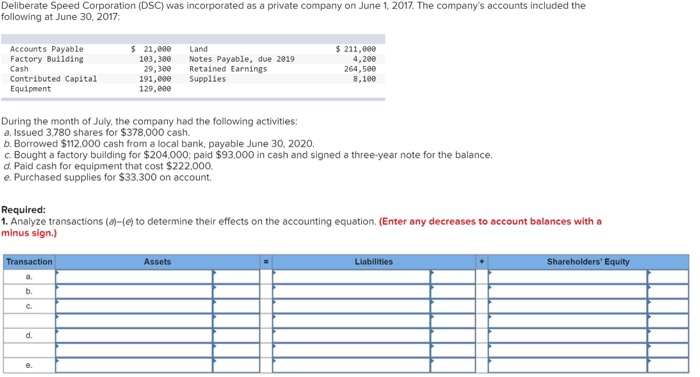

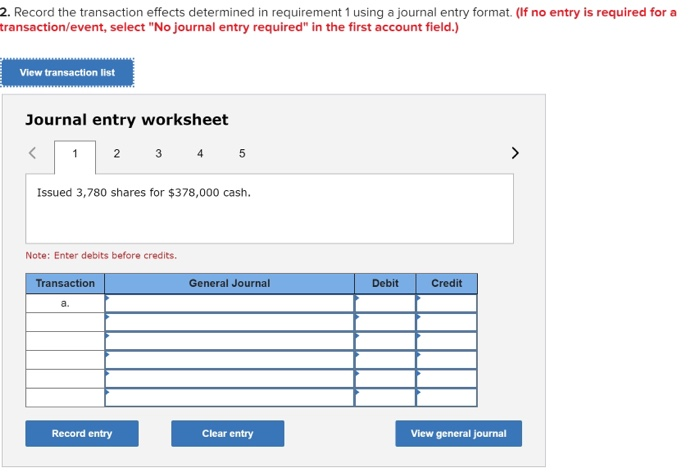

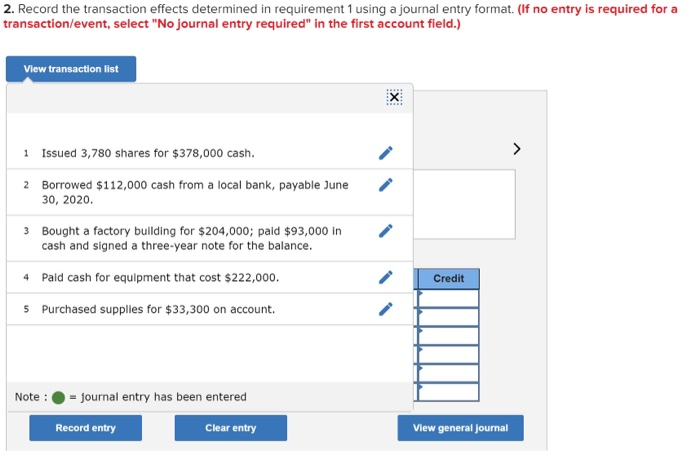

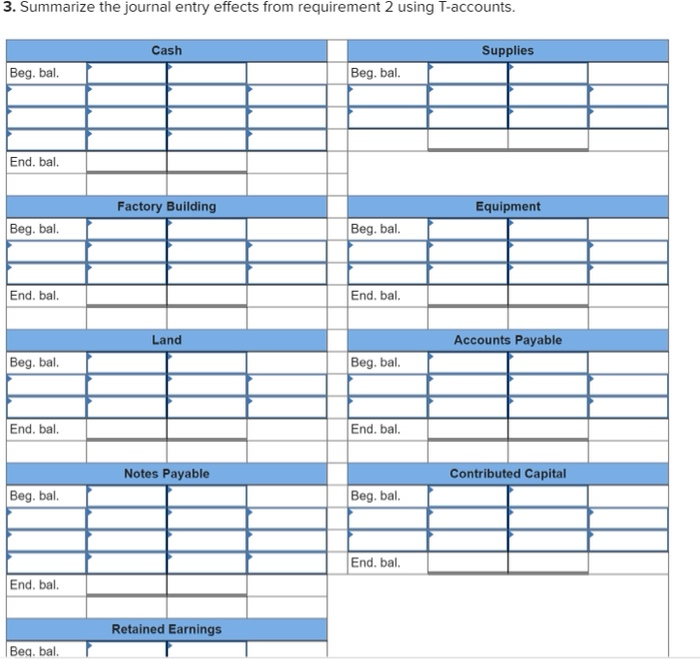

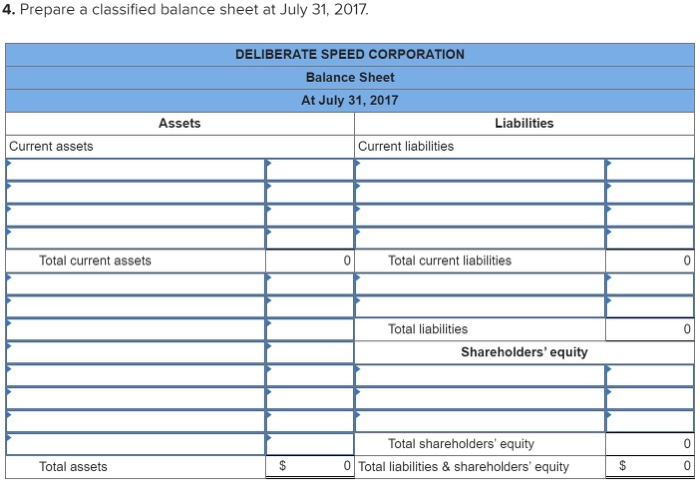

Deliberate Speed Corporation (DSC) was incorporated as a private company on June 1, 2017. The company's accounts included the following at June 30, 2017: Accounts Payable Factory Building Cash Contributed Capital Equipment $21,800 103,300 29, 300 191,00 129, eee Land Notes Payable, due 2019 Retained Earnings Supplies $ 211,000 4,200 264,500 8,100 During the month of July, the company had the following activities: a. Issued 3,780 shares for $378,000 cash. b. Borrowed $112.000 cash from a local bank, payable June 30, 2020. Bought a factory building for $204.000; paid $93,000 in cash and signed a three-year note for the balance. d. Paid cash for equipment that cost $222,000. e. Purchased supplies for $33,300 on account. Required: 1. Analyze transactions (a)(e) to determine their effects on the accounting equation (Enter any decreases to account balances with a minus sign.) Transaction Assets Liabilities Shareholders' Equity b. d. e. 2. Record the transaction effects determined in requirement 1 using a journal entry format. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Issued 3,780 shares for $378,000 cash. