Answered step by step

Verified Expert Solution

Question

1 Approved Answer

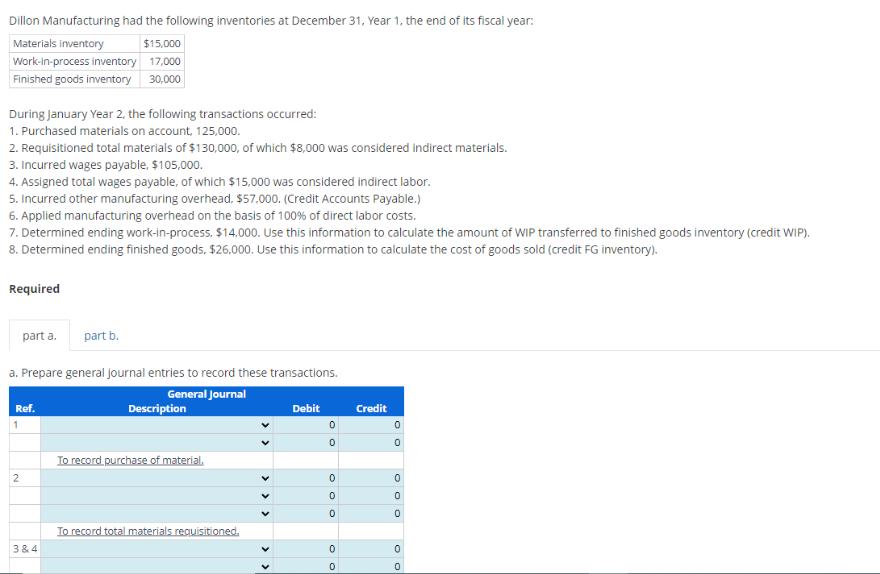

Dillon Manufacturing had the following inventories at December 31, Year 1, the end of its fiscal year: Materials inventory $15,000 Work-in-process inventory 17,000 Finished

