Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss the advantages and disadvantages of the Payback Period method in capital budgeting. Discussion must include at least two ( 2 ) of each. Bullet

Discuss the advantages and disadvantages of the Payback Period method in capital budgeting. Discussion must include at least two of each. Bullet responses are permitted and encouraged marks

What is the IRR rule in capital budgeting?

mark

What is the problem with IRR and mutually exclusive projects, and how can it be overcome?

marks

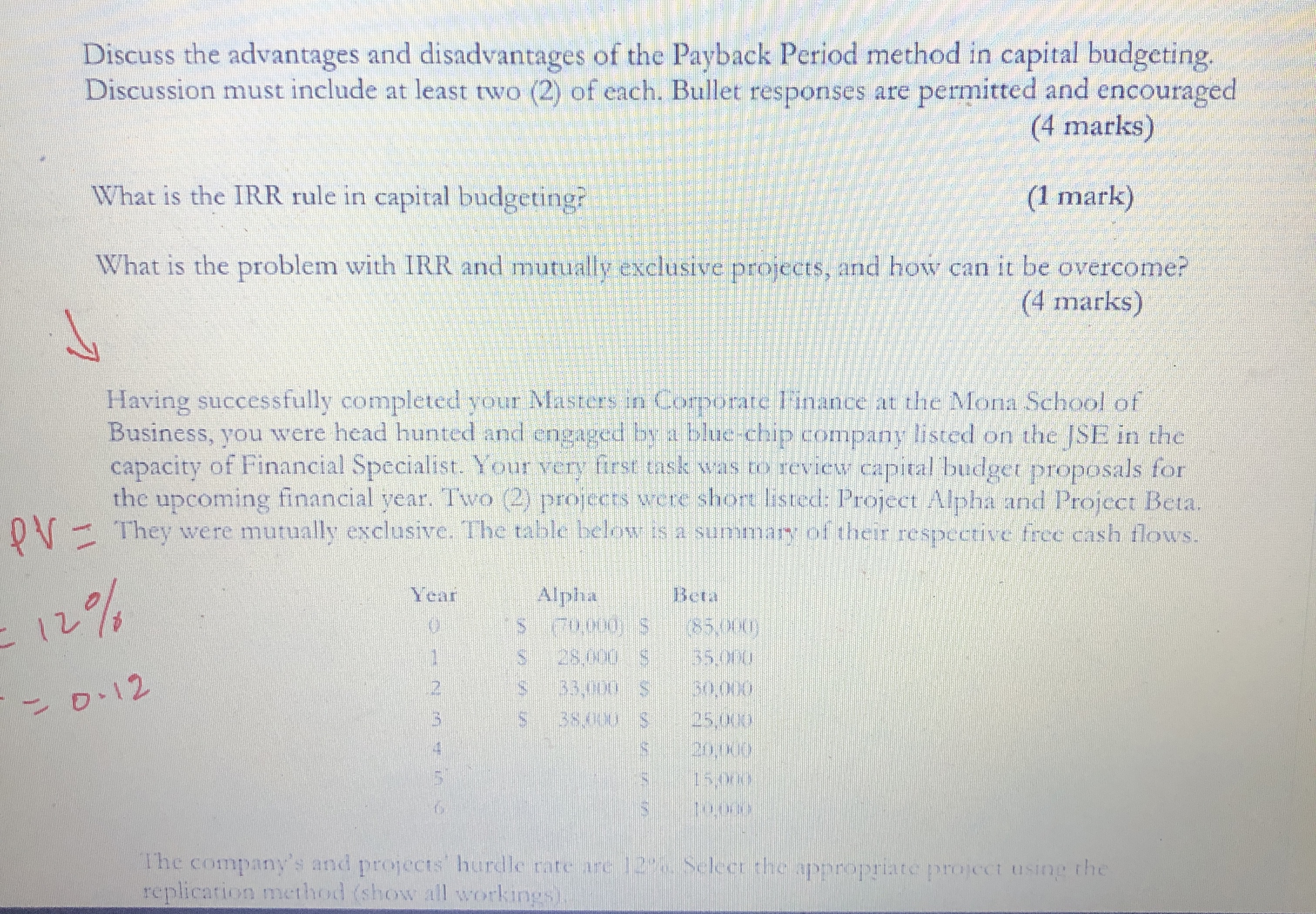

Having successfully completed your Masters in Corporate Pinance at the Mona School of Business, you were head hunted and engaged by a blucchip company listed on the JSE in the capacity of Financial Specialist. Your very first task was to review capital budget proposals for the upcoming financial year. Two projects were short listed: Project Alpha and Project Beta.

PV They were mutually exclusive. The table below is a summary of their respective free cash flows.

The company's and propect hurdte tate are Select the pppropriate promect using the replication method show all workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started