB01 Quad Bikes 6V 8 x KY01 Kids Kayaks with Paddle 8 x CB01 Cubby Houses 15 x PT01 Pool Inflatable Floats Add a freight charge of $150 to the invoice. Hint: The customer will exceed their credit limit-Click-Yes to proceed. Cash sale - 4 x PC01 Inflatable Play Centres, 5 x SG01 Soccer Goal Sets, 6 x PT01 Pool Inflatable Floats. The customer paid Cash. The money was kept in the safe for the next banking. Ensure tax inclusive box is ticked when recording the cash sale. Hint: Use the same processing method as the tutorial work.

Step by Step Solution

There are 3 Steps involved in it

Journal entries are the very first s... View full answer

Get step-by-step solutions from verified subject matter experts