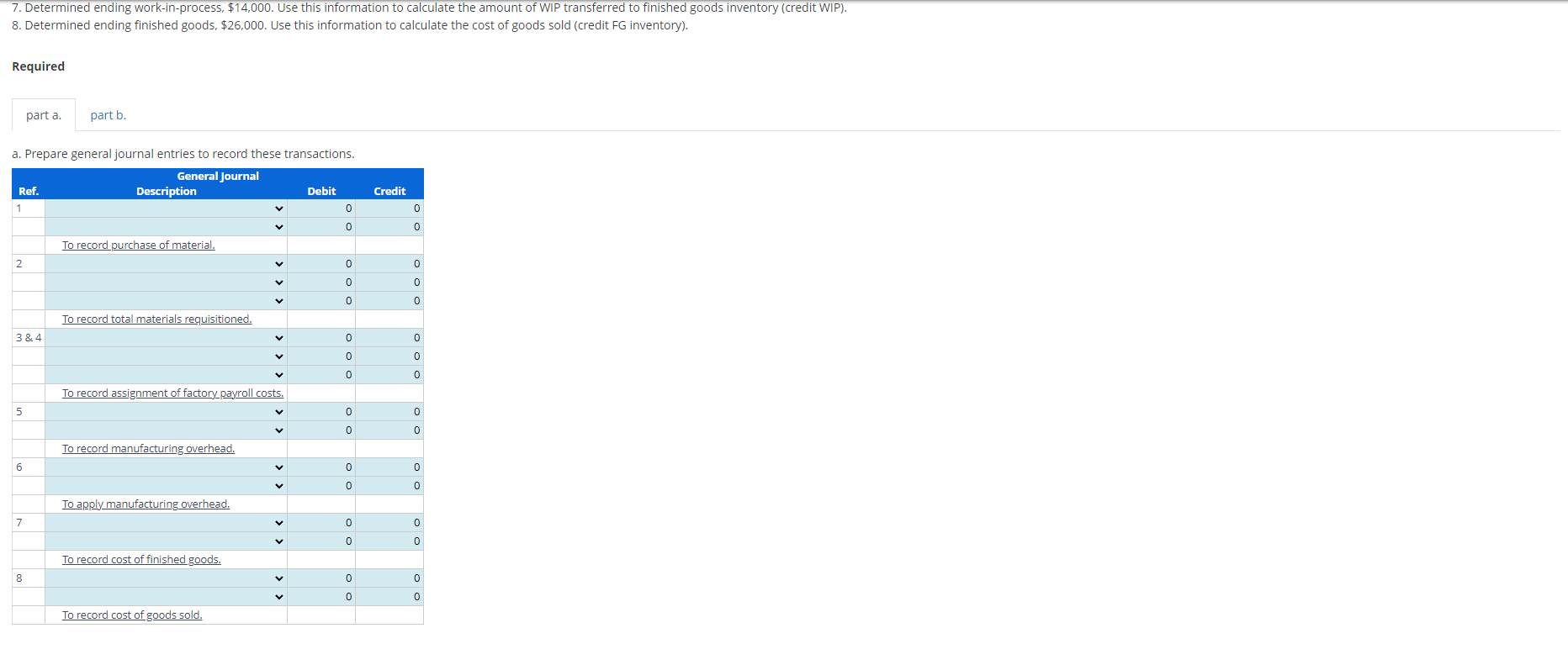

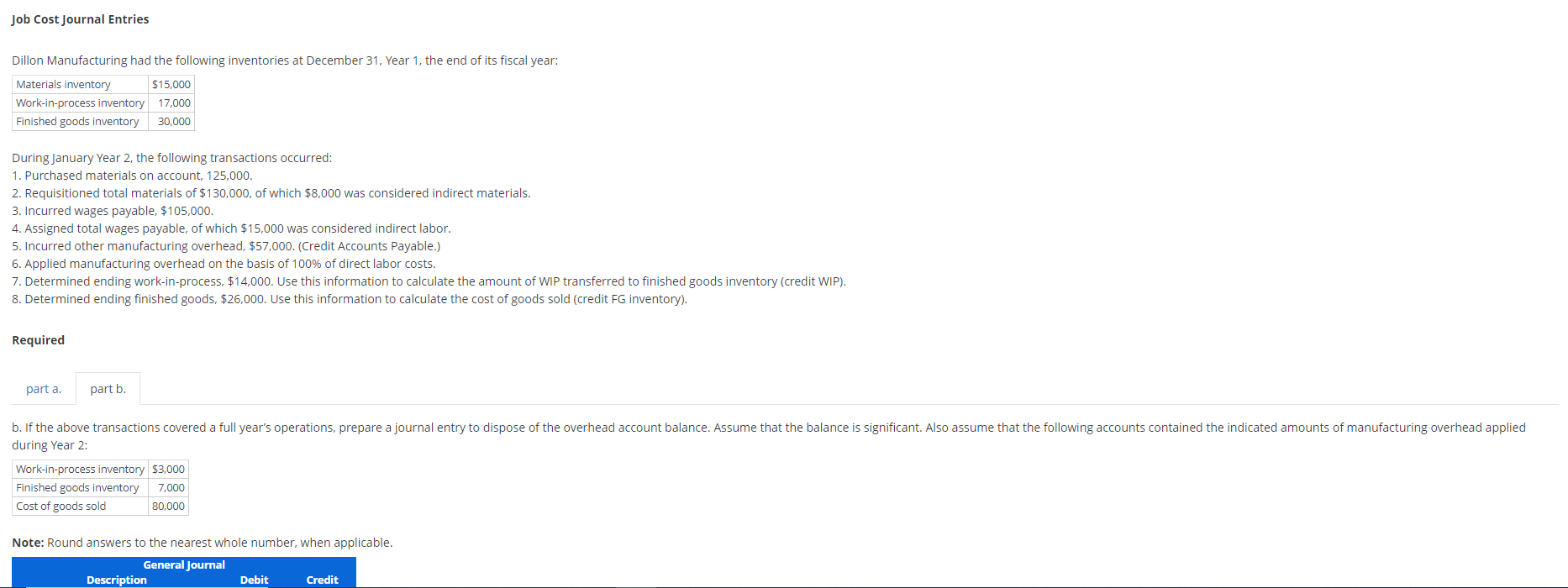

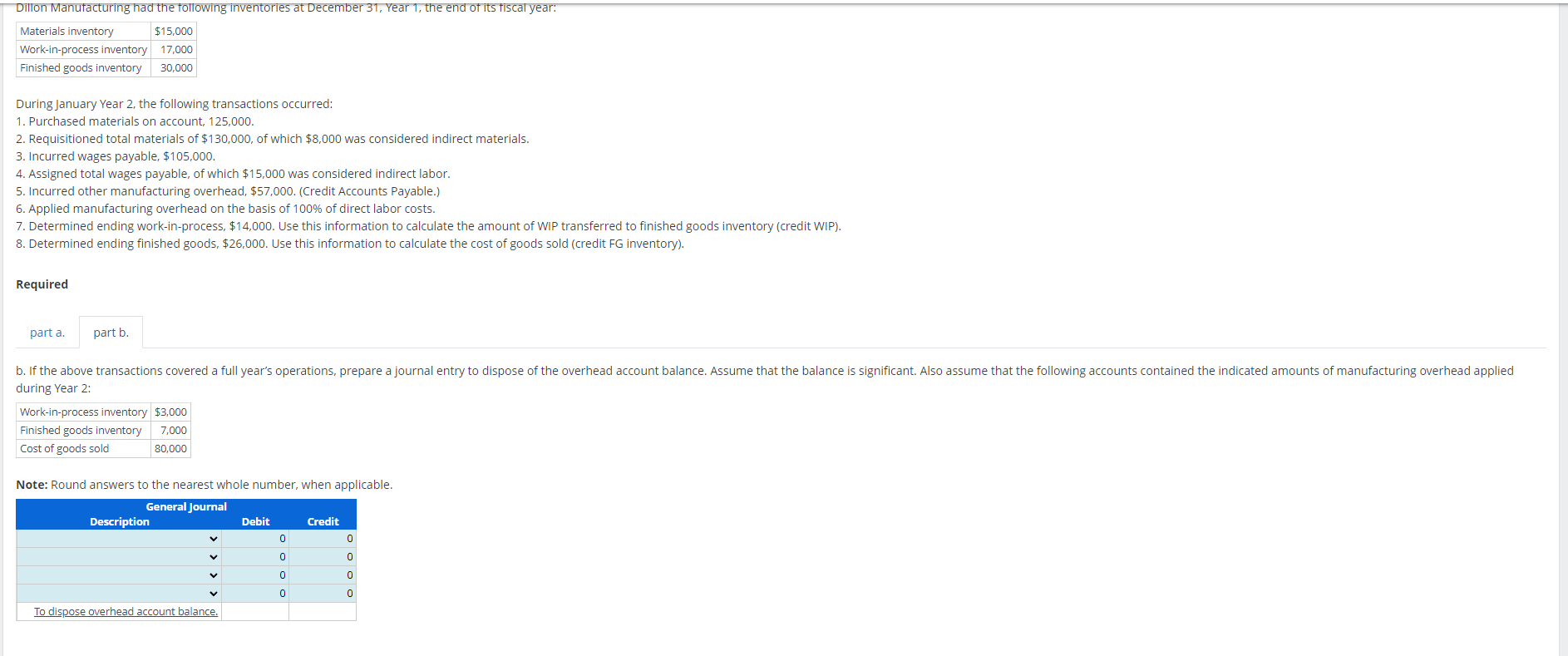

Dillon Manufacturing had the following inventories at December 31, Year 1, the end of its fiscal year: Materials inventory $15,000 Work-in-process inventory 17,000 Finished goods inventory 30,000 During January Year 2, the following transactions occurred: 1. Purchased materials on account, 125,000. 2. Requisitioned total materials of $130,000, of which $8,000 was considered indirect materials. 3. Incurred wages payable, $105,000. 4. Assigned total wages payable, of which $15,000 was considered indirect labor. 5. Incurred other manufacturing overhead. $57.000. (Credit Accounts Payable.) 6. Applied manufacturing overhead on the basis of 100% of direct labor costs. 7. Determined ending work-in-process, $14.000. Use this information to calculate the amount of WIP transferred to finished goods inventory (credit WIP). 8. Determined ending finished goods, $26,000. Use this information to calculate the cost of goods sold (credit FG inventory). Required part a. a. Prepare general Journal entries to record these transactions. General Journal Ref. 2 part b. 3&4 Description To record purchase of material. To record total materials requisitioned. < < Debit 0 0 0 OOO 0 0 0 Credit 0 0 OOO 0 0 0 7. Determined ending work-in-process, $14,000. Use this information to calculate the amount of WIP transferred to finished goods inventory (credit WIP). 8. Determined ending finished goods, $26,000. Use this information to calculate the cost of goods sold (credit FG inventory). Required a. Prepare general journal entries to record these transactions. General Journal Ref. 1 2 3 & 4 5 part a. 6 7 8 part b. Description To record purchase of material. To