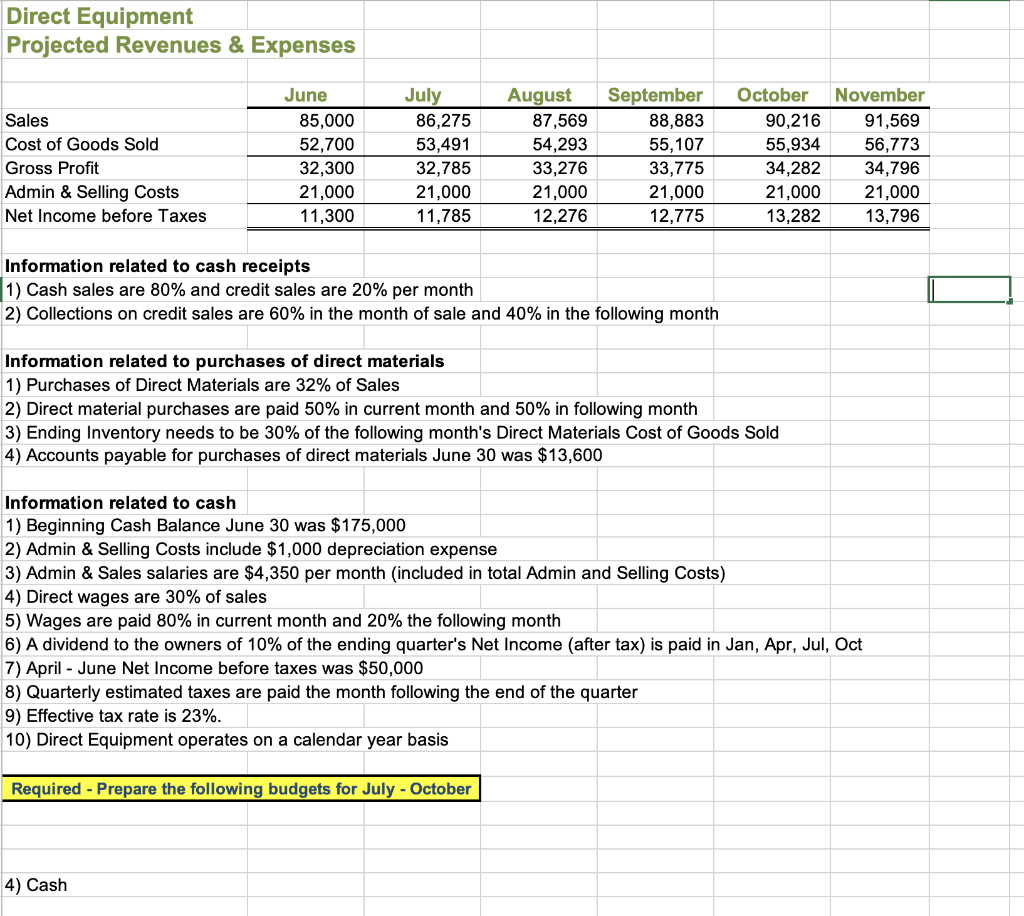

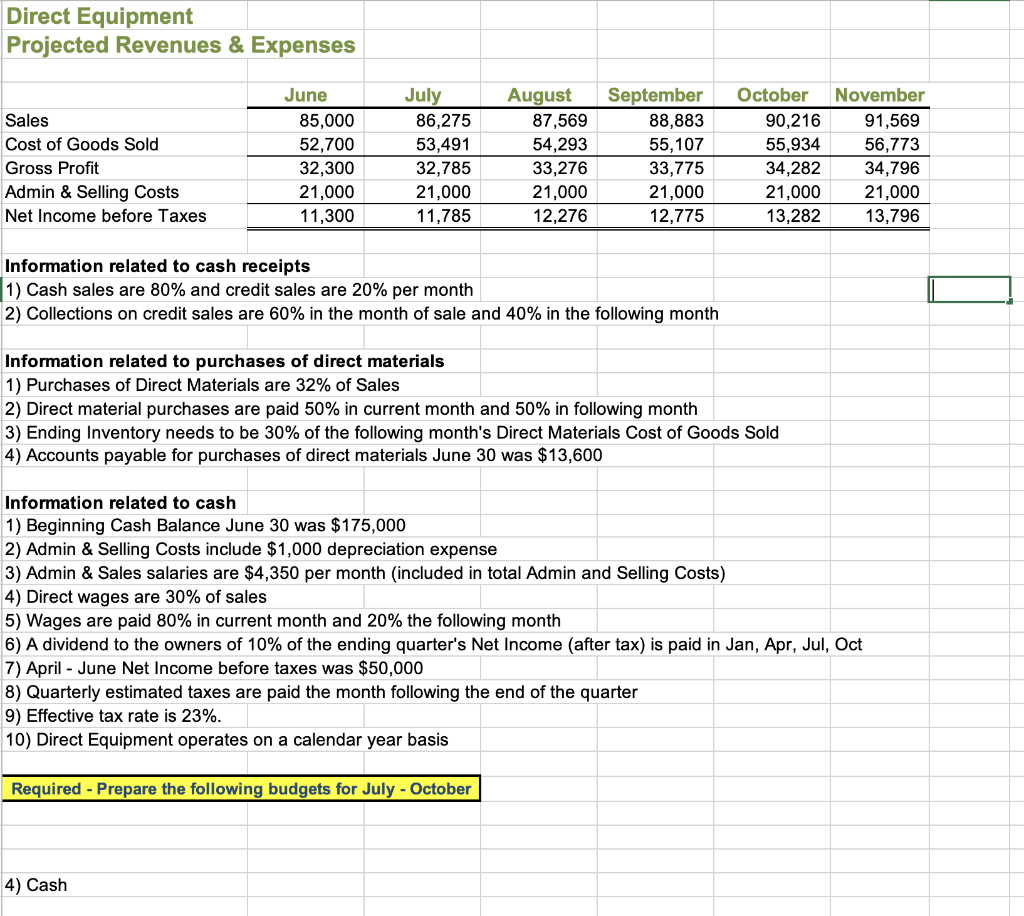

Direct Equipment Projected Revenues \& Expenses \begin{tabular}{|l|r|} \hline & Jun \\ \cline { 2 } Sales & 85 \\ \hline Cost of Goods Sold & 52 \\ \hline Gross Profit & 32 \\ \hline Admin \& Selling Costs & 21 \\ \hline Net Income before Taxes & 11 \\ \hline \end{tabular} 1) Cash sales are 80% and credit sales are 20% per month 2) Collections on credit sales are 60% in the month of sale and 40% in the following month Information related to purchases of direct materials 1) Purchases of Direct Materials are 32% of Sales 2) Direct material purchases are paid 50% in current month and 50% in following month 3) Ending Inventory needs to be 30% of the following month's Direct Materials Cost of Goods Sold 4) Accounts payable for purchases of direct materials June 30 was $13,600 Information related to cash 1) Beginning Cash Balance June 30 was $175,000 2) Admin \& Selling Costs include $1,000 depreciation expense 3) Admin \& Sales salaries are $4,350 per month (included in total Admin and Selling Costs) 4) Direct wages are 30% of sales 5) Wages are paid 80% in current month and 20% the following month 6) A dividend to the owners of 10% of the ending quarter's Net Income (after tax) is paid in Jan, Apr, Jul, Oct 7) April - June Net Income before taxes was $50,000 8) Quarterly estimated taxes are paid the month following the end of the quarter 9) Effective tax rate is 23%. 