Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harvest Company has the following December 31 General Ledger Account Balances after adjustments relating to Sales and Receivables: Sales $23,250 (of which 40% are

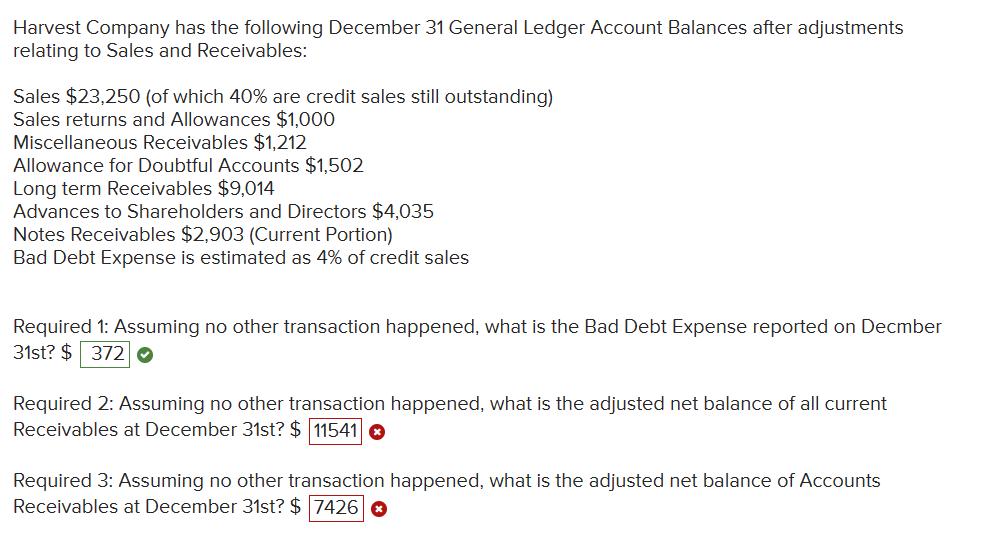

Harvest Company has the following December 31 General Ledger Account Balances after adjustments relating to Sales and Receivables: Sales $23,250 (of which 40% are credit sales still outstanding) Sales returns and Allowances $1,000 Miscellaneous Receivables $1,212 Allowance for Doubtful Accounts $1,502 Long term Receivables $9,014 Advances to Shareholders and Directors $4,035 Notes Receivables $2,903 (Current Portion) Bad Debt Expense is estimated as 4% of credit sales Required 1: Assuming no other transaction happened, what is the Bad Debt Expense reported on Decmber 31st? $372 Required 2: Assuming no other transaction happened, what is the adjusted net balance of all current Receivables at December 31st? $ 11541 Required 3: Assuming no other transaction happened, what is the adjusted net balance of Accounts Receivables at December 31st? $ 7426

Step by Step Solution

★★★★★

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Required 1 To calculate the Bad Debt Expense we need to determine the amount of credit sales that ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started