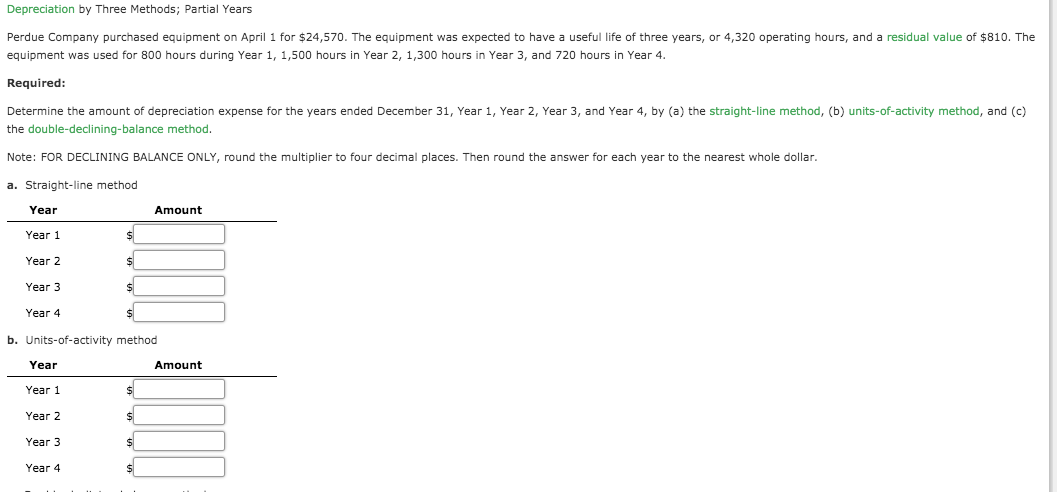

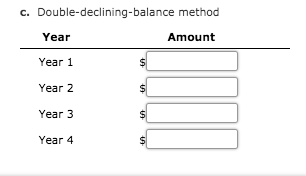

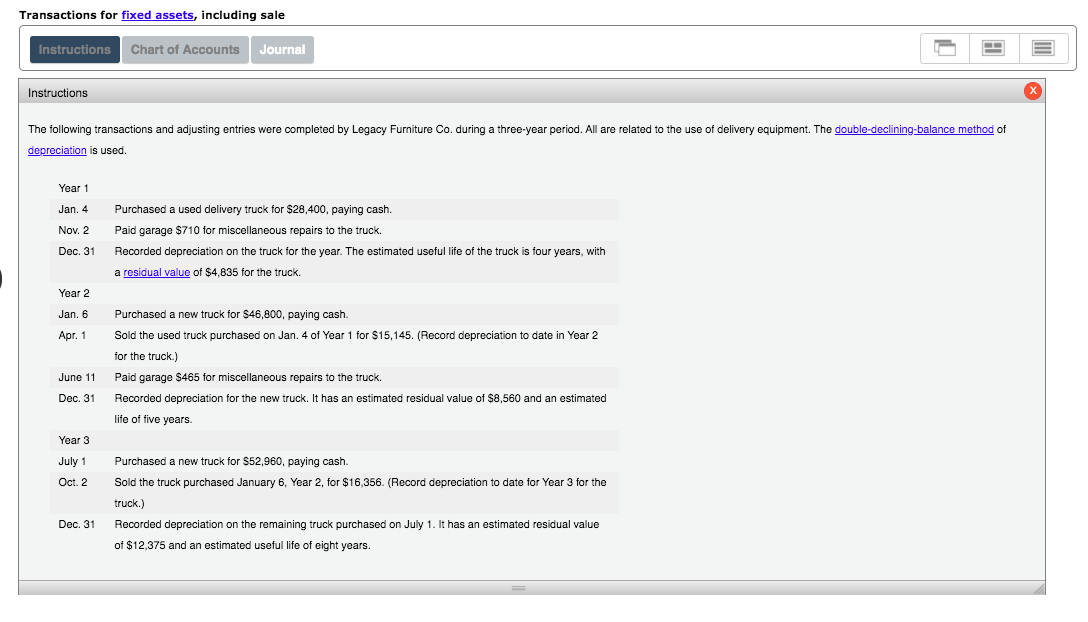

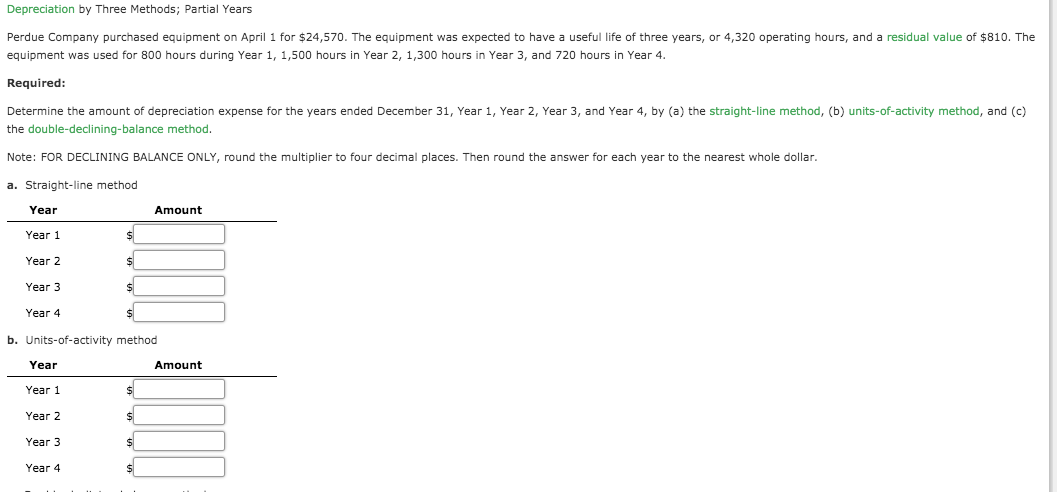

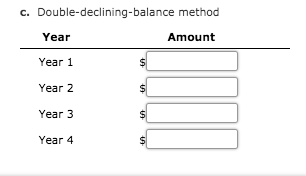

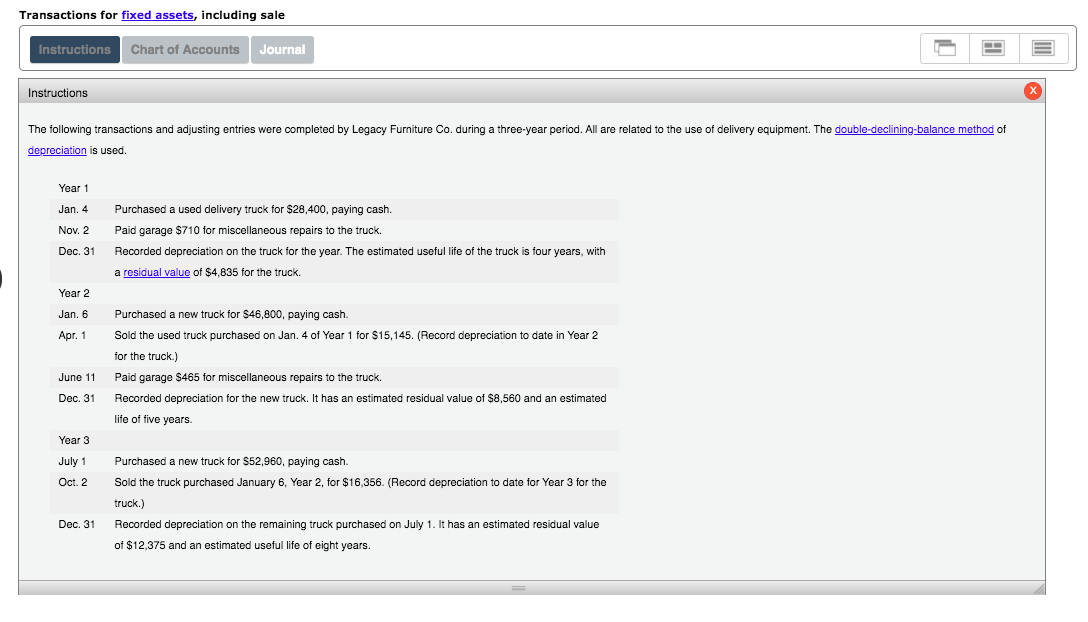

Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on April 1 for $24,570. The equipment was expected to have a useful life of three years, or 4,320 operating hours, and a residual value of $810. The equipment was used for 800 hours during Year 1, 1,500 hours in Year 2, 1,300 hours in Year 3, and 720 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) units-of-activity method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar a. Straight-line method Year Amount Year 1 Year 2 Year 3 Year 4 b. Units-of-activity method Year Amount Year 1 Year 2 Year 3 Year 4 c. Double-declining-balance method Year Amount Year 1 Year 2 Year 3 Year 4 Transactions for fixed assets, including sale Instructions Chart of Accounts Journal Instructions The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4 Nov. 2 Dec. 31 Purchased a used delivery truck for $28,400, paying cash. Paid garage $710 for miscellaneous repairs to the truck. Recorded depreciation on the truck for the year. The estimated useful life of the truck is four years, with a residual value of $4,835 for the truck. Year 2 Jan. 6 Apr. 1 Purchased a new truck for $46,800, paying cash. Sold the used truck purchased on Jan. 4 of Year 1 for $15,145. (Record depreciation to date in Year 2 for the truck.) Paid garage $465 for miscellaneous repairs to the truck. Recorded depreciation for the new truck. It has an estimated residual value of $8,560 and an estimated life of five years. June 11 Dec. 31 Year 3 July 1 Oct 2 Purchased a new truck for $52,960, paying cash Sold the truck purchased January 6, Year 2, for $16,356. (Record depreciation to date for Year 3 for the truck.) Recorded depreciation on the remaining truck purchased on July 1. It has an estimated residual value of $12,375 and an estimated useful life of eight years. Dec. 31