10) Direct Equipment operates on a calendar year basis Required - Prepare the following budgets for July - October 4) Cash Direct Equipment Projected Revenues \& Expenses \begin{tabular}{|l|r|} \hline & Jun \\ \cline { 2 } Sales & 85 \\ \hline Cost of Goods Sold & 52 \\ \hline Gross Profit & 32 \\ \hline Admin \& Selling Costs & 21 \\ \hline Net Income before Taxes & 11 \\ \hline \end{tabular} 1) Cash sales are 80% and credit sales are 20% per month 2) Collections on credit sales are 60% in the month of sale and 40% in the following month Information related to purchases of direct materials 1) Purchases of Direct Materials are 32% of Sales 2) Direct material purchases are paid 50% in current month and 50% in following month 3) Ending Inventory needs to be 30% of the following month's Direct Materials Cost of Goods Sold 4) Accounts payable for purchases of direct materials June 30 was $13,600 Information related to cash 1) Beginning Cash Balance June 30 was $175,000 2) Admin \& Selling Costs include $1,000 depreciation expense 3) Admin \& Sales salaries are $4,350 per month (included in total Admin and Selling Costs) 4) Direct wages are 30% of sales 5) Wages are paid 80% in current month and 20% the following month 6) A dividend to the owners of 10% of the ending quarter's Net Income (after tax) is paid in Jan, Apr, Jul, Oct 7) April - June Net Income before taxes was $50,000 8) Quarterly estimated taxes are paid the month following the end of the quarter 9) Effective tax rate is 23%. 10) Direct Equipment operates on a calendar year basis Required - Prepare the following budgets for July - October 4) Cash