record total materials requisitioned. To record manufacturing overhead. To apply manufacturing overhead. To record assignment of factory payroll costs. To record cost of finished goods. V To record cost of goods sold. V V V V V V V Debit 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Credit 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Job Cost Journal Entries Dillon Manufacturing had the following inventories at December 31, Year 1, the end of its fiscal year: $15,000 Materials inventory Work-in-process inventory 17,000 Finished goods inventory 30,000 During January Year 2, the following transactions occurred: 1. Purchased materials on account, 125,000. 2. Requisitioned total materials of $130,000, of which $8,000 was considered indirect materials. 3. Incurred wages payable, $105,000. 4. Assigned total wages payable, of which $15,000 was considered indirect labor. 5. Incurred other manufacturing overhead, $57,000. (Credit Accounts Payable.) 6. Applied manufacturing overhead on the basis of 100% of direct labor costs. 7. Determined ending work-in-process, $14,000. Use this information to calculate the amount of WIP transferred to finished goods inventory (credit WIP). 8. Determined ending finished goods, $26,000. Use this information to calculate the cost of goods sold (credit FG inventory). Required part a. part b. b. If the above transactions covered a full year's operations, prepare a journal entry to dispose of the overhead account balance. Assume that the balance is significant. Also assume that the following accounts contained the indicated amounts of manufacturing overhead applied during Year 2: Work-in-process inventory $3,000 Finished goods inventory 7,000 Cost of goods sold 80,000 Note: Round answers to the nearest whole number, when