Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine Cost of Good Sold and Ending Inventory using LIFO and FIFO method Date Jan. 1 Beginning inventory Jan. 11 Sales Jan. 15 Purchase Jan.

Determine Cost of Good Sold and Ending Inventory using LIFO and FIFO method

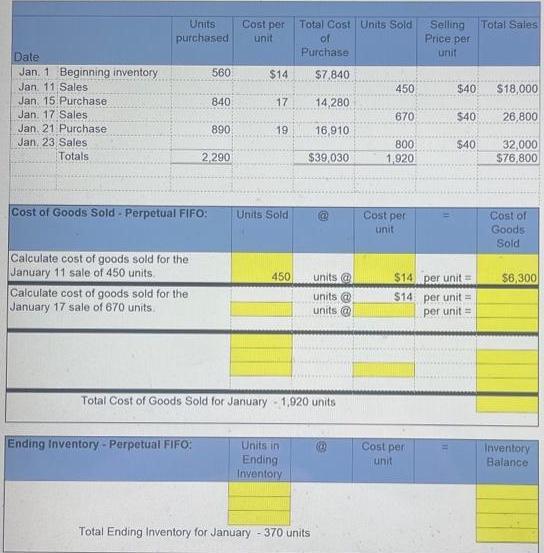

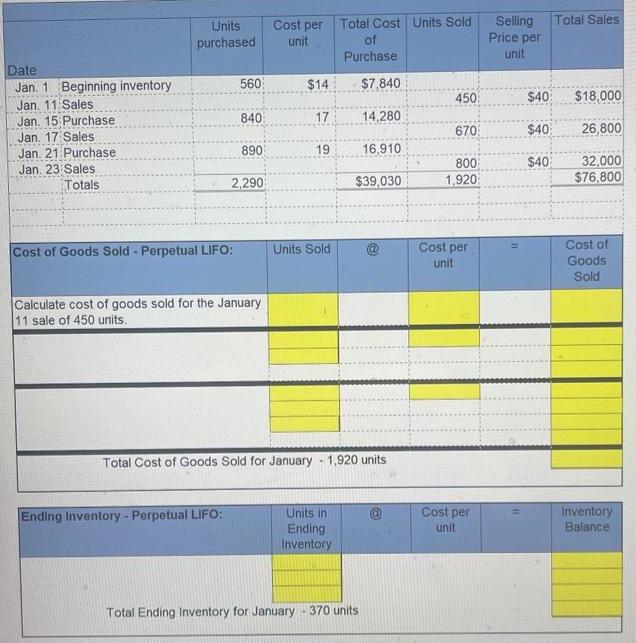

Date Jan. 1 Beginning inventory Jan. 11 Sales Jan. 15 Purchase Jan. 17 Sales Jan. 21 Purchase Jan. 23 Sales Totals Units purchased Cost of Goods Sold Perpetual FIFO: Calculate cost of goods sold for the January 11 sale of 450 units. Calculate cost of goods sold for the January 17 sale of 670 units. 560 Ending Inventory-Perpetual FIFO: 840 890 2,290 Cost per unit Total Cost Units Sold of Purchase $14 $7,840 17 19 Units Sold 450 Units in Ending Inventory. 14,280 16,910 $39,030 Total Cost of Goods Sold for January - 1,920 units Total Ending Inventory for January - 370 units units @ units @ units @ 450 670 800 1,920 Cost per unit Selling Price per unit Cost per unit $40 $40 $40 $14 per unit = $14 per unit = per unit = Total Sales www $18,000 26,800 32,000 $76,800 Cost of Goods Sold $6,300 Inventory Balance

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Cost of Goods Sold COGS and Ending Inventory using both the FIFO FirstIn FirstOut and LIFO LastIn FirstOut methods well analyze the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started