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal 2. Record the transaction effects determined in requirement 1 using a journal entry format. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list x > 1 Issued 3,780 shares for $378,000 cash. 2 Borrowed $112,000 cash from a local bank, payable June 30, 2020. 3 Bought a factory building for $204,000; paid $93,000 in cash and signed a three-year note for the balance. Credit 4 Paid cash for equipment that cost $222,000. 5 Purchased supplies for $33,300 on account Note : journal entry has been entered Record entry Clear entry View general Journal 3. Summarize the journal entry effects from requirement 2 using T-accounts. Cash Supplies Beg. bal. Beg. bal. End. bal. Factory Building Equipment Beg. bal. Beg. bal. End, bal. End. bal. Land Accounts Payable Beg. bal. Beg. bal. End. bal. End. bal. Notes Payable Contributed Capital Beg. bal. Beg, bal. End. bal. End. bal. Retained Earnings Beg. bal. 4. Prepare a classified balance sheet at July 31, 2017 DELIBERATE SPEED CORPORATION Balance Sheet At July 31, 2017 Assets Liabilities Current assets Current liabilities Total current assets 0 Total current liabilities 0 Total liabilities Shareholders' equity 0 Total shareholders' equity 0 Total liabilities & shareholders' equity Total assets $ $ 0 5. As of July 31, 2017, has the financing for DSC's investment in assets primarily come from liabilities or from shareholders' equity? Shareholders' equity Liabilities