applicable. General Journal Description Debit Credit Dillon Manufacturing had the following inventories at December 31, Year 1, the end of its fiscal year: Materials inventory $15,000 Work-in-process inventory 17,000 Finished goods inventory 30,000 During January Year 2, the following transactions occurred: 1. Purchased materials on account, 125,000. 2. Requisitioned total materials of $130,000, of which $8,000 was considered indirect materials. 3. Incurred wages payable, $105,000. 4. Assigned total wages payable, of which $15,000 was considered indirect labor. 5. Incurred other manufacturing overhead, $57,000. (Credit Accounts Payable.) 6. Applied manufacturing overhead on the basis of 100% of direct labor costs. 7. Determined ending work-in-process, $14,000. Use this information to calculate the amount of WIP transferred to finished goods inventory (credit WIP). 8. Determined ending finished goods, $26,000. Use this information to calculate the cost of goods sold (credit FG inventory). Required part a. part b. b. If the above transactions covered a full year's operations, prepare a journal entry to dispose of the overhead account balance. Assume that the balance is significant. Also assume that the following accounts contained the indicated amounts of manufacturing overhead applied during Year 2: Work-in-process inventory $3,000 7,000 80,000 Finished goods inventory Cost of goods sold Note: Round answers to the nearest whole number, when applicable. General Journal Description V To dispose overhead account balance. Debit 0 0 0 0 Credit 0 0 0 0

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the general journal entries to record the transactions and the journal entry to dispose o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started